- United States

- /

- Electric Utilities

- /

- NYSE:POR

Should Portland General Electric's (POR) EPS Beat and Revenue Miss Change Investor Outlook?

Reviewed by Sasha Jovanovic

- In the past week, Portland General Electric reported third-quarter earnings that exceeded analyst expectations on earnings per share, though revenue fell short of forecasts.

- This performance, combined with recent regulatory developments, has sparked renewed discussion about the company’s financial outlook and investor confidence in the utility's future direction.

- We’ll now examine how Portland General Electric's strong quarterly earnings update could influence its investment narrative and future prospects.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Portland General Electric Investment Narrative Recap

To be a Portland General Electric shareholder, an investor needs to believe in sustained demand from Oregon’s expanding industry and data center sectors, with the company’s ability to deliver through grid modernization and clean energy initiatives forming the core thesis. The recent third-quarter earnings beat on EPS provides a short-term boost to sentiment, but its effect on the most important catalyst, ongoing regulatory support for fair cost recovery, and the largest risk of margin pressure from rising costs and clean energy mandates is relatively limited.

Among recent announcements, the company's planned grid-scale battery storage expansion stands out. This initiative directly supports Portland General Electric’s transition to cleaner, more reliable energy delivery, reinforcing growth opportunities from increased electrification and systemwide demand, while addressing potential operational risks tied to grid reliability during peak periods.

However, investors should note that despite recent success, the risk of compressed margins from regulatory cost recovery constraints remains a key issue if clean energy mandates raise operating expenses...

Read the full narrative on Portland General Electric (it's free!)

Portland General Electric is projected to reach $4.0 billion in revenue and $479.0 million in earnings by 2028. This outlook assumes a 4.7% annual revenue growth rate and a $185.0 million increase in earnings from the current $294.0 million.

Uncover how Portland General Electric's forecasts yield a $48.33 fair value, a 5% downside to its current price.

Exploring Other Perspectives

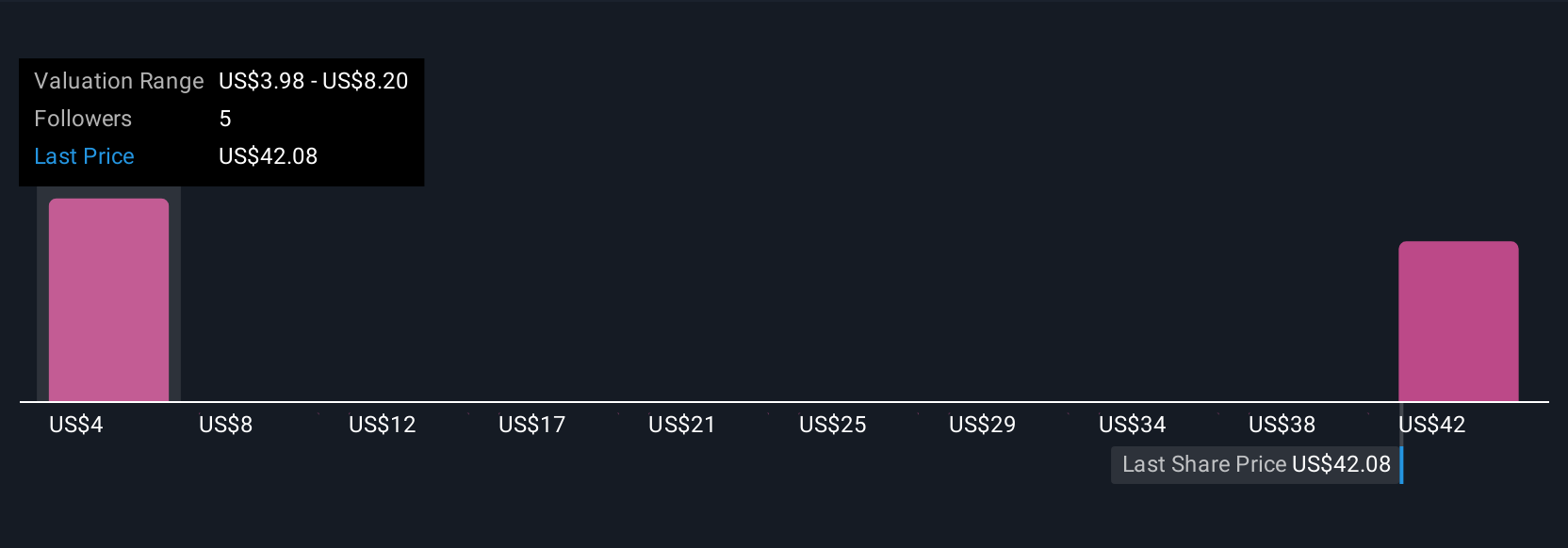

Fair value estimates from three Simply Wall St Community members span from US$3.91 to US$54.07 per share, highlighting sharply divergent views. Some are focused on Portland General Electric’s evolving approach to margin resilience and regulatory cost recovery, both of which could shape performance going forward.

Explore 3 other fair value estimates on Portland General Electric - why the stock might be worth less than half the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026