- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy (DTE): Assessing Valuation After Recent Modest Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for DTE Energy.

Momentum has been steadily building for DTE Energy, with a 17% year-to-date share price return and one-year total shareholder return of nearly 15%. This suggests investors are growing more optimistic about the company’s long-term earnings prospects, despite only modest short-term movement.

If you’re interested in what else the market is rewarding right now, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With steady returns and a modest discount to analyst targets, the big question for investors is whether DTE Energy remains undervalued or if the current share price has already factored in all future growth potential. Is there still a buying opportunity here?

Most Popular Narrative: 3.7% Undervalued

At $141.65, DTE Energy trades slightly below the most popular fair value estimate of $147.17. This puts the company in focus as analysts weigh fundamentals against high market expectations and ongoing grid transformation.

"A major upcoming catalyst for DTE is the rapid expansion in electricity demand being driven by hyperscale data centers, with 3 gigawatts of advanced negotiations and an additional 4 gigawatts in the pipeline. These loads, operating at nearly 90% capacity factors, will materially increase revenues and provide significant headroom for rate growth while improving overall system load factor and grid utilization."

Want to know what’s powering this valuation? Uncover the ambitious forecasts for future revenues, profit margins, and a premium multiple beyond the sector norm. See which bold financial moves form the bedrock of this fair value. The details may surprise you.

Result: Fair Value of $147.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, large-scale capital projects and evolving regulatory challenges could still threaten DTE’s projected growth if execution or policy support does not remain strong.

Find out about the key risks to this DTE Energy narrative.

Another View: Our DCF Model Challenges the Market

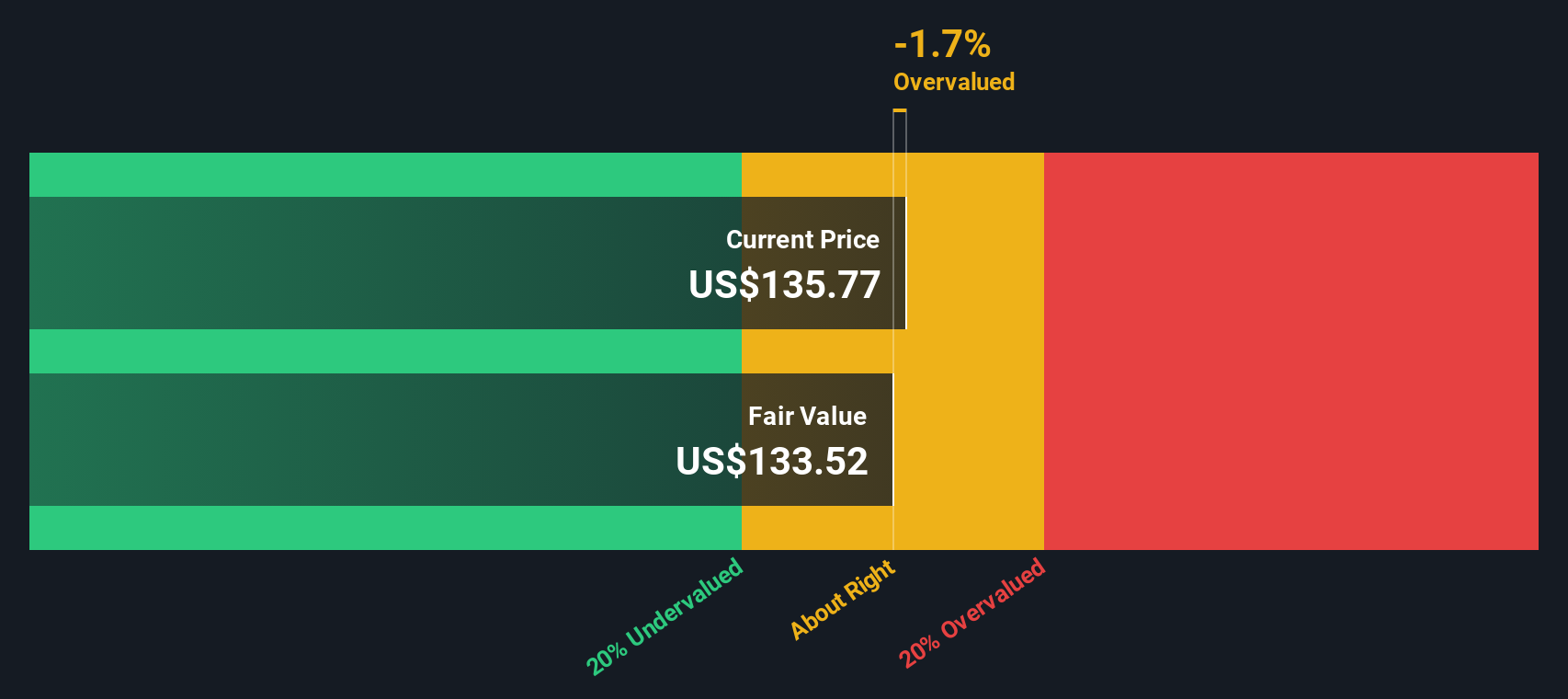

Looking at DTE Energy through the lens of our SWS DCF model offers a more cautious perspective. According to the discounted cash flow analysis, the stock is trading above its fair value of $132.30. This signals potential overvaluation by this method and may raise fresh doubts about growth expectations.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DTE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DTE Energy Narrative

If you want to dive deeper or see things from your own perspective, it’s easy to examine the numbers and build a personal narrative in just a few minutes. Do it your way

A great starting point for your DTE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the advantage today and check out other smart opportunities on Simply Wall Street. Don’t let fresh insights and potential wins pass you by. Unique stocks are just a step away.

- Jump straight into the digital frontier and uncover potential growth by evaluating these 79 cryptocurrency and blockchain stocks, which is leading the way in blockchain and new-age payment systems.

- Get ahead on passive income goals when you analyze which companies make the cut in these 18 dividend stocks with yields > 3% and offer attractive yields along with reliable financial strength.

- Unleash your curiosity for breakthrough medicine and tap into the next leap forward with these 33 healthcare AI stocks, transforming healthcare through cutting-edge AI innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026