- United States

- /

- Gas Utilities

- /

- NYSE:OGS

ONE Gas (OGS): Evaluating Valuation as Board Announces Leadership Transition and Governance Updates

Reviewed by Simply Wall St

ONE Gas (OGS) has set the stage for a transition in its leadership, with the board announcing longtime chair John W. Gibson will retire following the 2026 Annual Meeting. In addition, the company adopted updated by-laws, sharpening its board and committee governance processes.

See our latest analysis for ONE Gas.

News of a leadership transition at ONE Gas comes as the company rides steady momentum, with a 22.5% year-to-date share price return and a robust 13% total shareholder return over the past year. Confidence appears to be building in the stock, supported by strong performance and recent moves to reinforce governance and succession planning.

If this kind of strategic change sparks your curiosity, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading close to analyst price targets and the company boasting solid returns, investors may wonder if there is still value left to unlock or if the market has already priced in future growth.

Most Popular Narrative: Fairly Valued

The prevailing narrative places ONE Gas’s fair value estimate at $85.36, just above the recent close of $83.74. With such a slim margin, the focus shifts to the underlying growth drivers and regulatory climate influencing sentiment around the stock’s current price.

Favorable regulatory developments, particularly Texas House Bill 4384, enable full recovery of capital expenditures and reduce regulatory lag. This is anticipated to drive higher earnings and more predictable net profit margins in the coming years. Accelerating capital investment in system reinforcement and modernization (such as the Austin system project), in response to both safety and demand, expands the regulated rate base and results in higher allowed returns and EPS growth.

What is the source of this razor-thin gap between price and fair value? The narrative is built on bold regulatory bets, future profit leaps, and a game-changing approach to capital investment. Uncover which assumptions tip the balance and how these projections might surprise even seasoned investors. Find out exactly what’s fueling analyst conviction behind the current target.

Result: Fair Value of $85.36 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high capital requirements and cost inflation could pressure free cash flow and margins, which may challenge the upbeat growth scenario for ONE Gas.

Find out about the key risks to this ONE Gas narrative.

Another View: Multiples Tell a Different Story

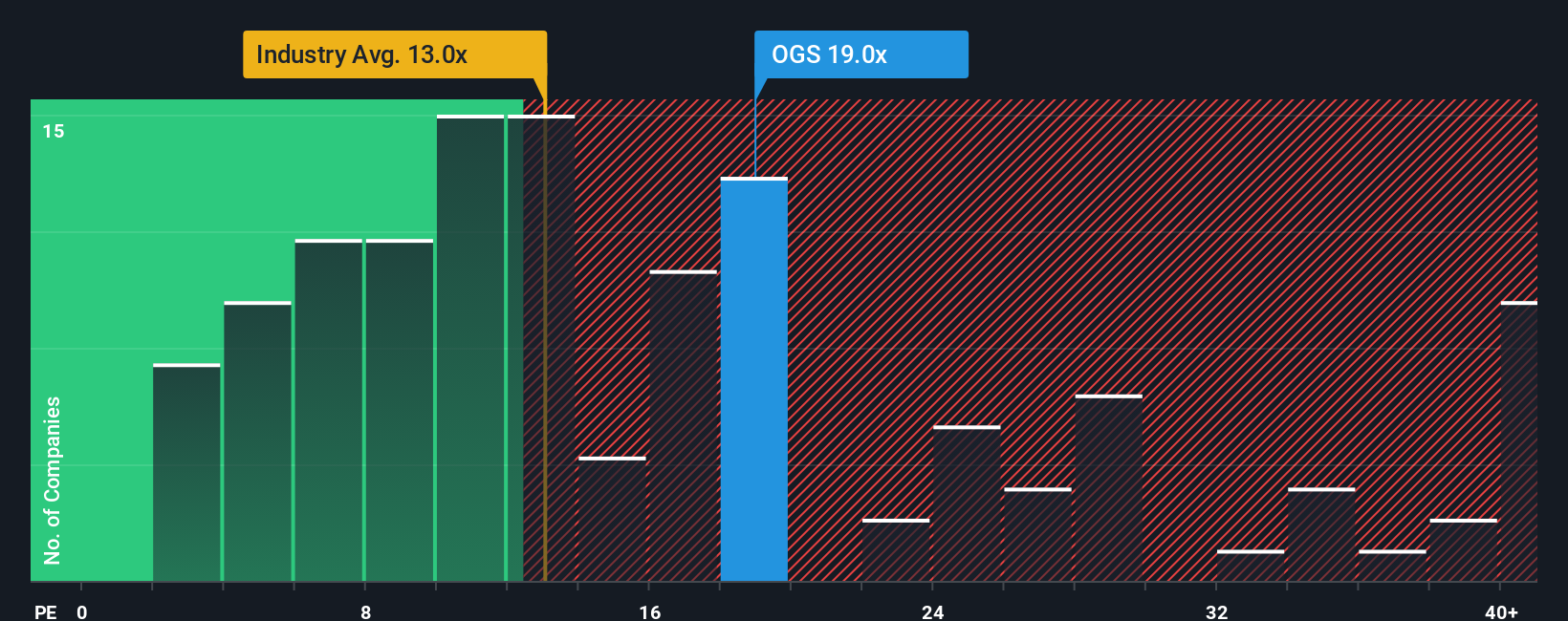

Looking at valuation through earnings, ONE Gas trades at a price-to-earnings ratio of 19.7x. This is higher than U.S. gas utility peers, which average 18.6x, and is also well above the global industry standard of 14.4x. While this signals a premium, our fair ratio analysis puts the “just right” level at 20.4x. Does this mean there is little upside left, or could optimism drive the stock even closer to its fair multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONE Gas Narrative

If you want to challenge this narrative or prefer crafting an analysis that fits your own perspective, you can assemble your own in just a few minutes. Do it your way

A great starting point for your ONE Gas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to get ahead. Our screener uncovers standout stocks that could become your next smart move. See what opportunities are opening up right now.

- Unlock higher payout potential when you scan these 15 dividend stocks with yields > 3% offering yields above 3% and reliable, consistent returns.

- Spot undervalued gems ready for a turnaround by checking out these 916 undervalued stocks based on cash flows that the market may have overlooked.

- Capitalize on the artificial intelligence boom by seeking out these 25 AI penny stocks changing the game with innovation and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGS

ONE Gas

Operates as a regulated natural gas distribution utility company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026