- United States

- /

- Electric Utilities

- /

- NYSE:PCG

Is PG&E (PCG) Undervalued? A Fresh Look at Utility Stock Valuation

Reviewed by Simply Wall St

PG&E (PCG) shares have shown some movement in the past month, with modest changes that reflect ongoing investor interest. Looking at longer-term figures, the stock is up 3% over the past 3 months.

See our latest analysis for PG&E.

While PG&E's share price has recently dipped, losing almost 21% year-to-date, its longer-term performance tells a more nuanced story. The company achieved a 3.5% total shareholder return over three years and nearly 30% over five years. The recent pullback reflects lingering investor caution, but the utility’s fundamentals and track record indicate there is still potential for long-term momentum to build if sentiment improves.

If you want to expand your investing universe beyond utilities, now’s an ideal moment to discover fast growing stocks with high insider ownership.

With shares currently trading well below analyst targets and recent earnings trending upward, the big question for investors is clear: Is PG&E an undervalued stock ready to rebound, or is the current price already factoring in all future growth?

Most Popular Narrative: 25% Undervalued

Based on the most popular narrative, PG&E’s fair value is set at $21.23 per share, which is notably higher than its last close of $15.84. This difference suggests a potential disconnect between near-term market sentiment and long-term growth expectations embedded in the narrative. This sets the stage for the underlying drivers of this valuation.

Expanding opportunities for capital investment in grid modernization, wildfire mitigation, and resilience, fueled by both regulatory mandates and the need to serve new electrification and decarbonization requirements, position PG&E to grow its rate base and regulated earnings steadily over the next decade.

Want to know what’s powering this bullish fair value? The secret is a high-conviction forecast for future revenues and profitability, using a forward-looking profit multiple that is rarely awarded in the utility sector. Beneath this surface lies a delicate balance of analyst optimism and market skepticism. Curious which growth levers and financial hurdles create this valuation gap? Find out by diving into the complete narrative.

Result: Fair Value of $21.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and the ongoing threat of wildfire liabilities could quickly undermine PG&E’s positive outlook and potential for future earnings growth.

Find out about the key risks to this PG&E narrative.

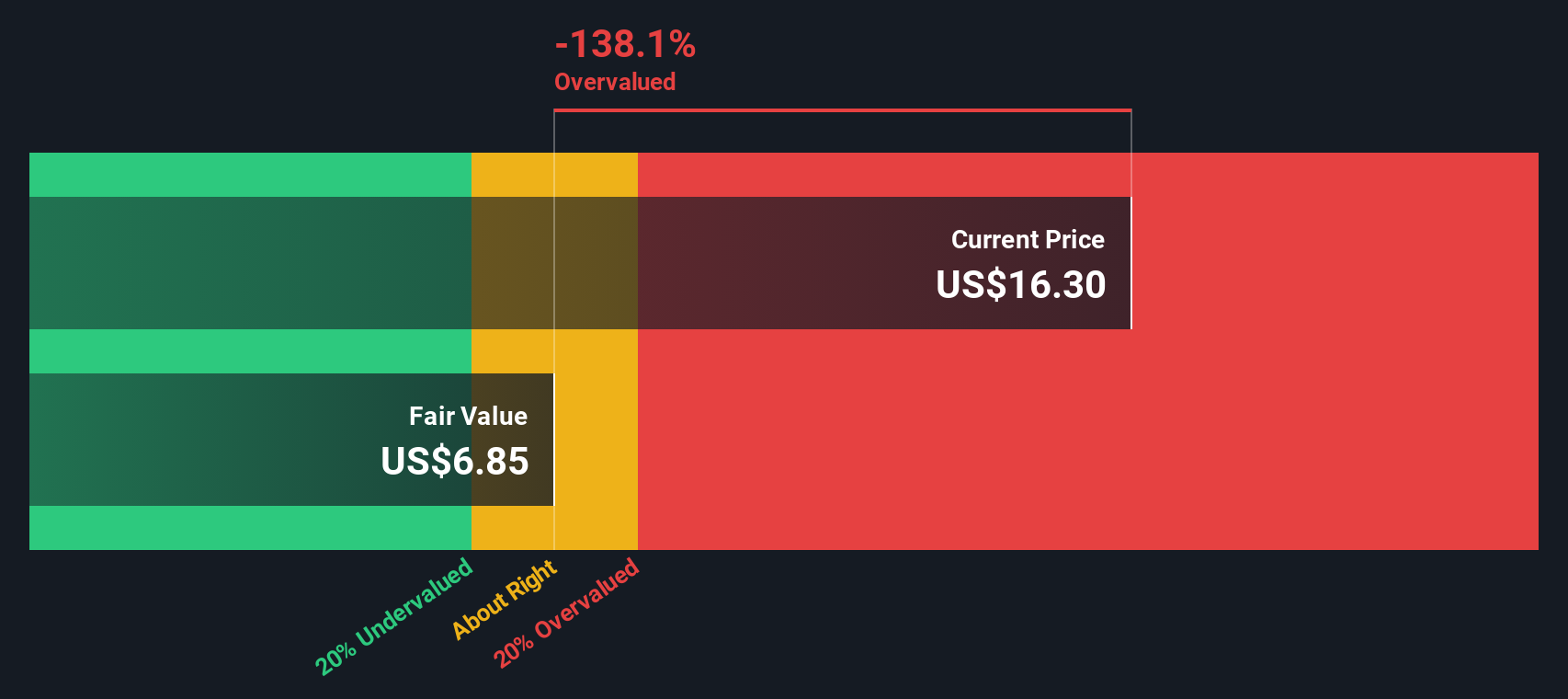

Another View: Discounted Cash Flow Model Tells a Different Story

Switching to our DCF model shows a much less optimistic result for PG&E. The calculation suggests that shares may actually be trading above fair value, not below. With such a stark contrast between methods, which valuation do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PG&E for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PG&E Narrative

If you want to challenge the consensus or dig into the details for yourself, you can create a personalized narrative in just a few minutes. Do it your way.

A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio by acting now on powerful themes other investors are just starting to notice. Don’t miss your chance to find your next standout winner.

- Target high yields and reliable cash flow when you browse these 14 dividend stocks with yields > 3% with robust returns above 3% for income-focused portfolios.

- Seize opportunities in disruptive healthcare technology by uncovering these 30 healthcare AI stocks that is transforming diagnostics, treatments, and patient outcomes.

- Ride the future of global finance with these 81 cryptocurrency and blockchain stocks at the forefront of blockchain and digital asset innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026