- United States

- /

- Other Utilities

- /

- NYSE:AVA

Avista (AVA): Assessing Valuation Following Improved Earnings and Positive Regulatory Developments

Reviewed by Simply Wall St

Avista (AVA) just released its latest quarterly results, showing higher earnings and revenue compared to last year. Alongside the report, the company reaffirmed full-year earnings guidance. This was aided by effective cost controls and constructive regulatory developments.

See our latest analysis for Avista.

Avista’s share price has shown solid momentum recently, climbing 8.9% over the past month and pushing its year-to-date gain to 12.4%. That momentum is matched by a one-year total shareholder return of 15.1%, reflecting both dividend payouts and price appreciation as confidence builds around the company’s improved outlook and steady execution on cost management. Looking further out, Avista has rewarded long-term investors with a total return of 36.2% over five years, reinforcing its reputation for steady, utility-style compounding growth.

If you’re considering what else is moving in the market, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares up double digits this year and trading just below analyst price targets, the key question for investors is whether Avista stock remains undervalued, or if these gains mean future growth is already reflected in the current price.

Most Popular Narrative: Fairly Valued

Avista’s most widely referenced narrative puts its fair value at $40.60, almost identical to the latest closing price of $40.84. This close alignment signals investor expectations largely match the analytical outlook, setting the scene for deeper insights into the assumptions behind this price.

“Robust, multi-year capital investment plans approaching $3 billion (2025 to 2029), with additional upside from grid expansion projects and new generation needs tied to large load requests, position Avista to earn regulated returns and drive long-term earnings expansion.”

Can Avista’s hefty capex ambitions really drive sustainable earnings expansion? Unpack the core projections and see which shape the narrative’s finely balanced valuation. The numbers may surprise you. Want to know exactly which financial levers analysts are betting on?

Result: Fair Value of $40.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory risks or significant cost overruns from ambitious grid investments could quickly challenge Avista’s current growth outlook and valuation assumptions.

Find out about the key risks to this Avista narrative.

Another View: Multiple-Based Valuation

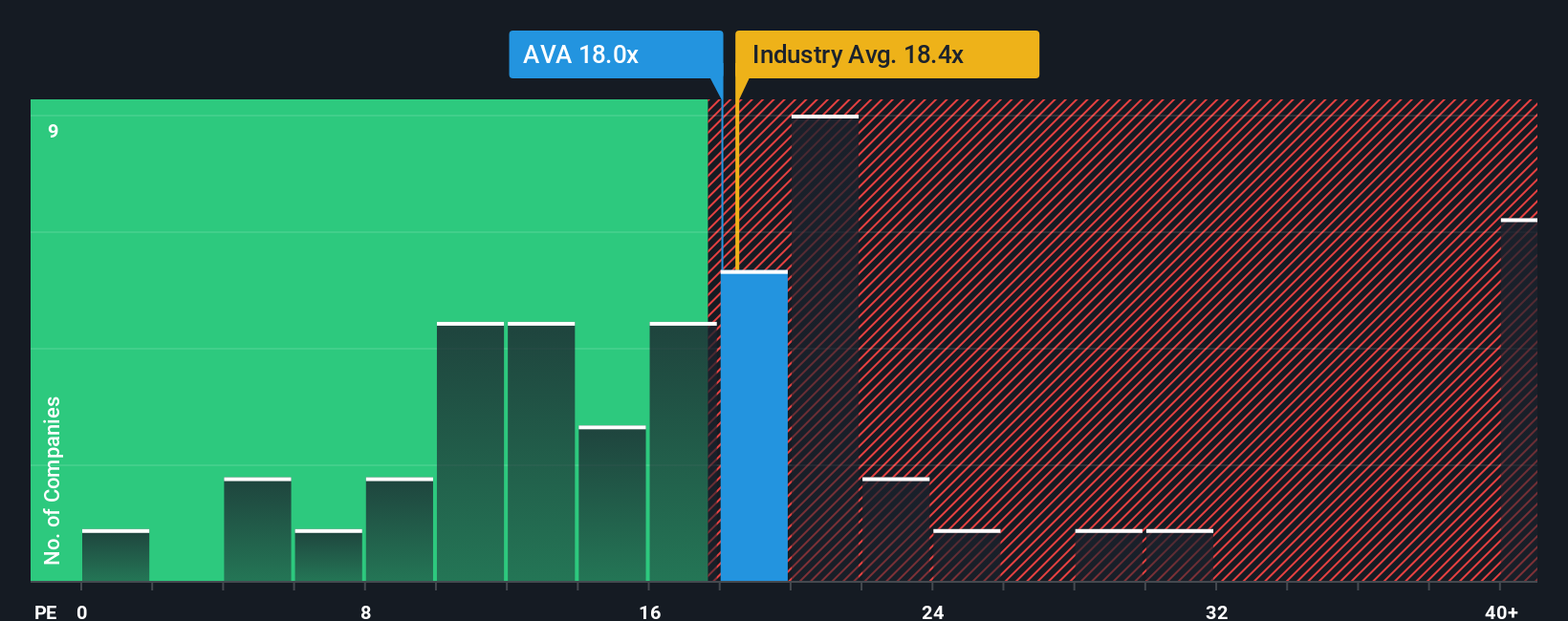

Switching perspectives, let’s look at valuation through the price-to-earnings lens. Avista trades at 17.6x earnings, a discount to both US utility peers (19.6x) and even the industry average. This also sits just below the fair ratio of 17.9x, suggesting balanced but limited upside. Is the real risk missing if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Avista Narrative

If you’re keen to dig into the numbers yourself or want to reach your own conclusions, it only takes a few minutes to put together your personal take and see how it compares. Do it your way

A great starting point for your Avista research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Potential Winners?

Unlock greater opportunities by searching for stocks with standout growth, innovative technology, or income potential. Don’t let the next top stock slip past you when these ideas are waiting to be found.

- Spot opportunities in future-defining technology by checking out these 27 quantum computing stocks. Rapid advances in this area could change entire industries.

- Secure more cash flow with these 16 dividend stocks with yields > 3%, which features stocks offering substantial yields for steady income and compounding returns.

- Catch the momentum in cutting-edge automation and intelligence through these 24 AI penny stocks. These businesses are powering the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives