- United States

- /

- Electric Utilities

- /

- NYSE:NRG

Should NRG Energy's (NRG) New $3 Billion Buyback and Data Center Push Prompt Investor Attention?

Reviewed by Sasha Jovanovic

- NRG Energy recently reported strong third-quarter results, beating both earnings and revenue estimates and announcing the completion of a share repurchase tranche totaling more than 3.15 million shares for US$500.66 million from July to October 2025, under its broader buyback program.

- Alongside record financial performance, the company expanded its long-term power agreements in the data center sector and initiated a new US$3 billion share repurchase plan through 2028, reflecting sustained demand growth linked to AI and cloud computing trends.

- We’ll explore how NRG’s ambitious new buyback plan and data center growth position influence its updated investment narrative following these developments.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

NRG Energy Investment Narrative Recap

To be a shareholder in NRG Energy, you need to believe in the company’s ability to capitalize on accelerating power demand from data centers and electrification while maintaining financial discipline amid portfolio shifts toward gas generation. The recent announcement of another US$3 billion buyback underscores management’s capital return focus, but does not materially reduce the short-term risk stemming from higher leverage and ongoing acquisition-related debt increases.

Among recent updates, NRG’s completion of its prior buyback tranche, repurchasing over 3.15 million shares for US$500.66 million, signals ongoing confidence in free cash flow and earnings stability. This is particularly relevant given capital needs tied to both the LS Power acquisition and the substantial new data center agreements, supporting the main growth catalyst of rising large-scale electricity demand.

However, in contrast to these growth drivers, investors should also be aware of the heightened financial risk from increased debt loads if interest rates or credit conditions shift...

Read the full narrative on NRG Energy (it's free!)

NRG Energy's outlook points to $34.5 billion in revenue and $1.6 billion in earnings by 2028. Achieving this would require 5.5% annual revenue growth and a $1.15 billion increase in earnings from the current $455 million.

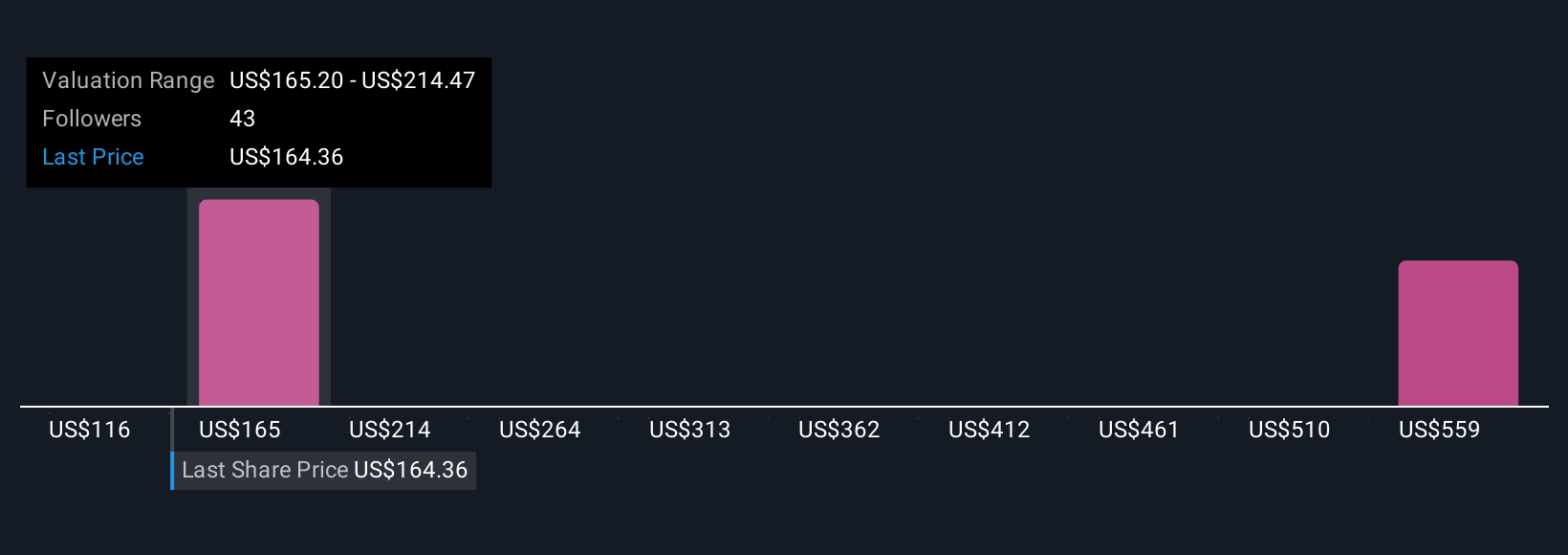

Uncover how NRG Energy's forecasts yield a $207.23 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Retail fair value estimates from the Simply Wall St Community range sharply from US$203 to US$589, based on three different analyses. Many see upside, but you should weigh this diversity against NRG’s focus on capital allocation and its exposure to fossil fuel assets when considering the long-term view.

Explore 3 other fair value estimates on NRG Energy - why the stock might be worth over 3x more than the current price!

Build Your Own NRG Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NRG Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NRG Energy's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives