- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

Does Robotaxi Launch And Buybacks Change The Bull Case For DiDi Global (DIDI.Y)?

Reviewed by Sasha Jovanovic

- DiDi Global Inc. recently reported third-quarter 2025 results showing higher sales of CNY 58,590 million and increased net income of CNY 1,459 million, while also completing a US$286.1 million share repurchase program covering 61,513,739 shares.

- A key development was the launch of a 24/7 fully unmanned Robotaxi trial in Guangzhou’s Huangpu district, signaling meaningful progress in DiDi’s autonomous driving commercialization efforts.

- Against this backdrop, we will examine how the fully unmanned Robotaxi launch reshapes DiDi Global’s investment narrative and long-term business profile.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is DiDi Global's Investment Narrative?

To own DiDi Global today, you really have to believe that its core ride-hailing engine can steadily turn growing sales into more consistent profitability, while optionality from autonomous driving adds genuine upside rather than just cost and complexity. The latest quarter’s higher revenue and improved net income, combined with completion of a US$286.1 million buyback, support a story of disciplined capital use in a still-volatile earnings year. The 24/7 fully unmanned Robotaxi trial in Guangzhou now becomes a key short term catalyst, as it offers real-world proof of DiDi’s autonomous capabilities and could influence sentiment on its long term margin potential. At the same time, it heightens execution and regulatory risk in a business that is still rebuilding confidence after past setbacks.

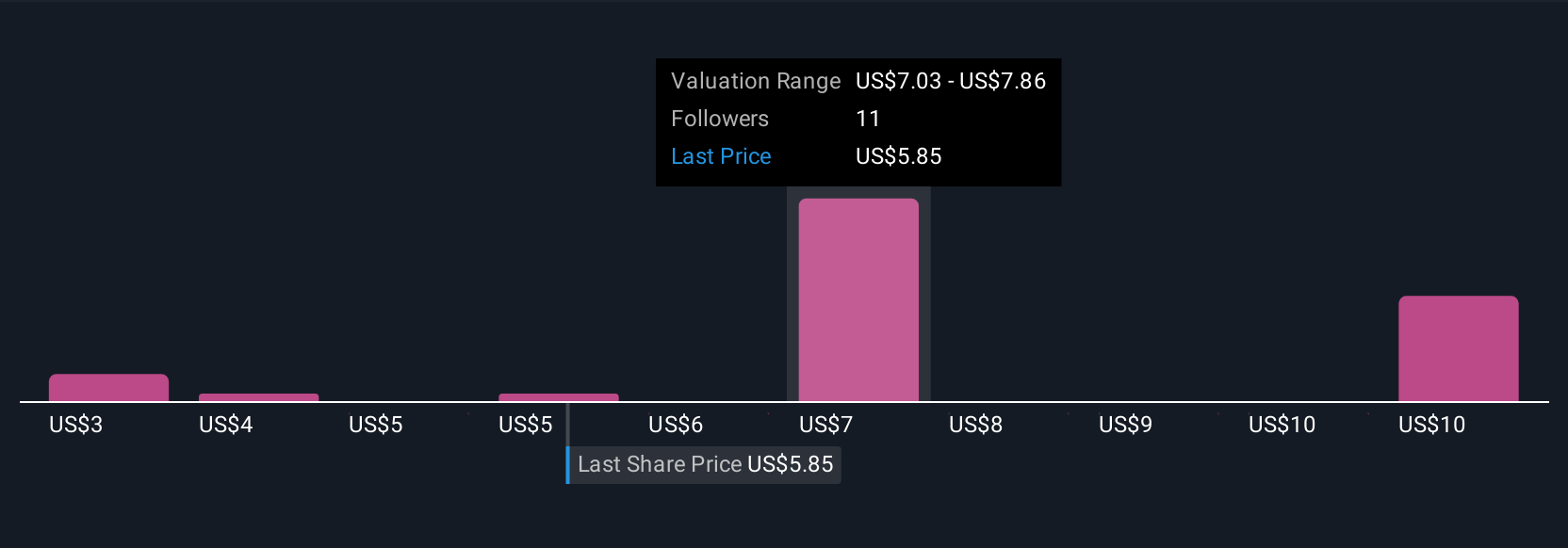

However, one risk in particular could catch new shareholders off guard if they overlook it. DiDi Global's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on DiDi Global - why the stock might be worth 50% less than the current price!

Build Your Own DiDi Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DiDi Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DiDi Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DiDi Global's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026