- United States

- /

- Other Utilities

- /

- NYSE:PEG

A Fresh Look at Public Service Enterprise Group's Valuation Following Strong Q3 Results and Upgraded Outlook (NYSE:PEG)

Reviewed by Simply Wall St

Public Service Enterprise Group (PEG) delivered stronger third quarter results than many expected, as revenue and net income climbed on the back of new electric and gas base rates along with steady infrastructure spending. The company also narrowed its earnings outlook toward the higher end of guidance, signaling continued confidence in its longer-term growth plans.

See our latest analysis for Public Service Enterprise Group.

After a rocky start to the year, Public Service Enterprise Group's share price has clawed back some lost ground, recently finishing at $82.40 after a 3.18% gain in the past day and a 2.33% share price return over the last month. While 2025 hasn't delivered fireworks for the share price, long-term shareholders have still seen a 0.87% total return in the past 12 months, and a robust 53.33% total return across three years. This suggests that momentum is steadier on a multi-year view as confidence in the company's infrastructure growth story remains intact.

With utilities finding new ways to deliver growth, now is a good moment to broaden your perspective and discover fast growing stocks with high insider ownership

Given the company’s consistently strong results and upgraded outlook, the key question is whether this momentum offers investors a compelling entry point or if the share price has already factored in the anticipated future growth.

Most Popular Narrative: 9.1% Undervalued

Public Service Enterprise Group's most widely followed narrative places its fair value at $90.61 per share, above the last close of $82.40. The gap spotlights the company's potential to outperform current market pricing as growth drivers intensify.

Sustained and increasing levels of utility capital investment ($3.8B in 2025; $21 to $24B through 2029) focused on grid modernization, infrastructure resilience, and clean energy programs position PSEG to capture value from regulatory-approved rate increases and expand its regulated asset base, driving future earnings and net margin growth.

The secret sauce in this narrative? Analysts are pricing in a bold outlook built on expanding margins and aggressive reinvestment. Curious how these powerful assumptions add up to the headline valuation? What if cash flows from New Jersey’s grid transformation are just the opening act? Dive deeper to uncover the big projections energizing this stock’s narrative.

Result: Fair Value of $90.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty over data center conversion rates and regulatory hurdles in New Jersey could act as roadblocks to the bullish growth story.

Find out about the key risks to this Public Service Enterprise Group narrative.

Another View: Multiples Tell Their Own Story

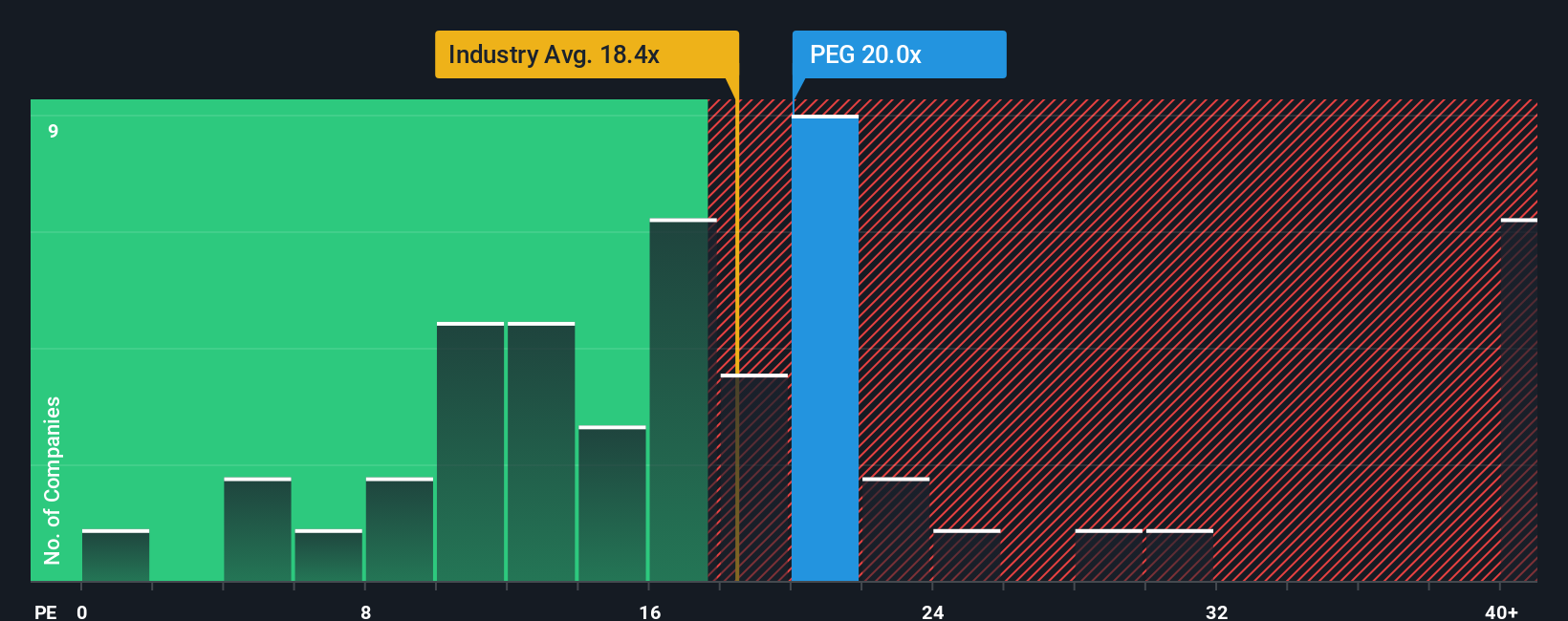

While analysts see upside to $90.61, our review of the current price-to-earnings ratio (19.8x) offers a more cautious lens. This figure is slightly below the US industry average (20.1x), but just above the peer group (19.7x), and still under the fair ratio of 21.1x. That moderation points to a market that is neither ignoring growth potential nor offering a deep bargain. Are investors already pricing in most of the optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Public Service Enterprise Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Public Service Enterprise Group Narrative

If you see the numbers differently or want your own angle on the data, you can build a fresh narrative in just minutes, your way: Do it your way

A great starting point for your Public Service Enterprise Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of investors source market-beating opportunities using tailored screeners. Tap into strategies you might be missing out on with these handpicked shortcuts:

- Accelerate your search for breakthrough technology by checking out these 28 quantum computing stocks before the next innovation wave hits the headlines.

- Secure consistent income and start your hunt for standout yield with these 17 dividend stocks with yields > 3% offering robust returns over 3%.

- Jump ahead of the crowd and spot market bargains with these 863 undervalued stocks based on cash flows identified for their strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEG

Public Service Enterprise Group

Through its subsidiaries, operates in electric and gas utility, and nuclear generation businesses in the United States.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives