- United States

- /

- Gas Utilities

- /

- NYSE:NJR

Assessing New Jersey Resources (NJR): Is the Utility Provider Trading Below Fair Value?

Reviewed by Simply Wall St

See our latest analysis for New Jersey Resources.

New Jersey Resources has shown modest momentum, with a 3.14% seven-day share price return and a 1.99% gain over the past month. This hints at a slight uptick in sentiment despite a generally stable year. Looking longer term, its total shareholder return over five years stands at 54.85%, demonstrating consistent value creation even as recent price moves have been more muted.

If you want to see what else is catching investor attention beyond steady utilities, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With returns steady and modest growth in the rearview, investors are left to consider whether New Jersey Resources is trading below its true value, or if the market has already factored in all future growth potential. Is there a buying opportunity here, or is everything priced in?

Most Popular Narrative: 14.1% Undervalued

The most widely followed narrative values New Jersey Resources at $53.57. This valuation is well above the last close price of $46.03. This sets the stage for a discussion about what factors are fueling analysts' optimism despite sluggish growth projections.

A multi-year pipeline of solar and clean energy projects at Clean Energy Ventures, supported by flexible, risk-adjusted capital deployment, offers upside to future revenues and margin diversification as demand for renewable infrastructure accelerates.

Curious what numbers could justify an upside this big? The narrative leans on shifting revenues, changing profit margins, and a future earnings multiple that could surprise you. Dig in to see which assumptions are making analysts raise expectations for New Jersey Resources.

Result: Fair Value of $53.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any shift in regulatory support or slower population growth could challenge current optimism and place long-term earnings and valuations at risk.

Find out about the key risks to this New Jersey Resources narrative.

Another View: What Do the Ratios Say?

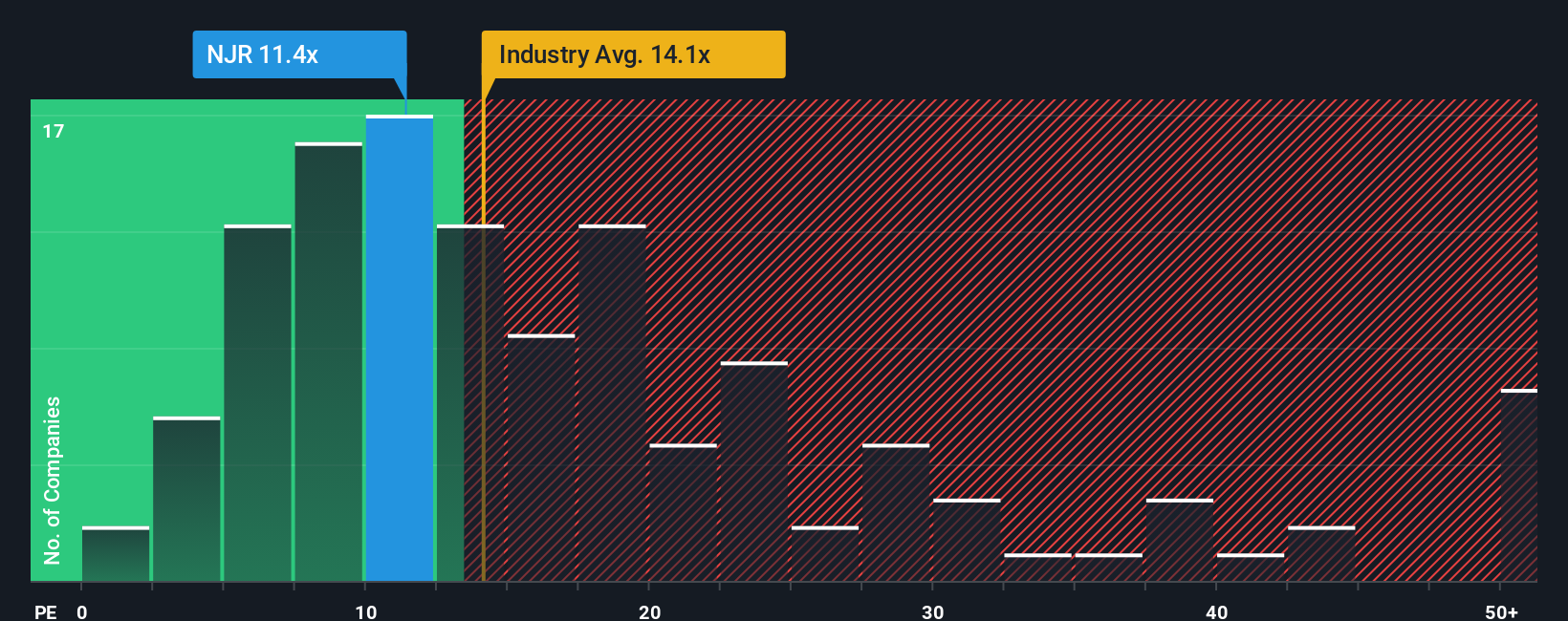

Looking at market ratios, New Jersey Resources trades at 11.2 times earnings, well below both the peer average of 20.4 and the industry average of 14.1. The fair ratio suggests a level closer to 15.7. This gap points to possible opportunity, but does the market know something others do not?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out New Jersey Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own New Jersey Resources Narrative

If you have a different perspective or want to dig into the details yourself, shaping your own view of New Jersey Resources takes just a few minutes. Do it your way.

A great starting point for your New Jersey Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always one step ahead. If you want to expand your opportunities, tap into other fast-growing trends and sectors before the market catches on.

- Uncover the most overlooked values with companies identified as these 885 undervalued stocks based on cash flows based on strong cash flow fundamentals and hidden potential.

- Supercharge your portfolio with tech innovators by browsing these 27 AI penny stocks at the forefront of artificial intelligence advancements and game-changing applications.

- Lock in reliable income streams from these 14 dividend stocks with yields > 3% that deliver yields above 3 percent for investors who value steady returns in any market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Jersey Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NJR

New Jersey Resources

An energy services holding company, distributes natural gas.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives