- United States

- /

- Gas Utilities

- /

- NYSE:NFG

Does National Fuel Gas Still Offer Value After a 30% Year-to-Date Surge in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if National Fuel Gas is actually a hidden value play, or if you might be joining in too late? You're in the right place to find out.

- While the stock dipped slightly by 0.2% over the past week and 5.5% over the past month, it is up an impressive 30.5% year-to-date and 121.5% over the last five years.

- National Fuel Gas has been catching attention in the energy sector as industry headlines highlight its ongoing infrastructure investments and strategic acquisitions. All of these efforts are aimed at boosting long-term growth, shaping investor expectations, and influencing the company’s evolving market outlook.

- On our valuation checks, National Fuel Gas scores a solid 5 out of 6, which suggests there could still be room for upside. We will break down what is driving this score and dig into the usual valuation methods. Stick around, because there may be a smarter way to look at value by the end of this article.

Approach 1: National Fuel Gas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This helps investors assess what a business might truly be worth today, based on its capacity to generate cash in the years ahead.

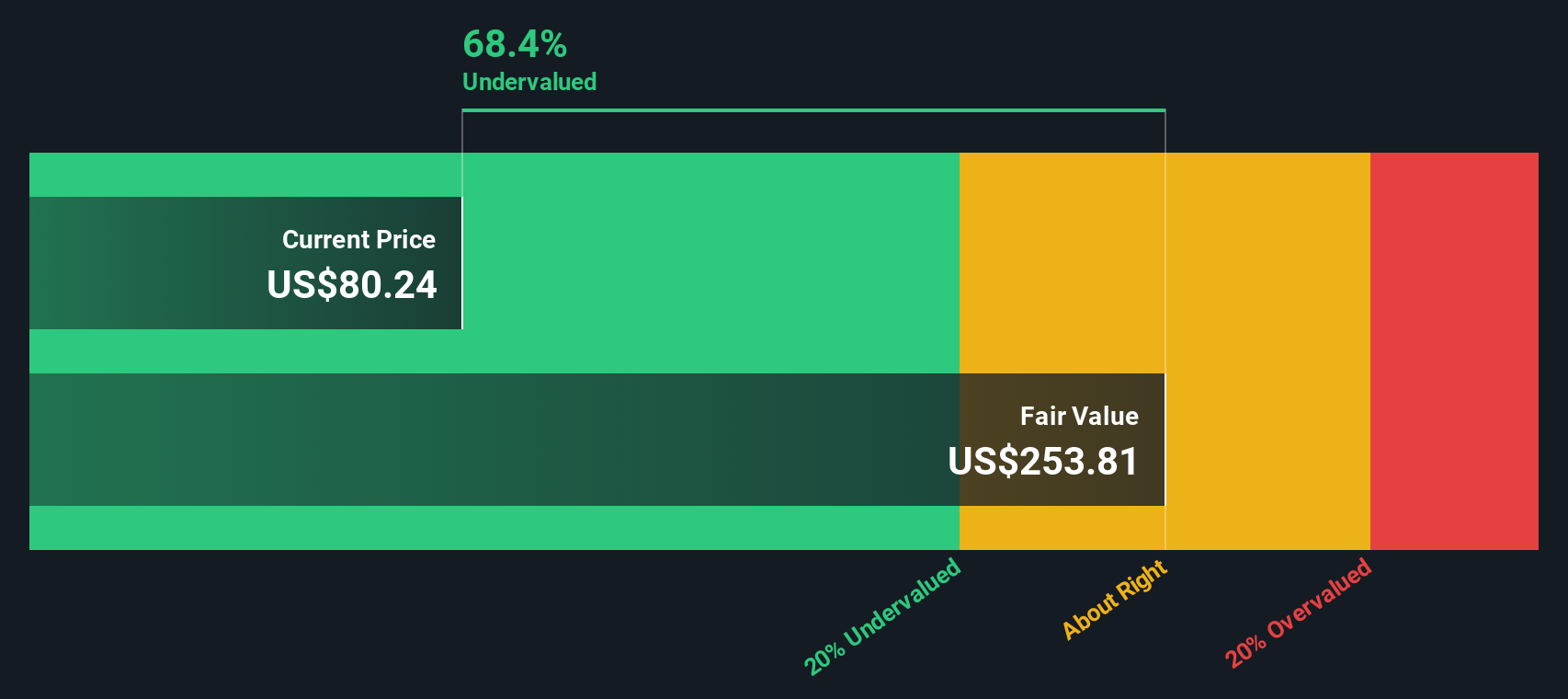

For National Fuel Gas, current Free Cash Flow sits at $39.37 million. Analysts expect a significant jump, with projections reaching $1.21 billion by 2035. Estimates past 2027 are extrapolated beyond the five-year analyst range. The model used here is the 2 Stage Free Cash Flow to Equity approach and outlines healthy annual growth in future years. All values are referenced in US dollars.

The result of this DCF approach is an intrinsic value of $252.36 per share. When compared to the current share price, this calculation signals that National Fuel Gas is trading at a 68.3% discount to its fair value. This may imply major upside potential for investors looking for value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests National Fuel Gas is undervalued by 68.3%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: National Fuel Gas Price vs Earnings

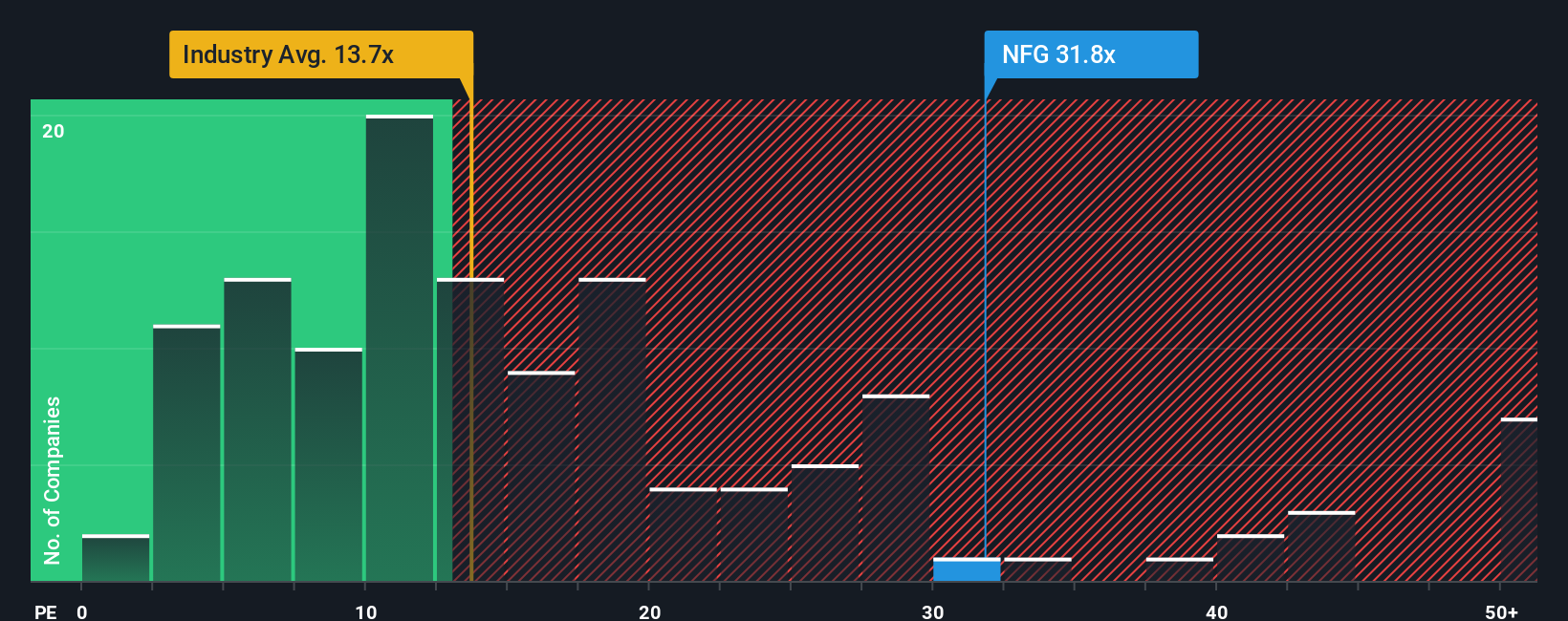

The Price-to-Earnings (PE) ratio is widely used for evaluating companies that are profitable, like National Fuel Gas. This ratio helps investors quickly gauge how much they are paying for each dollar of earnings and is particularly meaningful when the business has consistent profits. When considering PE ratios, it is important to remember that higher growth prospects or lower risk often justify a higher "normal" or "fair" PE ratio, while businesses facing slower growth or higher risk generally see lower ratios.

National Fuel Gas currently trades on a PE ratio of 14x. For context, this is just below the Gas Utilities industry average of 14.1x and sits well under the peer group’s average of 20.4x. However, instead of simply comparing the company to peers or the sector, Simply Wall St introduces the “Fair Ratio.” This is a proprietary multiple that weighs factors like expected earnings growth, profit margin, industry dynamics, market cap, and company-specific risks, offering a much more tailored benchmark than generic averages.

National Fuel Gas’s Fair Ratio stands at 22.7x, which is substantially higher than its current PE of 14x. This gap suggests investors may be undervaluing the company based on its unique qualities and outlook rather than just its sector or peer average.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your National Fuel Gas Narrative

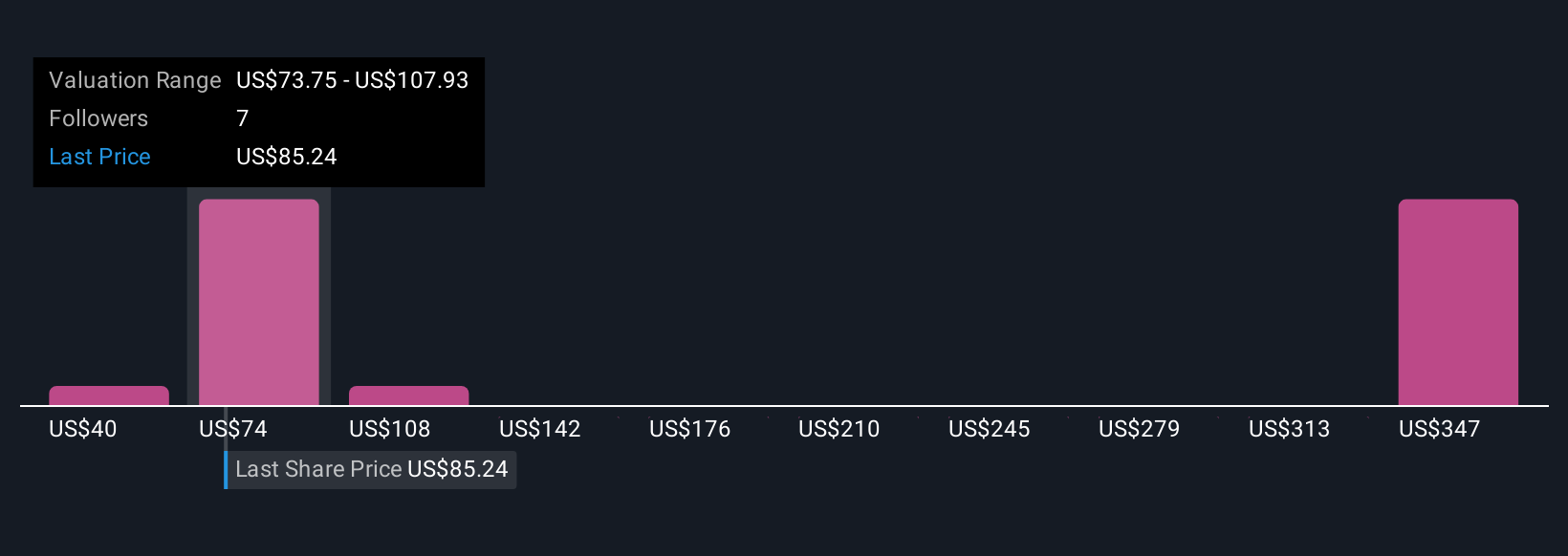

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a user’s own story about a company, connecting their forecasts for future revenue, earnings, and margins to an estimated fair value. This approach essentially turns the numbers into a personalized perspective about what the company is really worth and why. On Simply Wall St’s Community page, Narratives make this process easy and interactive for millions of investors who want to look beyond just ratios and instead see how real business stories play out in the numbers.

Narratives bridge a company’s business journey, such as upcoming projects, regulatory changes, or industry trends, with financial forecasts and a tailored fair value. This allows investors to weigh up their own reasons for buying or selling alongside what the current price tells them. Best of all, Narratives update automatically whenever new earnings results or key news emerges, so your view is always fresh and relevant.

For example, one Narrative might be optimistic, citing rising demand and strong cash flow to justify a much higher fair value for National Fuel Gas. In contrast, a more cautious Narrative could stress regulatory risks and the potential impact of electrification trends, resulting in a lower estimate. This shows how each investor’s story, and therefore their decision, can differ.

Do you think there's more to the story for National Fuel Gas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives