- United States

- /

- Electric Utilities

- /

- NYSE:NRG

Did Data Center Deals and LS Power Acquisition Just Shift NRG Energy's (NRG) Investment Narrative?

Reviewed by Sasha Jovanovic

- NRG Energy recently reported strong third-quarter 2025 results, highlighting rapid growth in its data center power agreements and a development pipeline reaching 5.4 gigawatts, while confirming that the LS Power acquisition remains on track for completion in early 2026 with regulatory filings submitted and financing secured.

- This combination of expanding long-term data center demand, a growing project pipeline, and pending gas asset acquisition is reshaping how investors assess NRG’s balance between growth opportunities and fossil-fuel exposure.

- Next, we’ll examine how NRG’s expanding data center power agreements could influence its investment narrative and longer-term earnings profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NRG Energy Investment Narrative Recap

To own NRG today, you need to believe that fast-growing data center power demand and the LS Power gas portfolio can sit side by side, supporting earnings while the company manages higher fossil-fuel and balance sheet exposure. The latest strong third-quarter 2025 results and confirmation that LS Power financing is secured reinforce the growth side of that equation, while the recent increase in short interest highlights that market focus on leverage and fossil-fuel risk is not going away.

Among the recent news, the rapid expansion of NRG’s data center power agreements and a 5.4 gigawatt development pipeline is most relevant here, because it directly addresses the key growth catalyst investors are watching: whether NRG can convert long-term digital infrastructure demand into durable earnings that offset the risks of more natural gas capacity and additional debt.

But against this growth story, investors should also be aware of how the larger LS Power gas acquisition could affect NRG’s longer term exposure to carbon pricing and future decarbonization policy...

Read the full narrative on NRG Energy (it's free!)

NRG Energy’s narrative projects $34.5 billion revenue and $1.6 billion earnings by 2028. This requires 5.5% yearly revenue growth and about a $1.1 billion earnings increase from $455.0 million today.

Uncover how NRG Energy's forecasts yield a $208.14 fair value, a 25% upside to its current price.

Exploring Other Perspectives

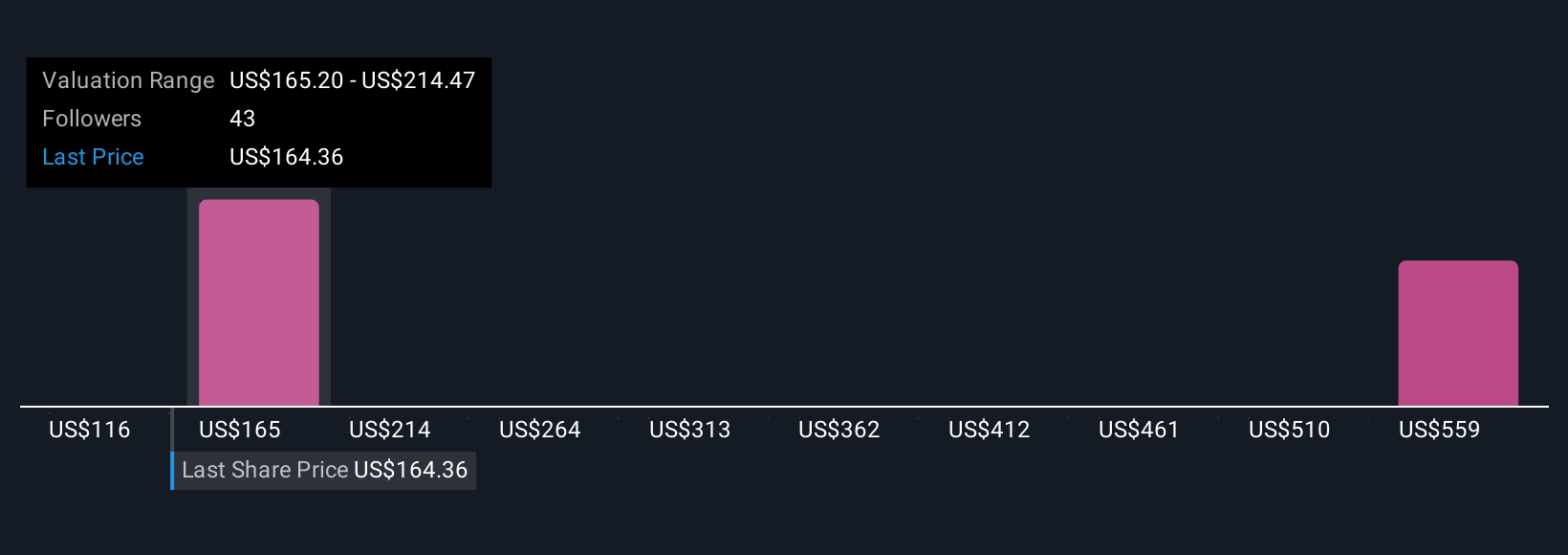

Three members of the Simply Wall St Community estimate NRG’s fair value between US$203 and US$567, highlighting how far opinions can spread. When you set those views against NRG’s growing reliance on natural gas assets, it is worth weighing how different expectations around future regulation and carbon costs could influence the company’s longer term performance and risk profile.

Explore 3 other fair value estimates on NRG Energy - why the stock might be worth just $203.00!

Build Your Own NRG Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NRG Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NRG Energy's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026