- United States

- /

- Electric Utilities

- /

- NYSE:PCG

Assessing PG&E After 24% 2025 Slide and Conflicting Valuation Signals

Reviewed by Bailey Pemberton

- If you are wondering whether PG&E is a beaten down utility or a quiet value opportunity, this article will walk you through what the market might be missing and where the upside or downside could really lie.

- Despite a long term gain of 28.0% over 5 years, the stock is down 6.0% over the last week, 6.8% over the last month, and 24.2% year to date, leaving it roughly 25.0% lower than a year ago and firmly on value hunters' radars.

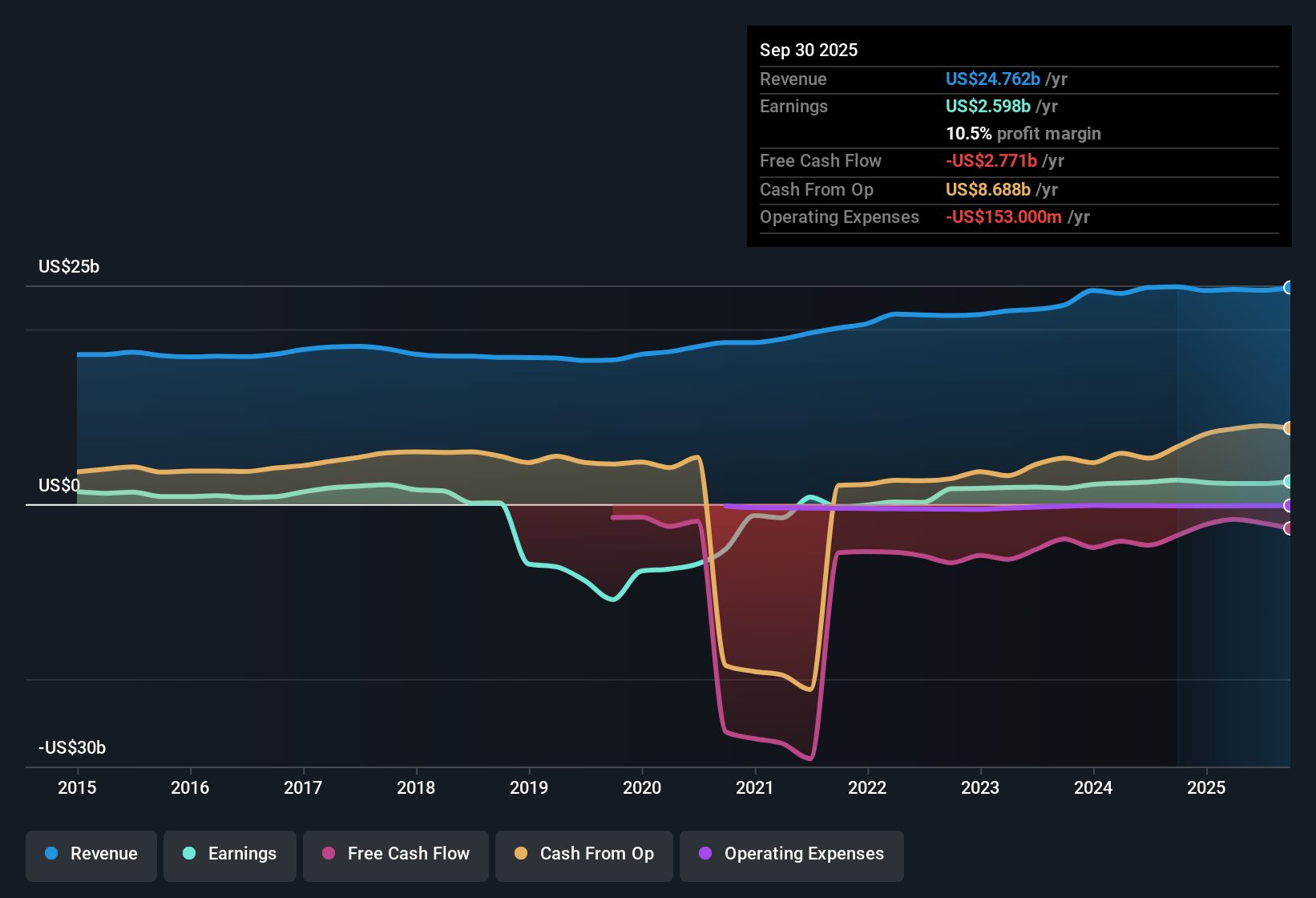

- These moves are happening as investors continue to weigh PG&E's progress on wildfire risk mitigation, regulatory settlements, and infrastructure upgrades against lingering legal and political overhangs. At the same time, ongoing grid hardening investments and California's clean energy push continue to reshape expectations for the utility's long term earnings power and risk profile.

- Right now, PG&E scores a 4/6 valuation check score, suggesting the market may not fully be pricing in the company's fundamentals. We will unpack that using multiple valuation approaches before finishing with a more complete way to think about what this stock is really worth.

Find out why PG&E's -25.0% return over the last year is lagging behind its peers.

Approach 1: PG&E Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividends and discounting them back into today’s dollars, then comparing that value with the current share price.

For PG&E, the model starts with an annual dividend per share of about $0.25 and assumes a long run dividend growth rate of 3.26%, capped from a higher implied rate to keep expectations conservative. With a return on equity of roughly 8.4% and an elevated payout ratio above 3x recent earnings, the DDM raises questions about how sustainable rapid dividend growth would be without stronger underlying profit expansion.

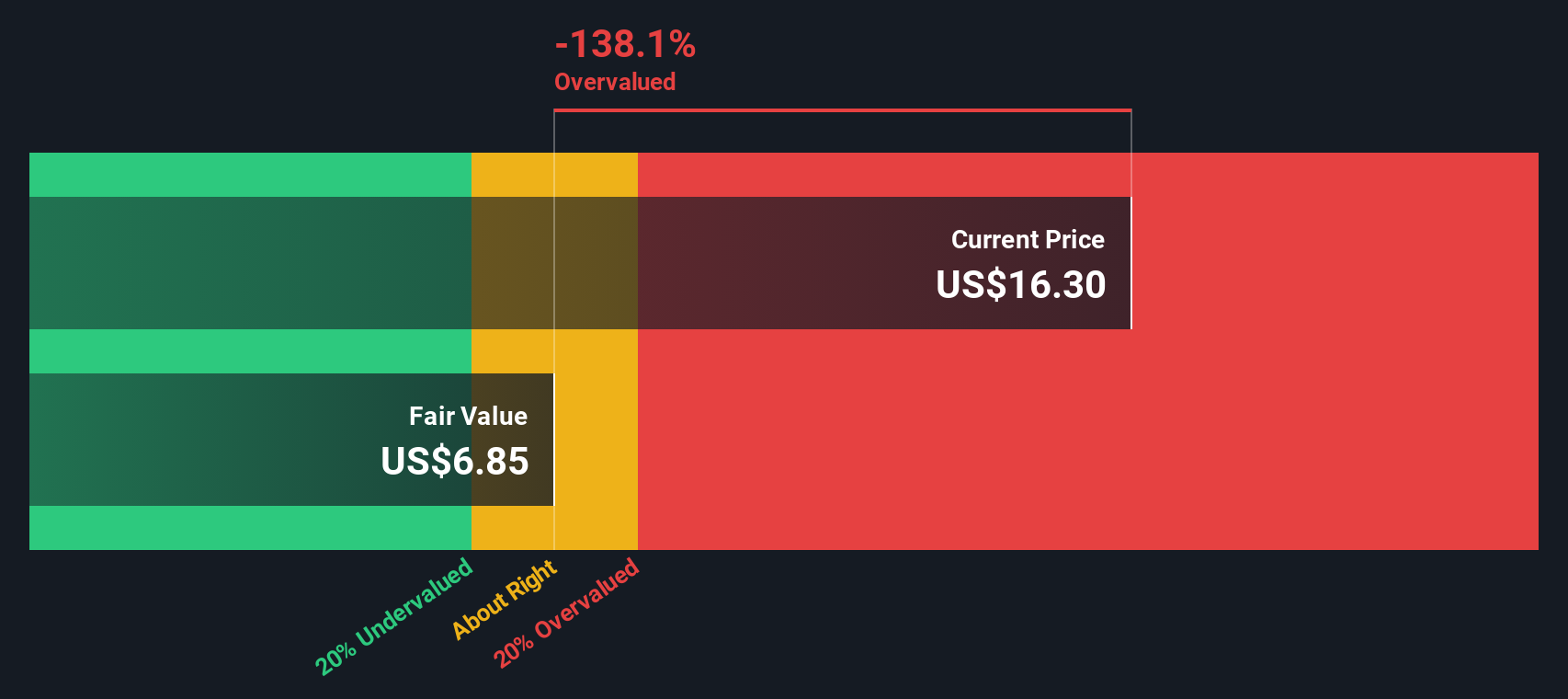

On this basis, the model arrives at an intrinsic value of roughly $6.85 per share. Compared with the current market price, this suggests the stock is about 121.4% overvalued, meaning investors today are paying far more than the DDM indicates the stream of future dividends is worth.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests PG&E may be overvalued by 121.4%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: PG&E Price vs Earnings

For a profitable utility like PG&E, the price to earnings, or PE, ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, companies with faster, more reliable growth and lower perceived risk can justify a higher “normal” PE, while slower growth and higher risk should pull that multiple down.

PG&E currently trades at about 12.8x earnings, noticeably below the Electric Utilities industry average of roughly 20.0x and a peer average near 20.2x. Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE investors might reasonably pay after considering PG&E’s specific earnings growth outlook, risk profile, profit margins, industry positioning, and market cap.

On this basis, PG&E’s Fair Ratio is estimated at around 26.9x, well above both its current 12.8x multiple and simple peer or industry comparisons. Because this approach adjusts for the company’s own fundamentals rather than relying only on broad averages, it suggests the market is discounting PG&E’s earnings potential and risk improvement too heavily, pointing to meaningful upside if sentiment normalizes.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PG&E Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of PG&E into a story that connects what you think will happen to its revenues, earnings and margins, into a financial forecast and then into a clear Fair Value you can compare with today’s Price to support your own decision on whether to buy, hold or sell. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, guided tool to record their assumptions, see how those translate into future cash flows, and instantly update their Fair Value when new information, such as earnings or wildfire news, comes in. For example, one bullish PG&E Narrative might assume margins rise, transmission spending pays off and lead to a Fair Value closer to the most optimistic analyst target around $23 per share. A more cautious Narrative might lean toward the lower end near $17, stressing regulatory and wildfire risks. Both perspectives are instantly tracked and refreshed as new facts emerge.

Do you think there's more to the story for PG&E? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026