- United States

- /

- Other Utilities

- /

- NYSE:PEG

Will Strong Q3 Results and Upgraded Outlook Change Public Service Enterprise Group's (PEG) Growth Narrative?

Reviewed by Sasha Jovanovic

- Public Service Enterprise Group reported third quarter earnings for the period ended September 30, 2025, posting revenues of US$3.23 billion and net income of US$622 million, both higher compared to the same period last year.

- The company’s earnings per share and revenue both surpassed expectations, prompting a major analyst to upgrade its outlook shortly after the results were released.

- We'll explore how these stronger-than-expected earnings may influence Public Service Enterprise Group’s future earnings growth narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Public Service Enterprise Group Investment Narrative Recap

To be a Public Service Enterprise Group (PSEG) shareholder, you need to believe in the long-term opportunity from rising electricity demand in the New Jersey and PJM region, especially from data center expansion and electrification, and PSEG’s ability to capture this growth through regulated infrastructure investment. While this quarter’s stronger-than-expected results help support near-term optimism, they do not meaningfully resolve the biggest risk: the uncertain conversion of PSEG’s large pipeline of data center load inquiries into actual utility customers.

One recent announcement that ties closely into these catalysts is the Long Island Power Authority’s extension of PSEG Long Island’s grid operations contract by five years. This extension underscores the company’s positioning as a trusted grid operator capable of benefiting from ongoing grid modernization and infrastructure investment trends, both of which are critical themes behind the current earnings growth narrative and future regulated revenue opportunities.

However, while the earnings momentum is encouraging, investors also need to consider that New Jersey’s in-state generation and resource adequacy challenges could bring surprises to the...

Read the full narrative on Public Service Enterprise Group (it's free!)

Public Service Enterprise Group's outlook anticipates $12.4 billion in revenue and $2.5 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 3.5% and a $0.5 billion increase in earnings from the current $2.0 billion.

Uncover how Public Service Enterprise Group's forecasts yield a $90.61 fair value, a 8% upside to its current price.

Exploring Other Perspectives

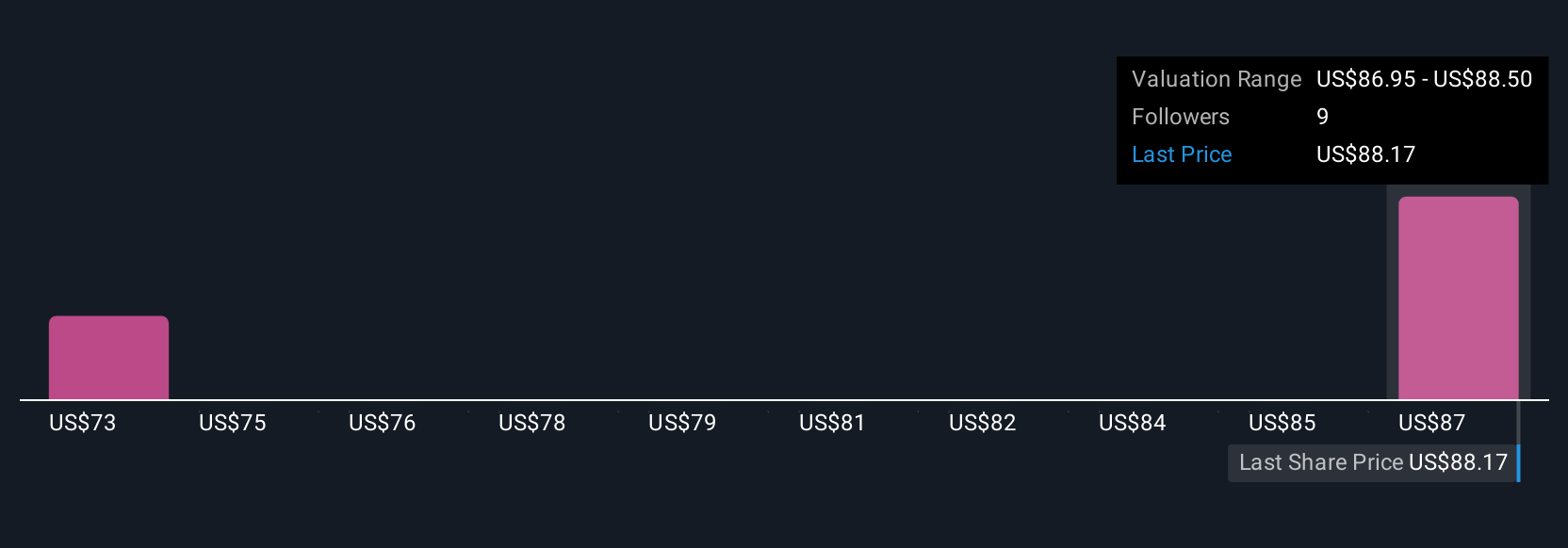

Simply Wall St Community members estimated PSEG’s fair value between US$73.03 and US$90.61 from three different analyses. Yet, with actual customer conversion of new large load requests still uncertain, long-term revenue predictability remains a hot topic across investment opinions.

Explore 3 other fair value estimates on Public Service Enterprise Group - why the stock might be worth as much as 8% more than the current price!

Build Your Own Public Service Enterprise Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Public Service Enterprise Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Public Service Enterprise Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Public Service Enterprise Group's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEG

Public Service Enterprise Group

Through its subsidiaries, operates in electric and gas utility, and nuclear generation businesses in the United States.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives