- United States

- /

- Water Utilities

- /

- NYSE:AWR

The Bull Case For American States Water (AWR) Could Change Following Record Q3 Sales and Earnings Momentum

Reviewed by Sasha Jovanovic

- American States Water Company recently reported its third quarter 2025 results, showing sales of US$182.72 million and net income of US$41.17 million, both up from the same period last year.

- A significant driver in this financial improvement was the combination of growth across its water and electric segments, as well as performance in contracted military base services.

- We'll examine how this strong operational and earnings momentum shapes the long-term investment narrative for American States Water.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

American States Water Investment Narrative Recap

Owning American States Water stock means believing in stable, utility-driven growth, where regulated rate increases and infrastructure investments support long-term earnings. The latest Q3 results highlight solid revenue and net income performance, but the biggest short-term catalyst, rate base growth from major infrastructure projects, was essentially as expected and not materially changed by this earnings update. However, the most significant risk remains unchanged: increased earnings volatility following the removal of full revenue decoupling for California water utilities by regulators. Recent dividend increases remain the most relevant announcement in the context of this earnings report, reinforcing management’s confidence in sustainable earnings. The company’s decision to raise quarterly dividends again in October, after a similar move in July, underlines its ongoing commitment to returning value to shareholders, even amid evolving regulatory pressures. But against this strong financial performance, investors should not overlook the risk of heightened revenue swings following the CPUC decision on decoupling...

Read the full narrative on American States Water (it's free!)

American States Water's narrative projects $749.2 million in revenue and $155.0 million in earnings by 2028. This requires 6.7% yearly revenue growth and a $30.7 million increase in earnings from $124.3 million currently.

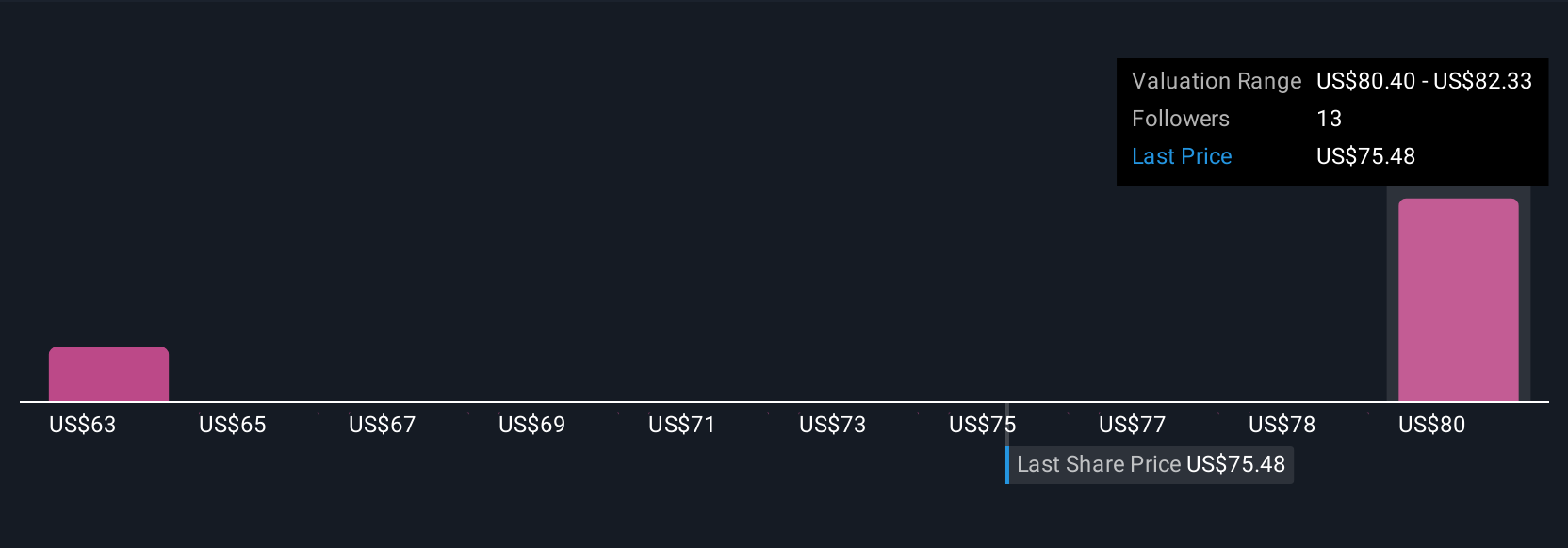

Uncover how American States Water's forecasts yield a $81.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members valued American States Water between US$59.44 and US$199.94 per share. While opinions cover a broad span, recent regulatory changes could introduce more revenue unpredictability, making it worthwhile to consider a variety of views before making any decisions.

Explore 3 other fair value estimates on American States Water - why the stock might be worth over 2x more than the current price!

Build Your Own American States Water Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American States Water research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American States Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American States Water's overall financial health at a glance.

No Opportunity In American States Water?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWR

American States Water

Through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives