- United States

- /

- Electric Utilities

- /

- NYSE:SO

A Look at Southern Company’s Valuation Following $1.75 Billion Capital Raise

Reviewed by Simply Wall St

Southern has just completed a $1.75 billion Composite Units Offering, a sizeable step that often signals a strategic move in capital management. Investors are watching closely to see how this new funding could shape the company's balance sheet.

See our latest analysis for Southern.

Southern’s recent $1.75 billion funding round has put a spotlight on the stock. While the share price dipped 8.5% over the past month, its momentum this year is clear with an 11.1% year-to-date share price return. Long-term investors are also seeing rewards, given the company’s robust 57% three-year and 79% five-year total shareholder returns, which point to steady growth and resilience through ups and downs.

If you’re tracking major moves like Southern’s capital raise, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the recent capital raise and analyst targets suggesting further upside, the key question is whether Southern’s shares still trade at a discount or if the market has already factored in its future growth potential.

Most Popular Narrative: 9.2% Undervalued

Southern’s recent closing price of $91.17 comes in below the fair value estimate of $100.45, suggesting room for upside in the eyes of the most-followed analyst narrative. This sets up a dynamic tug-of-war. Can long-term investments and regulatory tailwinds offset slower revenue growth to justify higher future margins?

Continued constructive regulatory frameworks, as shown by extended stable base rates in Georgia and unified commission support for major IRPs, provide strong visibility and stability for recovering new investments and earning allowed returns, strengthening net margins and reducing earnings volatility.

Want to know why so many analysts are betting on Southern’s next chapter? The narrative hangs on sharply higher profit margins and a sector-leading earnings jump. The real intrigue is the ambitious multiple attached to future profits. The blueprint for that price target will surprise even utility veterans. Dive in to uncover how the pieces are expected to fit together in this bullish forecast.

Result: Fair Value of $100.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty remains around rising capital costs and the potential for regulatory or policy changes, which could put pressure on margins and future earnings growth.

Find out about the key risks to this Southern narrative.

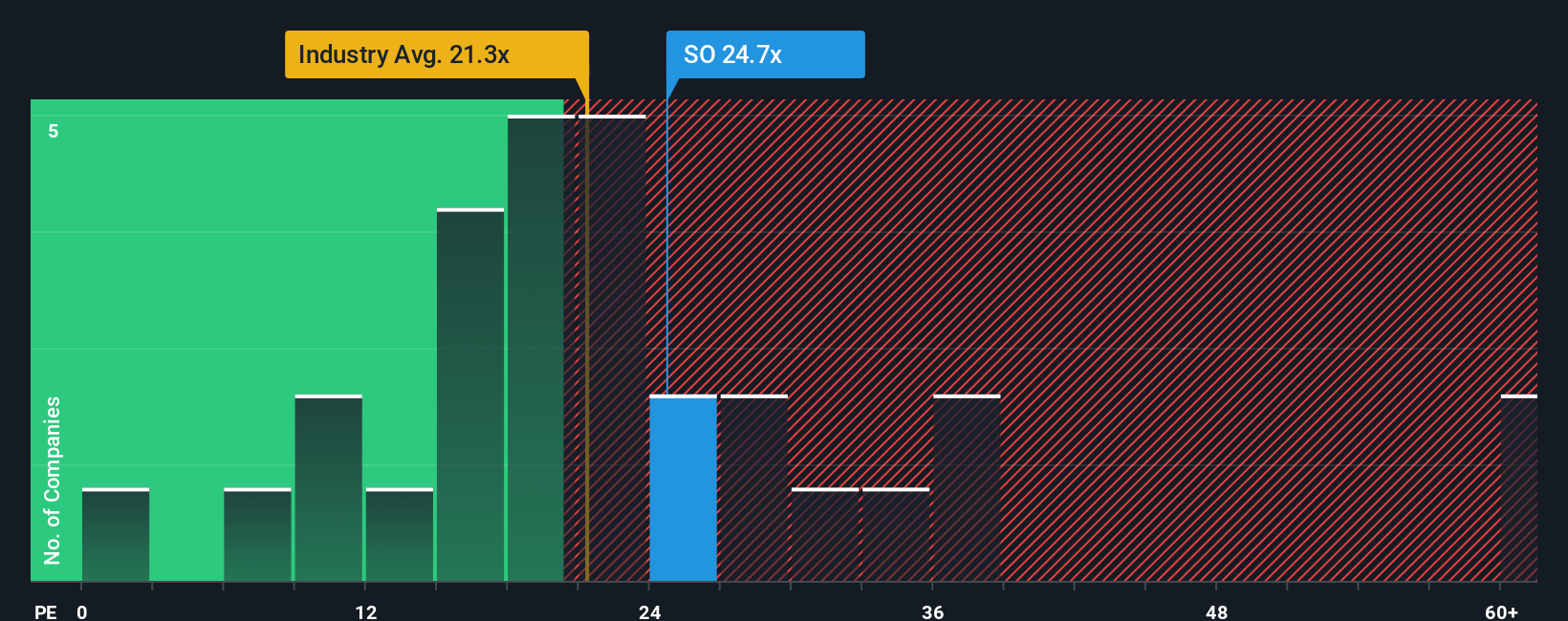

Another Angle: Relative Value Perspective

Looking at Southern's valuation through the lens of its price-to-earnings ratio, the stock trades at 22.5 times earnings. This is higher than the US Electric Utilities industry average of 20.7 times, but lower than the peer average of 25.6 times. The current ratio remains just below the fair ratio of 23.3 times. Investors are left to consider whether the market is comfortable with this premium for growth, or if there is more room for re-rating. Could this valuation gap mark an opportunity or a risk if industry sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southern Narrative

If you have a different take on Southern’s outlook or want to dive deeper into the numbers, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never rely on just one opportunity. Expand your research and seize strategies that can help you stay ahead of the market curve with these hand-picked stock ideas.

- Tap into the power of emerging technologies by examining these 27 AI penny stocks. These companies could reshape industries and help drive long-term growth.

- Capture steady income and build your portfolio’s resilience by researching companies behind these 15 dividend stocks with yields > 3%. They offer attractive yields and focus on sustainable payout potential.

- Position yourself for early gains by getting ahead with these 3585 penny stocks with strong financials, which show robust financials along with significant upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives