- United States

- /

- Electric Utilities

- /

- NYSE:ES

Should Connecticut’s Rejection of Aquarion Sale Change Eversource Energy’s (ES) Investment Narrative?

Reviewed by Sasha Jovanovic

- In late November 2025, Connecticut regulators rejected Eversource Energy's proposed sale of its water utility, Aquarion Water, forcing the company to rethink its plans to streamline operations and reduce debt.

- This regulatory setback heightened uncertainty around Eversource's business strategy, but also prompted a fresh analyst upgrade, illustrating a divergence in market sentiment toward the company's ability to adapt.

- We'll explore how the Aquarion sale rejection, and its implications for financial deleveraging, could influence Eversource Energy's investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Eversource Energy Investment Narrative Recap

Eversource Energy investors generally expect that steady grid investment, efficient operations, and stable regulatory outcomes will translate into predictable earnings and dividend growth. The Connecticut regulator’s rejection of the Aquarion Water sale is a setback for balance sheet improvement, but the biggest short-term catalyst, a constructive outcome in upcoming rate cases, remains intact, while heightened regulatory risk remains the clearest challenge to the business now.

Of the recent updates, the most relevant is Fitch Ratings assigning Eversource a Negative Outlook after the Aquarion sale rejection, citing greater uncertainty around deleveraging and political risks related to large infrastructure projects. This highlights the ongoing importance of regulatory decisions and balance sheet management to investors tracking near-term risks and catalysts.

By contrast, investors should be aware that heightened regulatory uncertainty in Connecticut could impact future earnings and cost recovery if...

Read the full narrative on Eversource Energy (it's free!)

Eversource Energy's outlook anticipates $14.8 billion in revenue and $2.1 billion in earnings by 2028. This reflects a 4.4% annual revenue growth rate and an earnings increase of approximately $1.24 billion from current earnings of $858 million.

Uncover how Eversource Energy's forecasts yield a $72.73 fair value, a 8% upside to its current price.

Exploring Other Perspectives

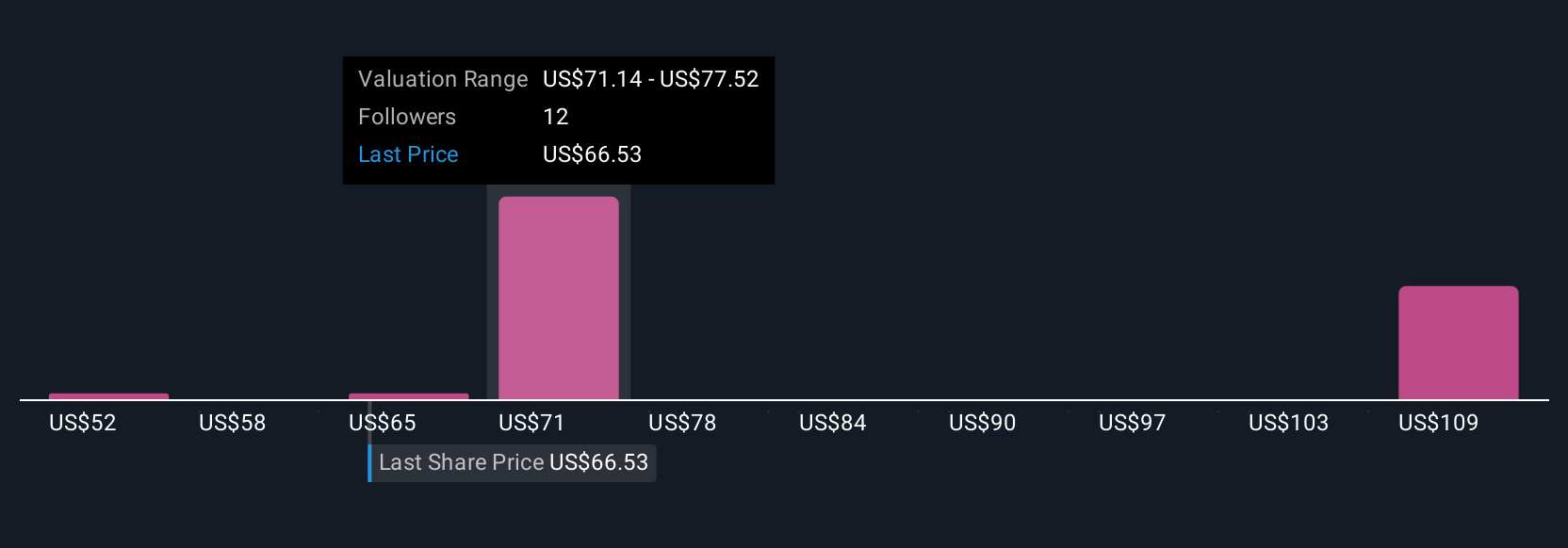

Simply Wall St Community members provided four fair value estimates ranging widely from US$52 to US$221.39 per share. Regulatory uncertainty in Connecticut continues to split opinion on the outlook for Eversource’s business model and future stability, explore several viewpoints from community participants.

Explore 4 other fair value estimates on Eversource Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Eversource Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eversource Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Eversource Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eversource Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026