- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Is Now the Right Time for Evergy After a 25% Jump and Industry Headlines?

Reviewed by Bailey Pemberton

- Wondering if Evergy is a bargain or overpriced? Here is a look at what is really driving the stock’s value right now.

- Evergy shares have delivered a robust 25.1% return so far this year and are up 23.3% over the past 12 months. This may signal that investor sentiment and risk appetite are shifting.

- Recent headlines have highlighted growing market interest in utilities as political and economic priorities evolve. Evergy has drawn attention following reports of increased infrastructure investment and industry consolidation. These developments help provide crucial context to the stock’s recent moves, especially as investors look for stable opportunities in uncertain markets.

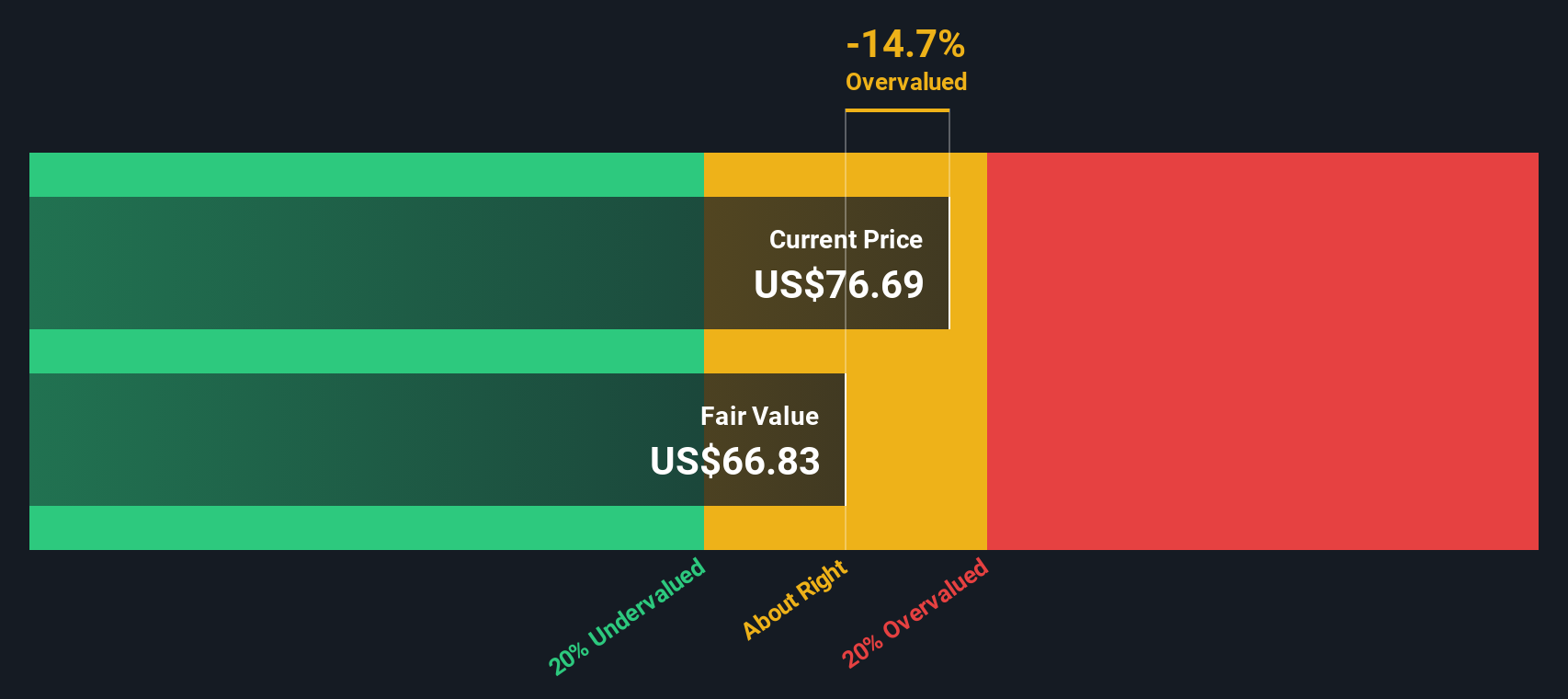

- When it comes to its valuation score, Evergy earns a 0 out of 6, meaning it does not currently pass any standard undervaluation checks. Below is a look at the traditional models and what they say about the stock’s worth. For a different perspective on value, continue reading to the end of this article. (0/6)

Evergy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Evergy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a stock's fair value based on projected dividends, assuming dividends grow at a sustainable rate forever. This approach is particularly relevant for companies with consistent dividend policies, such as utilities.

For Evergy, the model uses a recent annual dividend per share of $2.93. With a payout ratio of 71.7% and return on equity of 8.38%, the implied long-term dividend growth rate is about 2.4%. These figures suggest Evergy is distributing the bulk of its earnings as dividends, but only modest growth in payouts is expected going forward. This methodology is rooted in the calculation: (1 - 71.71%) x 8.38%, which helps estimate the company's sustainable growth rate.

Applying these assumptions, the DDM calculates Evergy’s intrinsic value at $63.89 per share. With the current market price around 20.7% above this intrinsic value, the implication is that Evergy may be overvalued relative to what future dividend streams justify.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Evergy may be overvalued by 20.7%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

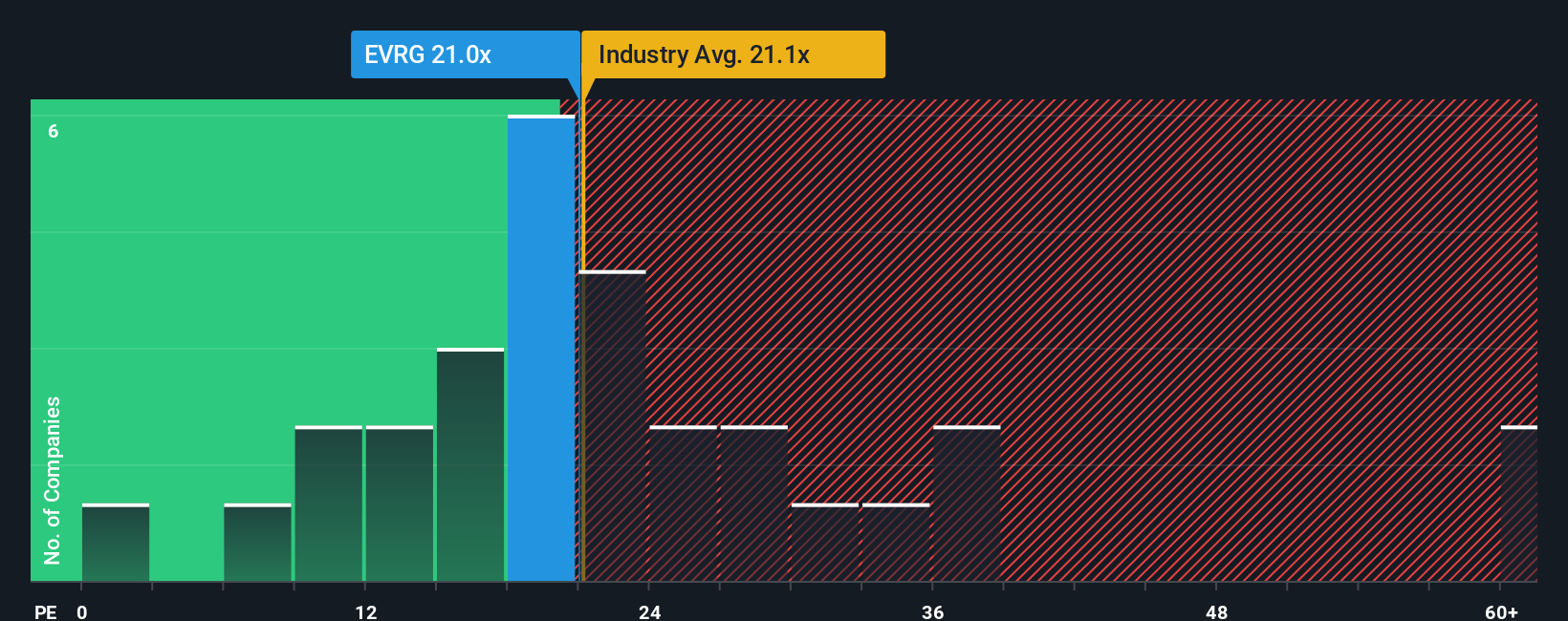

Approach 2: Evergy Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies. It relates a company’s share price to its earnings per share. PE ratios are especially suitable in this context because they show how much investors are willing to pay today for a dollar of the company’s earnings. This makes them a practical tool for comparing valuation across similar businesses.

A “normal” or “fair” PE ratio can vary over time as growth expectations and risk appetite shift. Companies with higher expected growth or greater stability often command higher PE ratios, while those with more risk or lower growth see lower multiples. In Evergy’s case, the current PE ratio is 20.9x. This matches the industry average of 20.9x and is slightly above the peer average of 18.2x.

Simply Wall St’s proprietary Fair Ratio is a more refined benchmark. It is calculated to reflect not just earnings growth, but also factors such as industry dynamics, profit margins, market capitalization, and company-specific risks. Unlike a straight comparison to industry or peers, the Fair Ratio aims to adjust for Evergy’s unique mix of attributes. For Evergy, the Fair Ratio is 20.7x, which is very close to its actual PE ratio.

Since Evergy’s PE and Fair Ratio differ by less than 0.10, the stock appears to be valued about right based on this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

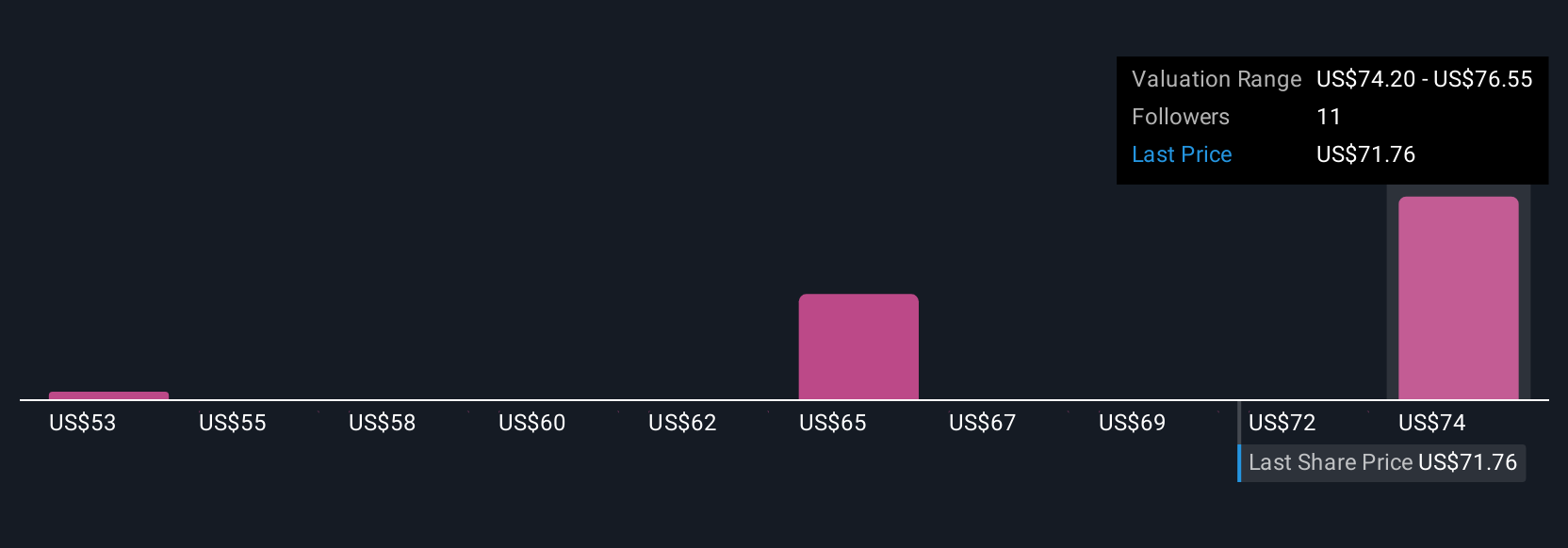

Upgrade Your Decision Making: Choose your Evergy Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story as an investor, your perspective on where Evergy is headed, including what you expect for its future revenue, earnings, and profit margins. Narratives combine your view of the company's opportunities and risks with a financial forecast, then link that story directly to a fair value for the shares. On Simply Wall St's Community page, millions of investors use Narratives to make quantitative forecasts much less daunting and far more approachable.

By creating or following a Narrative, you can easily see whether your expectations for Evergy make it a buy or sell by comparing your Fair Value directly to today's price. Narratives update automatically as new information arrives, such as breaking news or fresh earnings, so your viewpoint always stays relevant in a fast-changing market.

For example, one investor’s Narrative might estimate high revenue growth and a fair value of $84.32 per share, while a more cautious outlook could put Evergy’s Fair Value as low as $71.10. Both are built on transparent, personalized forecasts and assumptions you can examine, debate, and adjust.

Do you think there's more to the story for Evergy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success