- United States

- /

- Renewable Energy

- /

- NasdaqCM:HNRG

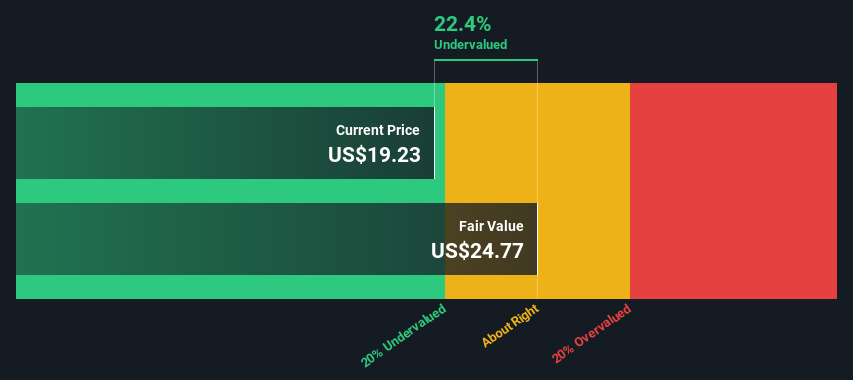

A Closer Look at Hallador Energy (HNRG) Valuation After Strong Q3 Results and Expansion Plans

Reviewed by Simply Wall St

Hallador Energy (HNRG) delivered a standout third-quarter update, reporting big gains in both revenue and net income as energy demand spiked and coal and electric sales climbed. Favorable natural gas prices also contributed to the momentum.

See our latest analysis for Hallador Energy.

After its upbeat third-quarter earnings report and plans to expand capacity, Hallador Energy’s share price reflected renewed optimism, climbing over 8% in the past month and delivering a year-to-date share price return of 94%. Even more striking, its five-year total shareholder return sits above 2,400%, underscoring the powerful long-term momentum behind the stock.

If Hallador’s recent surge has you thinking about what else the market might be overlooking, now could be the right moment to explore fast growing stocks with high insider ownership

Yet with such rapid gains and another quarter of blockbuster results, the real question is whether Hallador Energy’s shares remain undervalued, or if today’s price already reflects most of its future growth prospects. Is there more upside ahead?

Price-to-Sales of 2.2x: Is it justified?

Hallador Energy’s stock is trading at a price-to-sales (P/S) ratio of 2.2x, which places it below several key comparables and suggests relative value at its last close of $22.72.

The price-to-sales ratio compares a company’s market value to its annual revenue, making it especially useful for evaluating firms where earnings can be volatile or negative, as is often the case in the energy sector.

In Hallador’s case, the 2.2x P/S ratio stands out as favorable when compared to both the peer group average of 3.1x and the North American Renewable Energy industry average of 2.9x. However, a closer look reveals that the estimated fair price-to-sales ratio is 1.5x. This suggests the market might have priced in more optimistic assumptions than historical norms would suggest, and that the ratio could revert toward those levels over time.

Explore the SWS fair ratio for Hallador Energy

Result: Price-to-Sales of 2.2x (UNDERVALUED)

However, persistent negative net income and a possible reversion in price-to-sales ratio present real risks that could challenge Hallador’s current valuation momentum.

Find out about the key risks to this Hallador Energy narrative.

Another View: Our DCF Model Weighs In

The SWS DCF model provides a very different perspective. According to this approach, Hallador Energy’s shares are trading well above the DCF-derived fair value of $12.58, suggesting the stock is overvalued by this metric. Does this signal that the recent rally is stretched, or could the market know something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hallador Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hallador Energy Narrative

If you think the numbers point to a different story or want to dig deeper on your own terms, it's easy to build a personal narrative in just a few minutes. Do it your way

A great starting point for your Hallador Energy research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more opportunities?

Don’t limit your portfolio to just one star performer. Take action and discover compelling stocks that could add real upside, before the crowd catches on.

- Spot companies set to benefit from breakthroughs in advanced algorithms by checking out these 27 AI penny stocks.

- Capture steady streams of income with these 14 dividend stocks with yields > 3%, which offers yields above the market average.

- Seize the chance to own value-focused businesses with attractive price tags by exploring these 881 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hallador Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HNRG

Hallador Energy

Through its subsidiaries, engages in the production of steam coal for the electric power generation industry in Indiana.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives