- United States

- /

- Gas Utilities

- /

- NYSE:NWN

Will Rising Sales and Improved Net Income Shift Northwest Natural Holding's (NWN) Long-Term Outlook?

Reviewed by Sasha Jovanovic

- Northwest Natural Holding Company reported third quarter and nine-month earnings, with sales rising to US$164.73 million and US$895.21 million, respectively, compared to the prior year; the company saw its quarterly net loss widen to US$29.89 million, while nine-month net income improved to US$55.53 million.

- This performance highlights stronger sales and improved long-term profitability, despite a continued quarterly loss, pointing to mixed but evolving business trends.

- We'll explore how the latest improvement in nine-month net income could influence the company’s long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Northwest Natural Holding Investment Narrative Recap

For investors considering Northwest Natural Holding, the core investment case emphasizes the potential for stable, long-term earnings from regulated utilities, balanced against the uncertainty of regulatory changes and fuel transition pressures. This latest earnings report, which showed rising nine-month sales and net income despite ongoing quarterly losses, does little to shift the short-term focus away from the biggest catalyst, continued customer growth in Texas, and the prominent risk of policy-driven declines in gas utility demand; the impact of this news appears modest for now.

Among recent announcements, the October 9, 2025, dividend increase to US$0.4925 per share stands out, reinforcing the company’s commitment to steady shareholder returns. This ongoing dividend policy may support investor confidence in the face of evolving industry risks surrounding regulatory decisions and capital recovery.

However, in contrast to growing revenue, investors should also watch for signs that regulatory and policy risks could start affecting...

Read the full narrative on Northwest Natural Holding (it's free!)

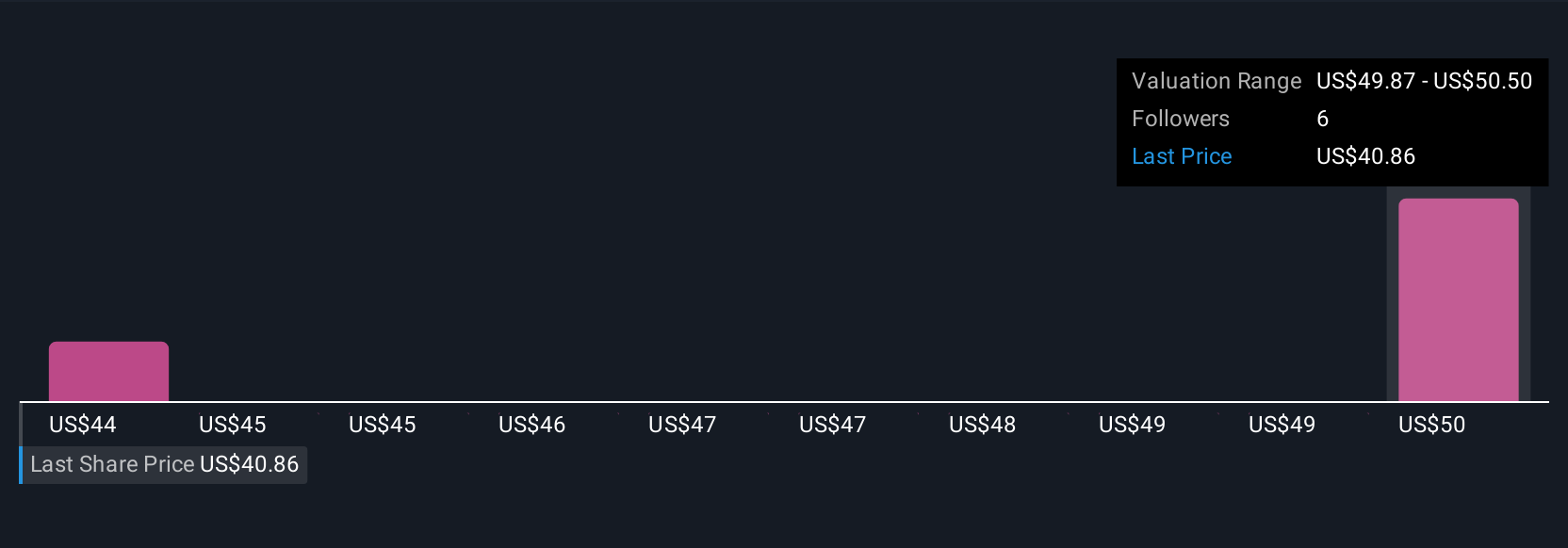

Northwest Natural Holding's outlook calls for $1.6 billion in revenue and $153.7 million in earnings by 2028. This is based on 8.5% annual revenue growth and a $50.4 million increase in earnings from the current $103.3 million.

Uncover how Northwest Natural Holding's forecasts yield a $52.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range from US$42.92 to US$52, signaling sharply different views. Against this backdrop, ongoing regulatory risk remains critical to watch as it could sway the company’s growth outlook and margin profile; consider several viewpoints when assessing the stock.

Explore 2 other fair value estimates on Northwest Natural Holding - why the stock might be worth 8% less than the current price!

Build Your Own Northwest Natural Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Natural Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Natural Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Natural Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives