- United States

- /

- Other Utilities

- /

- NYSE:CNP

How Investors May Respond To CenterPoint Energy (CNP) Joining Palantir Nvidia In AI Power Grid Platform

Reviewed by Sasha Jovanovic

- Earlier this month, Palantir Technologies announced “Chain Reaction,” an AI infrastructure operating system developed with founding partners CenterPoint Energy and Nvidia, aimed at optimizing power generation, grid stability, and data center capacity for AI demand across the US.

- The partnership gives CenterPoint Energy a role in shaping software for large-scale AI power needs, potentially influencing how utilities manage grid reliability, capital deployment, and coordination with hyperscale data centers.

- Against this backdrop, we’ll explore how CenterPoint’s role in Chain Reaction could reshape its long-term growth story in AI-driven electricity demand.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

CenterPoint Energy Investment Narrative Recap

To own CenterPoint Energy, you need to believe that regulated utility earnings backed by rising Texas electricity demand can support its premium valuation, while execution and financing risks stay contained. The Chain Reaction partnership aligns with this thesis by tying CenterPoint directly into AI-driven power needs, but it does not meaningfully change near term catalysts, which still center on delivering its large capital plan on time and maintaining constructive regulatory outcomes.

The most relevant recent development alongside Chain Reaction is CenterPoint’s reaffirmed long term plan, including a targeted 11% rate base growth and 7% to 9% EPS growth through 2030, supported by a US$65 billion ten year capital program. This capital plan is increasingly underpinned by expected load growth from data centers and industrial activity in Texas, making execution and timely cost recovery even more critical as AI related demand expectations build.

Yet while AI linked demand can be a tailwind, investors should also be aware that higher interest costs on US$3.4 billion of net new debt since last year could...

Read the full narrative on CenterPoint Energy (it's free!)

CenterPoint Energy's narrative projects $10.5 billion revenue and $1.5 billion earnings by 2028.

Uncover how CenterPoint Energy's forecasts yield a $42.60 fair value, a 11% upside to its current price.

Exploring Other Perspectives

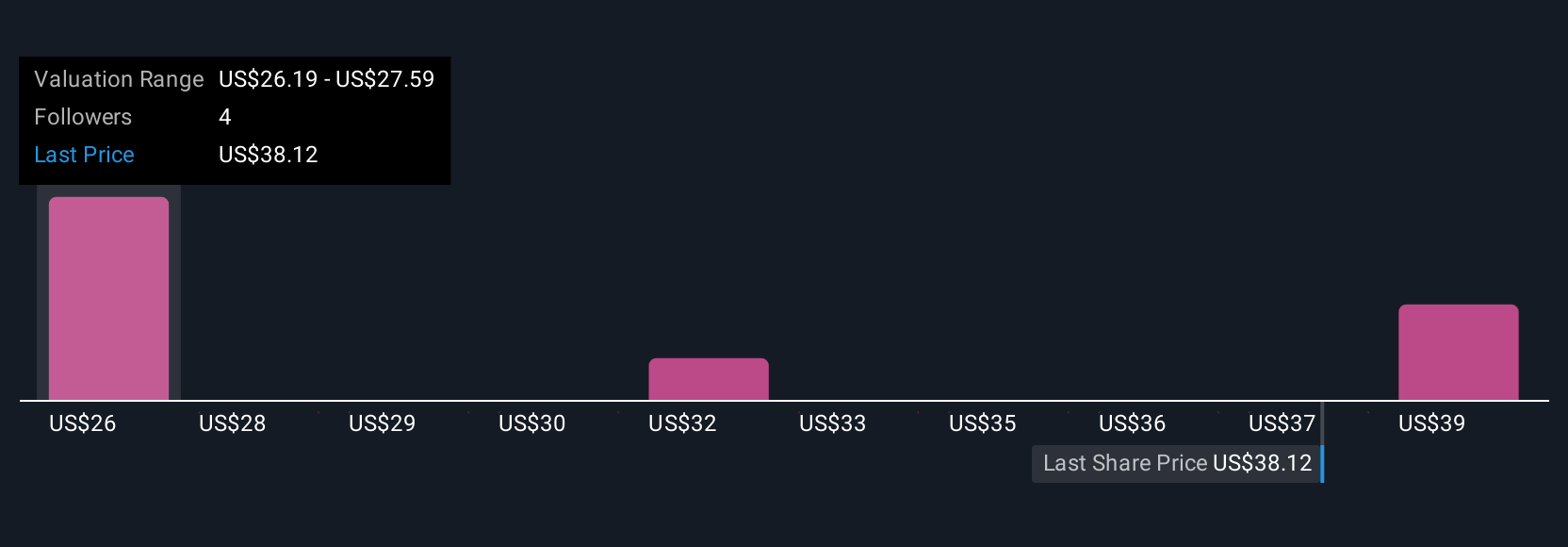

Four fair value estimates from the Simply Wall St Community span roughly US$26 to US$43, reflecting very different views on what CenterPoint is worth. Against this range, the company’s US$65 billion capital plan and focus on Texas load growth give you a clear operational backdrop to weigh alongside those competing estimates and to compare how others see the balance between growth and execution risk.

Explore 4 other fair value estimates on CenterPoint Energy - why the stock might be worth as much as 12% more than the current price!

Build Your Own CenterPoint Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CenterPoint Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CenterPoint Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CenterPoint Energy's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026