- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

Data Center Demand and Higher Capex Might Change the Case for Investing in Alliant Energy (LNT)

Reviewed by Sasha Jovanovic

- In the past week, Alliant Energy announced a 17% increase in its four-year capital expenditure plan to US$13.4 billion, supported by robust demand growth from major data center contracts and higher 2026 earnings and dividend targets.

- This significant expansion responds to a projected 50% increase in peak energy demand by 2030, linked to ongoing agreements with large technology clients and sustained operational investments in renewable generation and storage.

- We'll examine how the raised capital expenditure and data center demand are expected to influence Alliant Energy's investment outlook and growth narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Alliant Energy Investment Narrative Recap

To be a shareholder in Alliant Energy, you need to be confident in the company’s ability to convert record-high demand from mega data center contracts into sustainable revenue and earnings growth, amid significant regulatory oversight and large-scale capital commitments. The recent capital expenditure increase supports this growth outlook; however, it does not fully resolve the biggest short-term uncertainty, whether key data center projects like QTS will ramp as expected or face onboarding delays that threaten anticipated earnings. At the same time, the scale of the investment highlights how concentrated Alliant’s future hinges on a handful of large customers, amplifying concentration risk even as it invests for higher regulated returns.

Among several announcements, Alliant’s decision to raise its 2026 earnings guidance and boost its annual dividend target stands out as most connected to the elevated capital plan and surging demand from new data center projects. This signals management’s continued confidence in its growth strategy and commitment to delivering shareholder returns, but also raises the stakes tied to successful execution of these major customer contracts and the supporting infrastructure buildout. In contrast, investors should be aware that if just one major data center partner delays onboarding, then ...

Read the full narrative on Alliant Energy (it's free!)

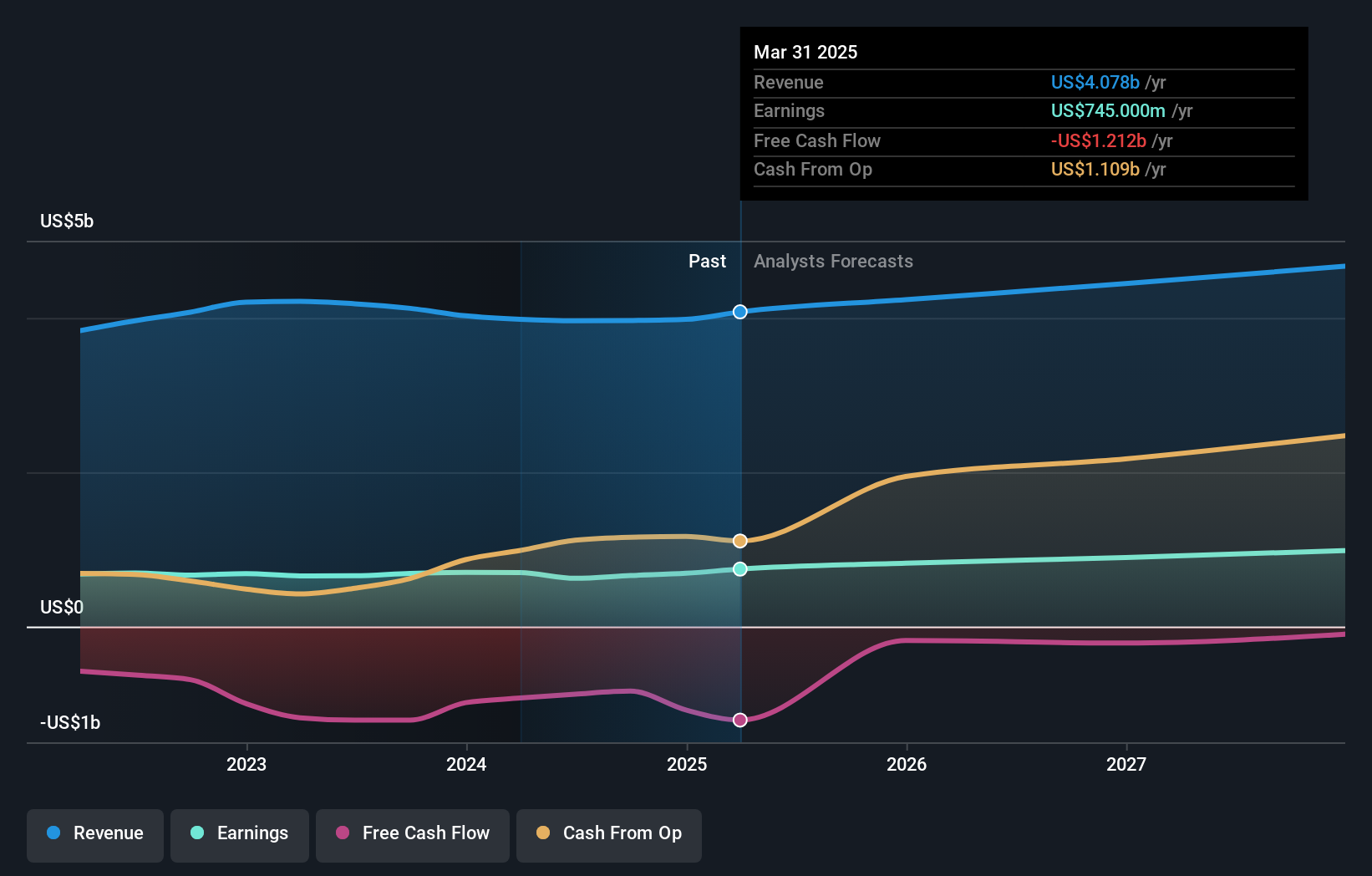

Alliant Energy's narrative projects $4.9 billion in revenue and $1.1 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $268 million increase in earnings from $832 million currently.

Uncover how Alliant Energy's forecasts yield a $70.90 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced two fair value forecasts for Alliant Energy shares, ranging widely from US$61.05 to US$70.90. With project risk concentrated in a few large-scale data center agreements, consider how easily sentiment can shift before you decide what future performance looks like.

Explore 2 other fair value estimates on Alliant Energy - why the stock might be worth 9% less than the current price!

Build Your Own Alliant Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliant Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alliant Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliant Energy's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives