- United States

- /

- Electric Utilities

- /

- NasdaqGS:MGEE

Is MGE Energy (MGEE) Overvalued or Undervalued? Evaluating the Latest Valuation Signals

Reviewed by Simply Wall St

See our latest analysis for MGE Energy.

This latest drop brings MGE Energy’s share price return for the year to a challenging -13.8%, reflecting fading investor momentum despite steady earnings growth and broader sector shifts. Looking at a longer timeframe, the company’s total shareholder return stands at -21.35% for the past year, but remains positive over three and five years. This suggests resilience beyond the recent slide.

If you’re reevaluating your portfolio in light of shifting market sentiment, this could be the perfect moment to discover fast growing stocks with high insider ownership

With a muted stock price and steady earnings gains, is MGE Energy now flying under the radar, or is the current valuation simply reflecting future growth prospects and leaving little room for upside?

Price-to-Earnings of 21.8x: Is it justified?

At MGE Energy's last close of $80.13, shares trade at a price-to-earnings (P/E) ratio of 21.8x. This multiple is notably above both the industry average and the level implied by fundamental analysis, inviting a closer look at whether growth prospects or other factors justify the market's premium.

The P/E ratio compares a company’s share price against its per-share earnings and offers a shorthand for how much investors are willing to pay for each dollar of profit. For a utility like MGEE, this is a key gauge of market confidence in the company’s earnings power and stability.

MGEE’s P/E of 21.8x exceeds the US Electric Utilities industry average of 20.5x and also surpasses the estimated fair P/E of 19.4x derived from company fundamentals. This suggests the stock may be priced for stronger growth or safety than peers, but current sector headwinds and growth trends may limit upside. The fair ratio provides a potential anchor for future market movements.

Explore the SWS fair ratio for MGE Energy

Result: Price-to-Earnings of 21.8x (OVERVALUED)

However, ongoing sector headwinds and a limited discount to analysts’ price target could quickly challenge the case for a rebound in MGEE shares.

Find out about the key risks to this MGE Energy narrative.

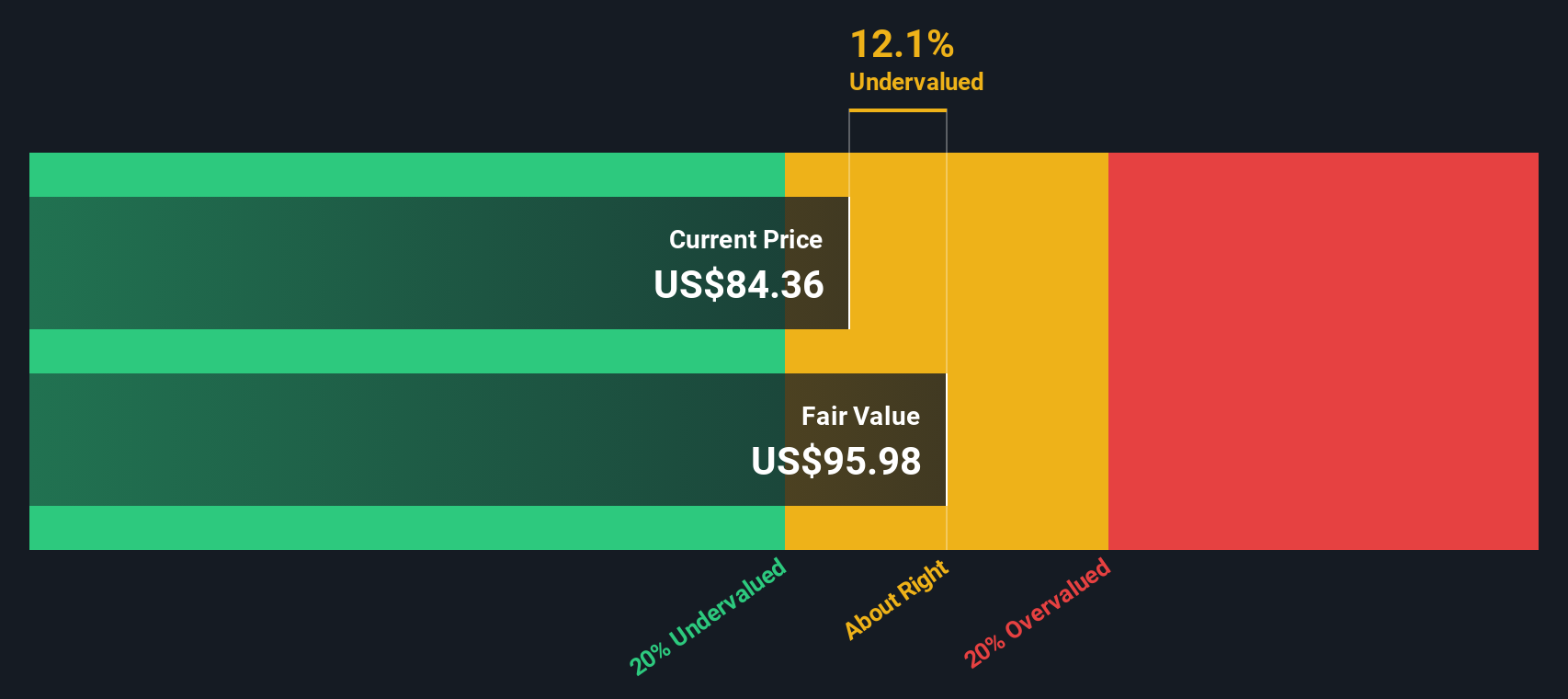

Another View: SWS DCF Model Suggests Undervaluation

While MGE Energy appears overvalued based on its price-to-earnings ratio, our DCF model takes a more optimistic stance. The SWS DCF model values MGEE at $122.35 per share, about 34.5% above the current price, indicating a potential undervaluation by the market.

Look into how the SWS DCF model arrives at its fair value.

This sharp difference in valuation raises a key question: are investors focusing too much on near-term earnings, or is the discounted cash flow model too optimistic about MGEE’s long-term prospects?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MGE Energy Narrative

If you see the story differently or want to test your own ideas, crafting a personal analysis takes just a few minutes, so Do it your way.

A great starting point for your MGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Fuel your portfolio’s potential by using the Simply Wall Street Screener to spot unique winners before everyone else.

- Tap into the rapidly growing world of artificial intelligence with these 25 AI penny stocks. These technologies are reshaping industries and redefining what is possible.

- Uncover hidden gems trading below their real value through these 927 undervalued stocks based on cash flows. This tool offers a shortcut to finding quality stocks that may be ready for a turnaround.

- Lock in consistent cash flow and work toward long-term peace of mind by targeting these 14 dividend stocks with yields > 3% with high yields and proven track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGEE

MGE Energy

Through its subsidiaries, operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026