- United States

- /

- Other Utilities

- /

- NYSE:BKH

Did Kansas Rate Approval Redefine Black Hills' (BKH) Approach to Revenue Stability and Investment?

Reviewed by Simply Wall St

- Black Hills Corp. recently received approval from the Kansas Corporation Commission for a unanimous settlement on new utility rates, allowing recovery of about US$118 million in system investments and recognition of inflation-related costs since its last general rate filing in 2021.

- This development strengthens Black Hills' ability to recover infrastructure investments and maintain stable, predictable cash flows through enhanced base rate revenues and regulatory mechanisms.

- We'll explore how the approved Kansas rate settlement supports Black Hills' revenue stability and aligns with its long-term investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Black Hills Investment Narrative Recap

To be a Black Hills shareholder, you need to believe in the reliability of regulated utility revenues and the company’s ongoing capital investment in critical infrastructure. The recent Kansas rate approval is a positive for near-term revenue stability, but the largest catalyst, large-scale capital projects tied to data center demand, remains unaffected. The key risk for Black Hills continues to be execution on these growth projects, where delays or missed milestones could impact future earnings and revenue growth.

Among recent announcements, the board’s reaffirmation of a US$0.676 per share quarterly dividend stands out. This ongoing dividend commitment underscores management’s confidence in cash flow stability, which is supported by regulatory settlements like the Kansas decision. For investors focused on catalysts, sustained dividend payments can signal underlying business health as the company progresses with capital allocation plans.

However, despite these positives, investors should be aware that if major capital projects such as Ready Wyoming or the Colorado Clean Energy Plan experience setbacks or cost overruns...

Read the full narrative on Black Hills (it's free!)

Black Hills is projected to reach $2.4 billion in revenue and $368.3 million in earnings by 2028. This outlook assumes a 2.9% annual revenue growth rate and reflects an earnings increase of $88.8 million from the current earnings of $279.5 million.

Uncover how Black Hills' forecasts yield a $65.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

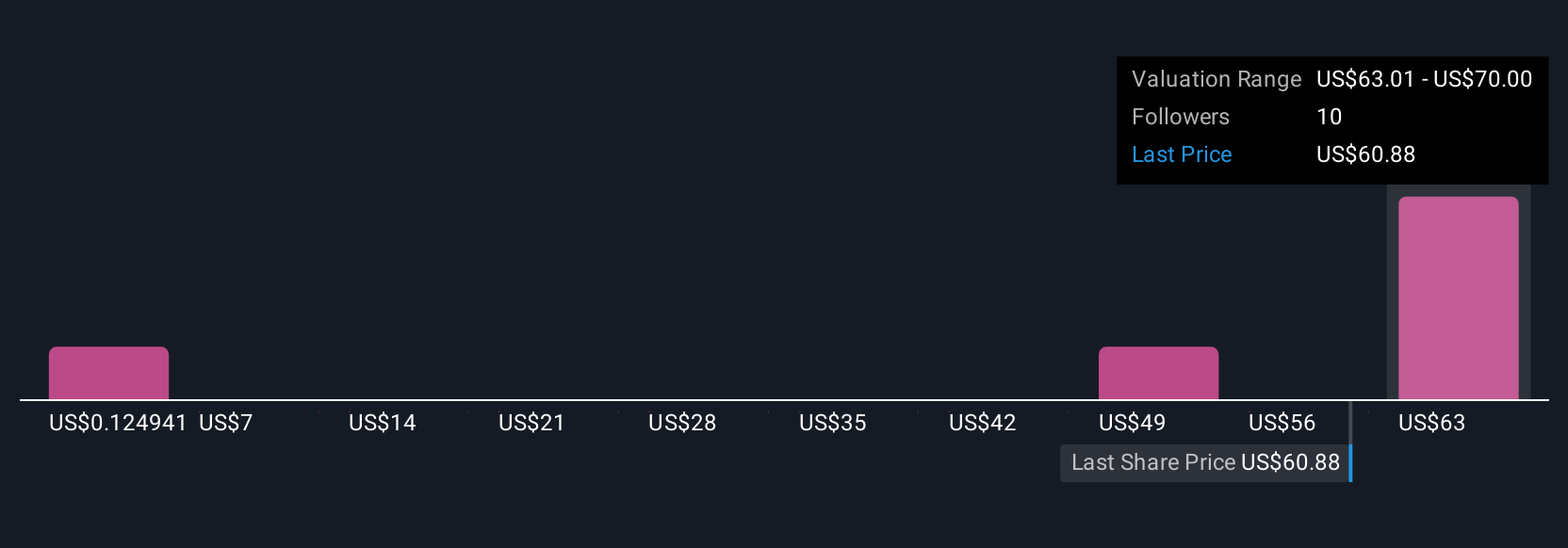

Six Simply Wall St Community fair value estimates for Black Hills range from US$6.02 to US$70 per share. With the regulatory settlement driving near-term cash flow stability, opinions differ on how risks around major project execution could shape future returns, explore how others are approaching this question.

Explore 6 other fair value estimates on Black Hills - why the stock might be worth less than half the current price!

Build Your Own Black Hills Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Hills research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Hills research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Hills' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives