- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Assessing Constellation Energy After Clean Energy Push and 45.9% Price Surge in 2025

Reviewed by Bailey Pemberton

- Wondering if Constellation Energy’s recent hot streak is actually justified by the fundamentals? You are not alone. Today we will dig into what the numbers and the market are really saying about its value.

- The stock has had a wild ride lately, down 2.5% in the past week and 7.1% over the past month. Even with those dips, it has surged 45.9% year-to-date and 57.6% in the past year.

- Much of this action has been driven by a string of news stories highlighting Constellation’s aggressive moves in clean energy, strategic partnerships, and new project launches, fueling speculation about its long-term market leadership. These headlines have clearly caught investor attention, but they have also introduced plenty of debate about risk versus reward going forward.

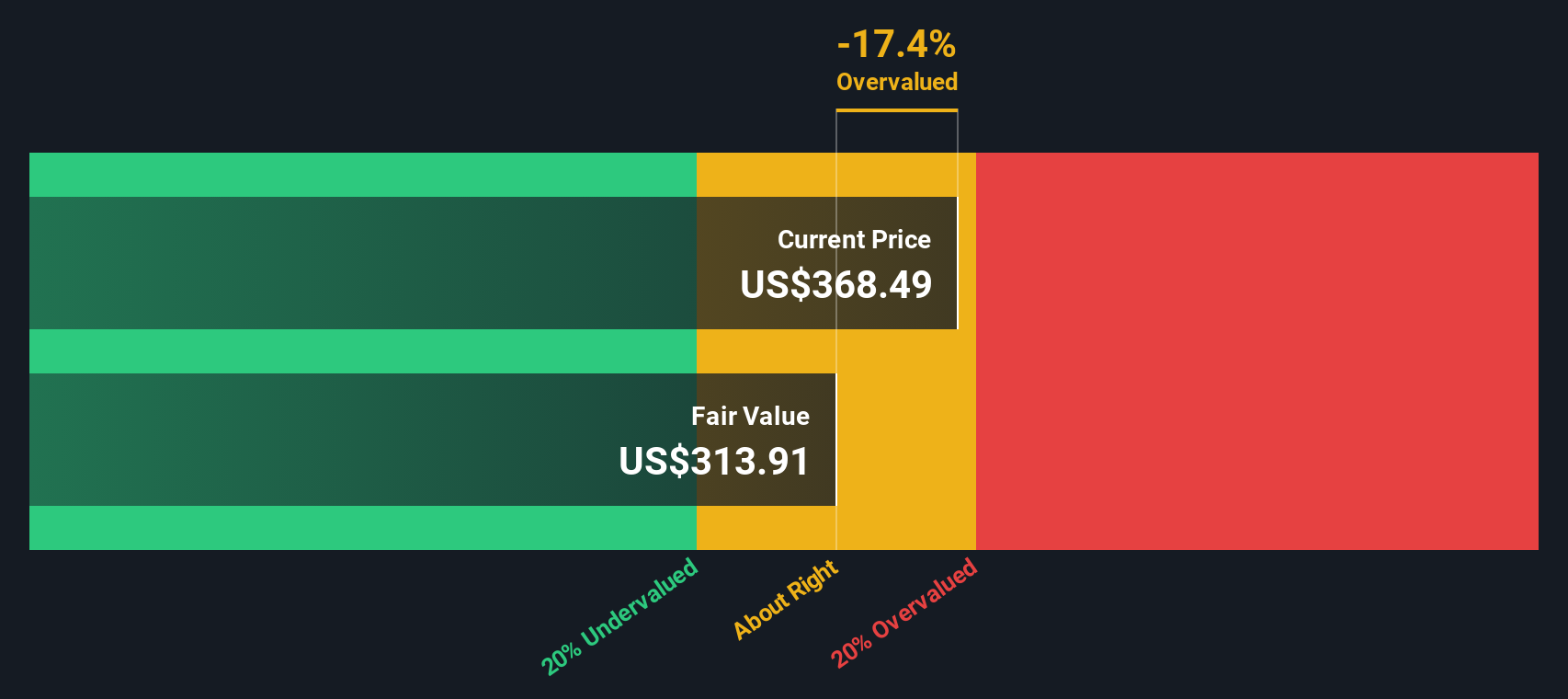

- When it comes to value, Constellation Energy currently has a valuation score of 2 out of 6. We will explore what that means using different valuation approaches. Keep reading for an additional way to judge if this is your next smart buy.

Constellation Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Constellation Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to today’s value. This method offers a forward-looking perspective, focusing on how much money the business is expected to generate for shareholders over time.

For Constellation Energy, the DCF analysis begins with its latest twelve-month Free Cash Flow (FCF), which currently stands at a negative $657 million. Analyst projections anticipate a sharp turnaround, with FCF expected to reach about $5.67 billion by the end of 2029. Analysts contribute cash flow estimates for the next five years. For subsequent years, cash flows are extrapolated, providing a decade-long outlook that reflects expected momentum in the underlying business.

Based on these projections, the model calculates an intrinsic value of $492.26 per share. This figure indicates the stock is currently trading at a 28.1% discount to its fair value. This suggests the market may be underestimating Constellation Energy’s growth potential according to cash flow forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Energy is undervalued by 28.1%. Track this in your watchlist or portfolio, or discover 883 more undervalued stocks based on cash flows.

Approach 2: Constellation Energy Price vs Earnings

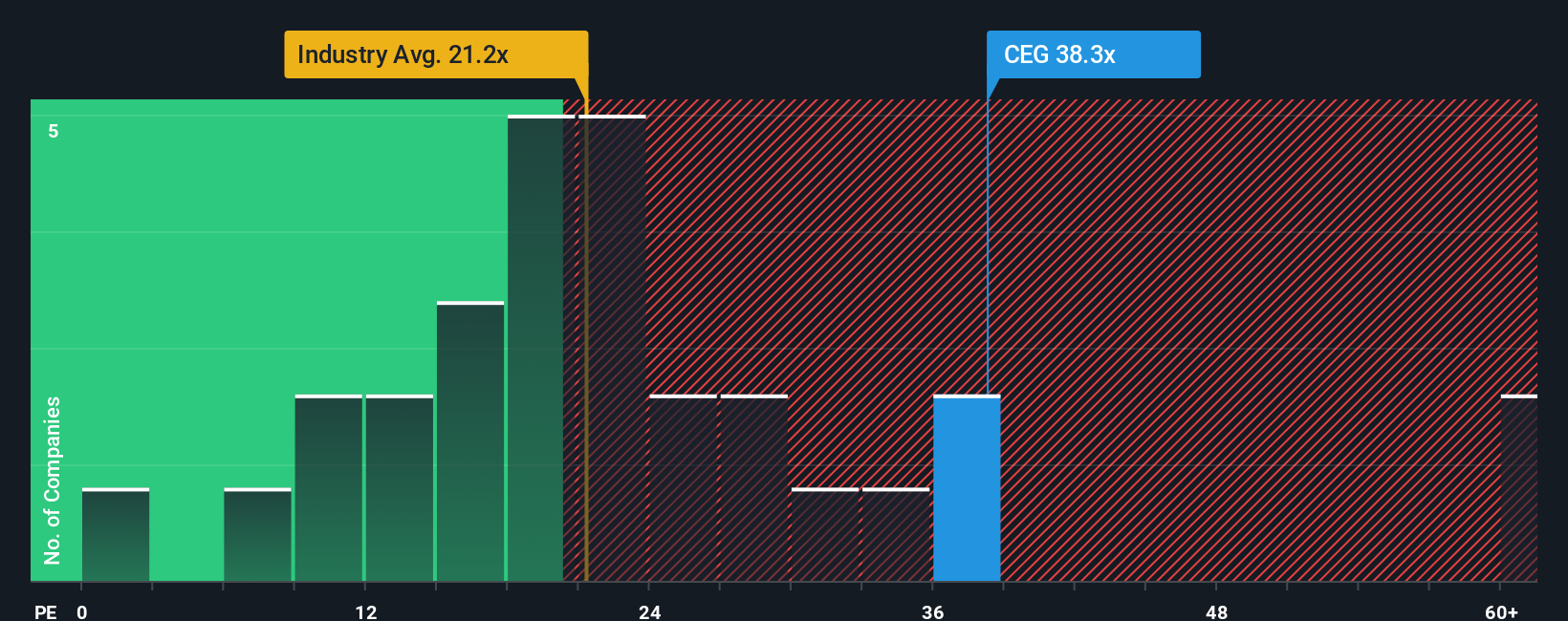

For profitable companies like Constellation Energy, the Price-to-Earnings (PE) ratio remains one of the most effective ways to gauge valuation. The PE ratio helps investors understand how much they are paying for each dollar of current earnings, making it especially meaningful when evaluating companies with positive profits.

It is important to note that what counts as a "normal" or "fair" PE ratio depends on factors such as a company's future growth prospects and overall risk. Higher expected earnings growth can justify higher PE ratios, while greater risks typically require a lower multiple.

Currently, Constellation Energy trades at a PE ratio of 40.36x. This is well above the Electric Utilities industry average of 20.96x and higher than its peers’ average of 21.92x. At first glance, this premium might make the stock look expensive compared to the wider sector.

However, Simply Wall St's proprietary “Fair Ratio” for Constellation Energy is 39.48x. The Fair Ratio is a more nuanced benchmark than industry or peer averages because it integrates specifics such as growth forecasts, profit margins, company size, and unique business risks. By considering these factors, it creates a more tailored and realistic valuation anchor for investors.

Comparing the Fair Ratio (39.48x) to Constellation's actual PE (40.36x) reveals that the stock is priced just slightly above its fair value. The difference is minimal, indicating the market’s current pricing is closely aligned to the company’s actual profile and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Energy Narrative

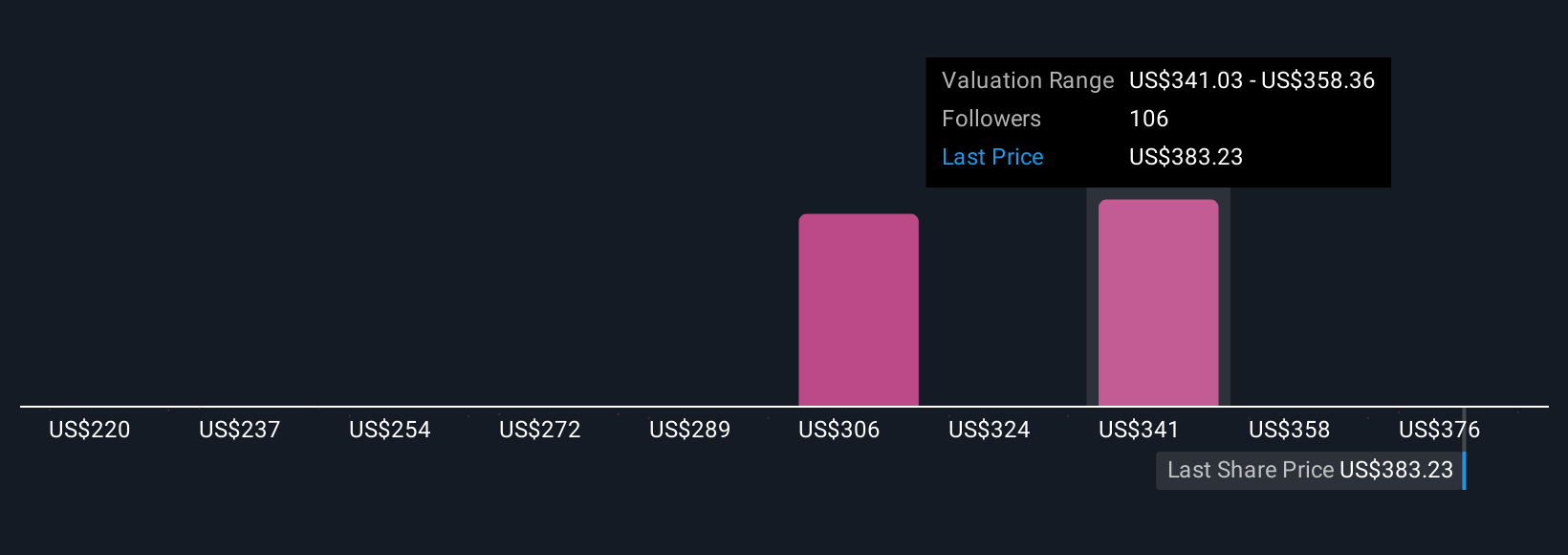

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own investable story—an approach that combines your personal view of a company’s future with the hard numbers it might achieve, like fair value and estimates for revenue, earnings, and profit margins.

Narratives work by linking the company’s evolving story to your financial forecast and then to a precise fair value. This lets you see exactly how your outlook stacks up against the current share price. They are easy to create and share right on Simply Wall St’s Community page, an open platform where millions of investors refine their decisions daily.

When you use Narratives, you get a straightforward way to decide whether to buy or sell. You simply compare your calculated fair value against the current market price. Unlike static analysis, Narratives update dynamically as new information arrives, such as earnings reports or news events, so your investment thinking is always in step with real-world developments.

For Constellation Energy, for example, some investors see major upside, forecasting a fair value as high as $393 per share based on ambitious growth and margin expectations. Others take a cautious view, setting fair value down at $184 if risks play out. With Narratives, you can easily adopt, edit, or build your own scenario and act with greater conviction and clarity.

Do you think there's more to the story for Constellation Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives