- United States

- /

- Water Utilities

- /

- NYSE:AWR

American States Water (AWR): Evaluating Valuation After Strong Q3 Results, New Contracts, and Dividend Growth

Reviewed by Simply Wall St

American States Water (AWR) just posted solid third-quarter results, with both earnings and revenue coming in above expectations. The company’s performance was lifted by higher utility rates as well as healthy contract growth.

See our latest analysis for American States Water.

AWR’s share price has edged higher in recent days, helped by the upbeat quarterly results and news of fresh contract wins and dividend growth. However, momentum has faded over the past year, with a 1-year total shareholder return of -11%. Longer-term returns remain modest, but the company’s steady investments and regulatory wins hint at improving prospects ahead.

If you’re curious about what’s next in the market, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

After a period of lackluster returns, is American States Water’s recent surge just a temporary lift? Or could the stock still offer meaningful upside for investors seeking value as the company’s growth accelerates?

Most Popular Narrative: 8% Undervalued

With American States Water closing at $75.02, the most widely followed narrative estimates fair value at $81.50, a healthy premium over current levels. The positive gap is driven by several tailwinds shaping the company’s future.

Robust infrastructure investment, with $170 to $210 million targeted for 2025 and rate base growth authorized by recent CPUC rate case decisions, positions the company to earn higher returns on a growing asset base, contributing to long-term increases in both revenue and potential net margins.

Craving the details on how this value was calculated? The narrative actually hinges on bold financial projections underlying revenue expansion, profit margin shift, and a future valuation multiple more aggressive than industry norms. Find out what forecasts and hidden assumptions underpin this optimistic outlook: read on for the full story.

Result: Fair Value of $81.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and California’s water supply risks could challenge American States Water’s optimistic growth path if conditions deteriorate or if legislation fails.

Find out about the key risks to this American States Water narrative.

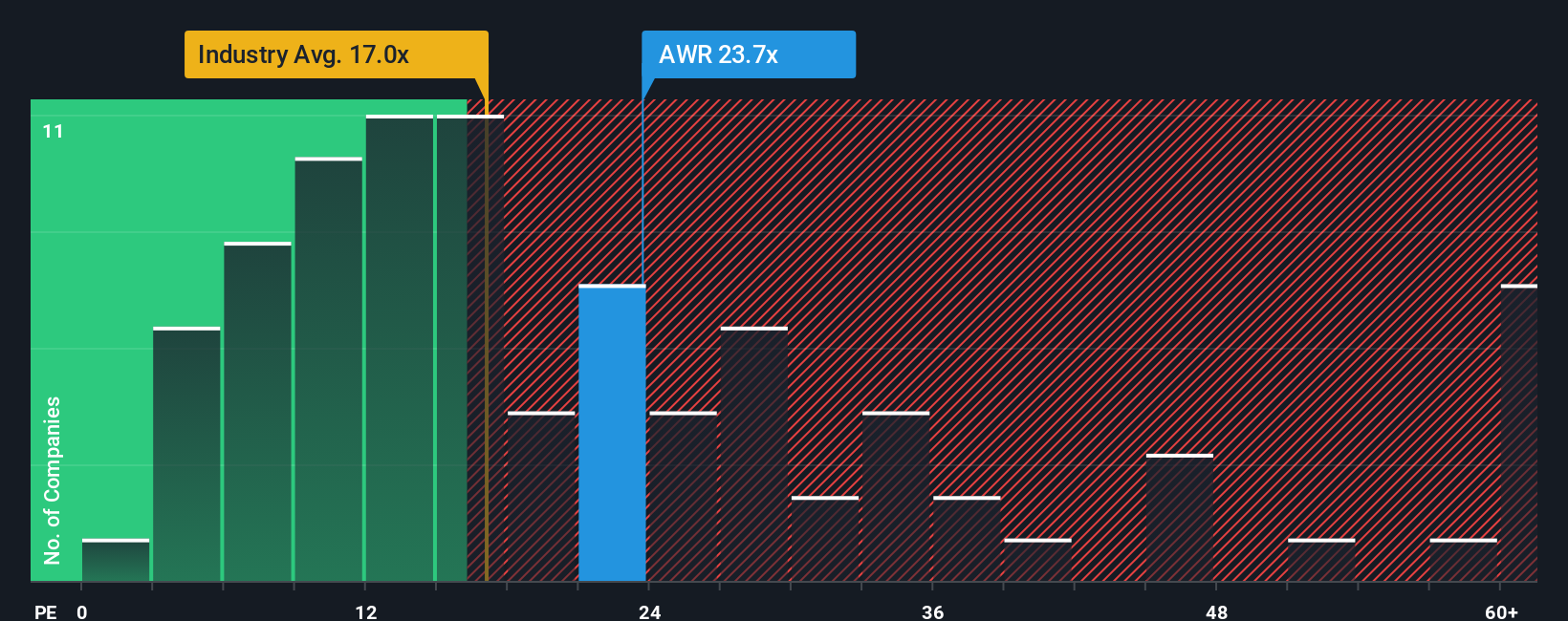

Another View: The Market’s Multiple Tells a Different Story

Looking at where American States Water trades on a price-to-earnings basis, the picture shifts. Shares change hands at 22.4 times earnings, which is notably higher than US peers (18.6x), global rivals (16.3x), and above the fair ratio of 17.3x that the market could move toward. This means the stock currently carries a premium, which could limit upside if investor sentiment or market conditions change. Are buyers paying too much up front, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American States Water Narrative

If you think there’s more to the story or want to dig into the numbers your own way, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your American States Water research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors know that one great stock isn't enough. Supercharge your portfolio and boost your opportunity for outsized returns with these handpicked growth ideas from the Simply Wall Street Screener. Missing out could mean leaving profits on the table.

- Spot hidden opportunities by checking out these 863 undervalued stocks based on cash flows with robust cash flows that may be flying under the market’s radar.

- Maximize your long-term income strategy by targeting these 16 dividend stocks with yields > 3% offering yields above 3% and historically reliable payouts.

- Get ahead of tomorrow’s innovation by tracking these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and rapid industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWR

American States Water

Through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives