- United States

- /

- Water Utilities

- /

- NasdaqGS:HTO

How ESG Milestone And Emissions Cuts At H2O America (HTO) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- H2O America was recently named to Newsweek’s America’s Most Responsible Companies 2026 list for the second consecutive year, highlighting 2024 achievements such as a 43% cut in greenhouse gas emissions, major infrastructure upgrades, and expanded community programs.

- This repeat ESG recognition, alongside initiatives like increased solar generation and smart meter rollouts, reinforces H2O America’s positioning as a responsibility-focused regulated utility.

- Next, we’ll examine how this renewed ESG recognition and emissions progress may influence H2O America’s existing investment narrative and risk profile.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

H2O America Investment Narrative Recap

To own H2O America, you need to believe in a regulated water utility that can steadily grow earnings while funding heavy infrastructure and ESG investments. Newsweek’s repeat “Most Responsible Companies” recognition strengthens the long term responsibility story, but it does not materially change the near term focus on executing capital projects and managing rising water production and interest costs.

The most relevant recent announcement alongside this ESG news is H2O America’s reaffirmed plan to keep its organic growth rate through 2029 in the top half of a 5% to 7% range. That ambition, paired with ongoing investments in advanced metering and resilient infrastructure, ties directly into the key catalyst of earning fair regulatory returns on a US$2 billion style capital plan while containing cost pressures.

However, even with this positive recognition, investors should still be aware of the risk that rising wholesale water costs and interest expenses could...

Read the full narrative on H2O America (it's free!)

H2O America's narrative projects $860.2 million revenue and $125.7 million earnings by 2028. This requires 2.9% yearly revenue growth and about a $22.9 million earnings increase from $102.8 million today.

Uncover how H2O America's forecasts yield a $61.67 fair value, a 29% upside to its current price.

Exploring Other Perspectives

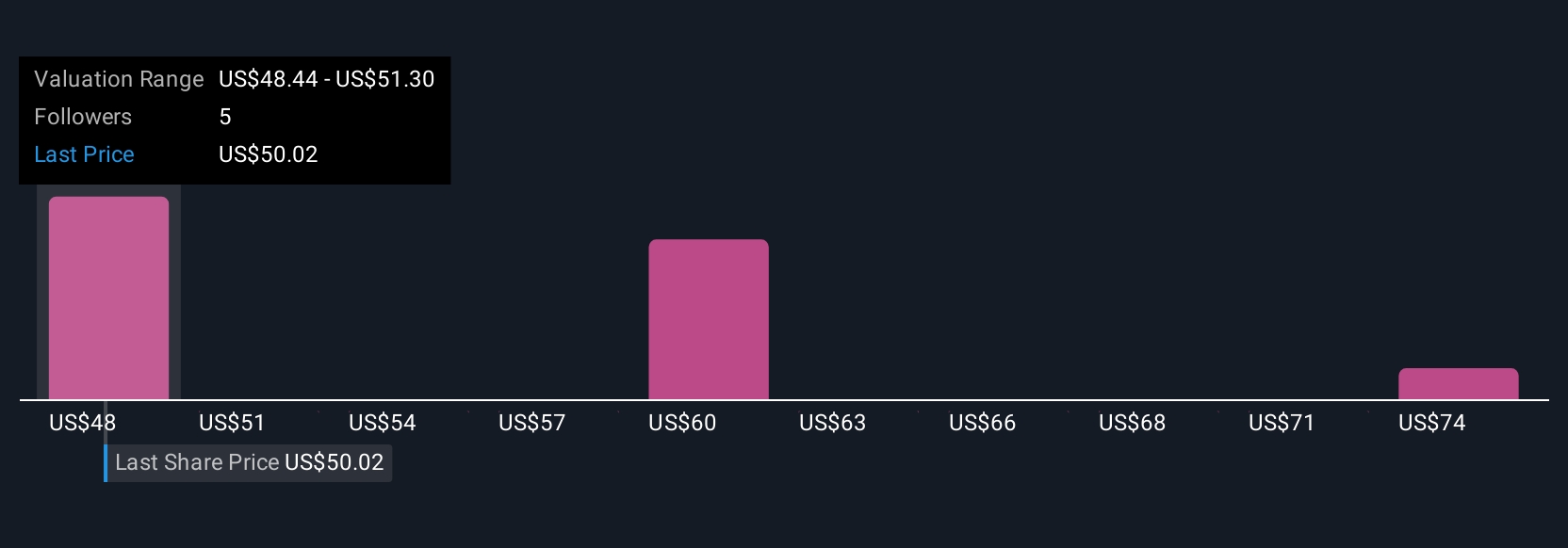

Simply Wall St Community members currently see H2O America’s fair value between about US$48.69 and US$61.67 across 2 different estimates, highlighting how far opinions can spread. Against that backdrop, the need for substantial infrastructure spending and reliable regulatory approvals could be a key swing factor in whether the business delivers on its current earnings growth expectations.

Explore 2 other fair value estimates on H2O America - why the stock might be worth just $48.69!

Build Your Own H2O America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H2O America research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free H2O America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H2O America's overall financial health at a glance.

No Opportunity In H2O America?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H2O America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTO

H2O America

Through its subsidiaries, provides water utility and other related services in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026