- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

How Investors May Respond To AEP’s Board Transition and $157 Million Bond Offering

Reviewed by Simply Wall St

- On July 22, 2025, American Electric Power Company announced that Sara Martinez Tucker would step down as Chair of the Board for personal reasons, with CEO William J. Fehrman elected as her successor effective August 1, 2025, and Ms. Tucker remaining on the Board as Lead Director.

- This leadership transition comes alongside the company’s completion of a US$157 million corporate bond offering and continued dividend affirmations, highlighting AEP’s commitment to both financial stability and ongoing capital investments.

- We’ll now examine how the new Board leadership and recent financing developments may influence American Electric Power’s investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

American Electric Power Company Investment Narrative Recap

To be a shareholder in American Electric Power Company, you need to believe in the company’s ability to drive earnings growth from rising commercial and industrial electricity demand, substantial capital investments, and ongoing regulatory initiatives. The recent transition of Board leadership from Sara Martinez Tucker to CEO William J. Fehrman, alongside dividend consistency and new bond financing, does not appear to have a material impact on the company’s core catalysts or the most significant risk, uncertainties in Ohio’s regulatory environment, which could affect future revenues and margins.

Of the recent announcements, the US$157 million fixed-rate bond offering stands out, supporting AEP’s ability to fund planned infrastructure expansions aligned with its stated capital investment program. Steady access to capital markets is key as the company balances major investment needs with the goal of sustaining returns in a changing utility sector.

However, as regulatory outcomes in Ohio remain uncertain, investors should be alert to how this risk could ...

Read the full narrative on American Electric Power Company (it's free!)

American Electric Power Company's narrative projects $23.7 billion revenue and $3.9 billion earnings by 2028. This requires 5.6% yearly revenue growth and a $1.1 billion earnings increase from $2.8 billion today.

Uncover how American Electric Power Company's forecasts yield a $109.28 fair value, in line with its current price.

Exploring Other Perspectives

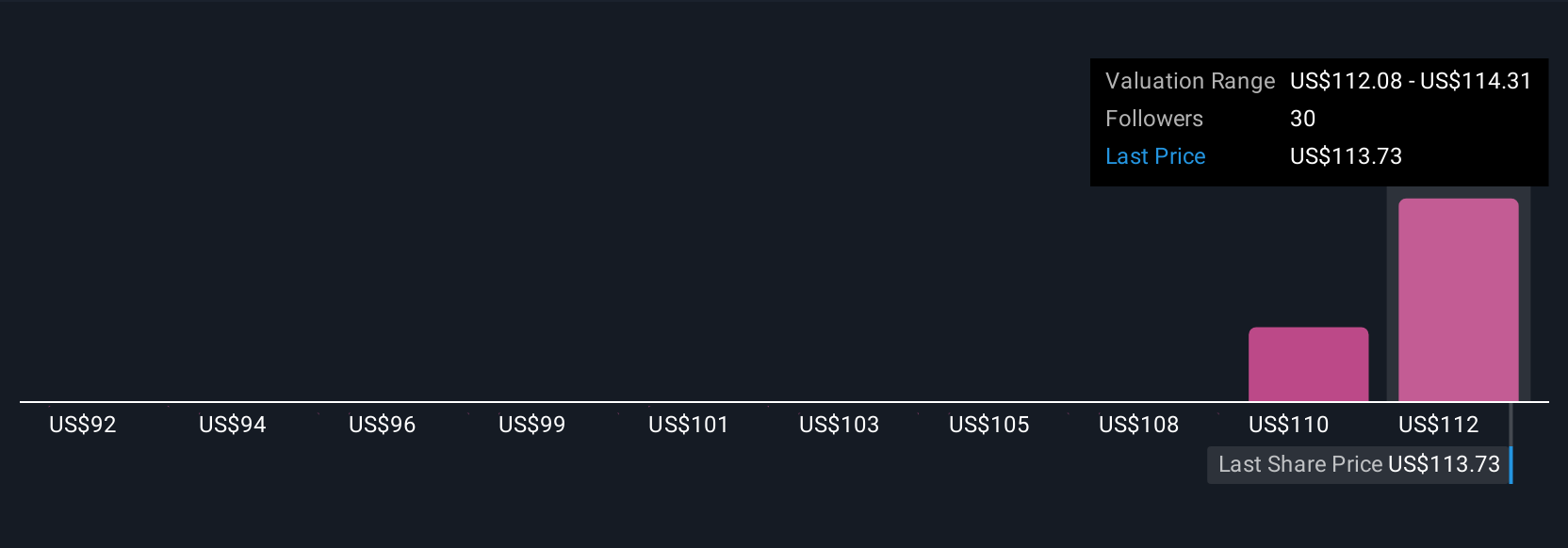

Four Simply Wall St Community fair value estimates put AEP’s potential between US$92 and US$117.31 per share. While regulatory changes in Ohio remain a concern, these varied views highlight how market participants weigh both opportunity and uncertainty.

Explore 4 other fair value estimates on American Electric Power Company - why the stock might be worth as much as 7% more than the current price!

Build Your Own American Electric Power Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Electric Power Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Electric Power Company's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives