- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

DiDi (OTCPK:DIDI.Y): Reassessing Valuation After Launching a 24/7 Fully Unmanned Robotaxi Trial in Guangzhou

Reviewed by Simply Wall St

DiDi Global (OTCPK:DIDI.Y) just kicked off a 24/7 fully unmanned Robotaxi trial in Guangzhou, putting real, driverless rides in front of everyday users and giving investors a clearer glimpse of its autonomous future.

See our latest analysis for DiDi Global.

The market seems to be weighing that growth story against risk, with a 1 day share price return of minus 3.9 percent but a year to date share price gain of 11.7 percent and a solid 3 year total shareholder return of nearly 40 percent. This suggests momentum has cooled recently rather than disappeared.

If DiDi’s Robotaxi push has you thinking about what else could reshape mobility and logistics, it is worth exploring high growth tech and AI stocks for more tech and AI driven opportunities.

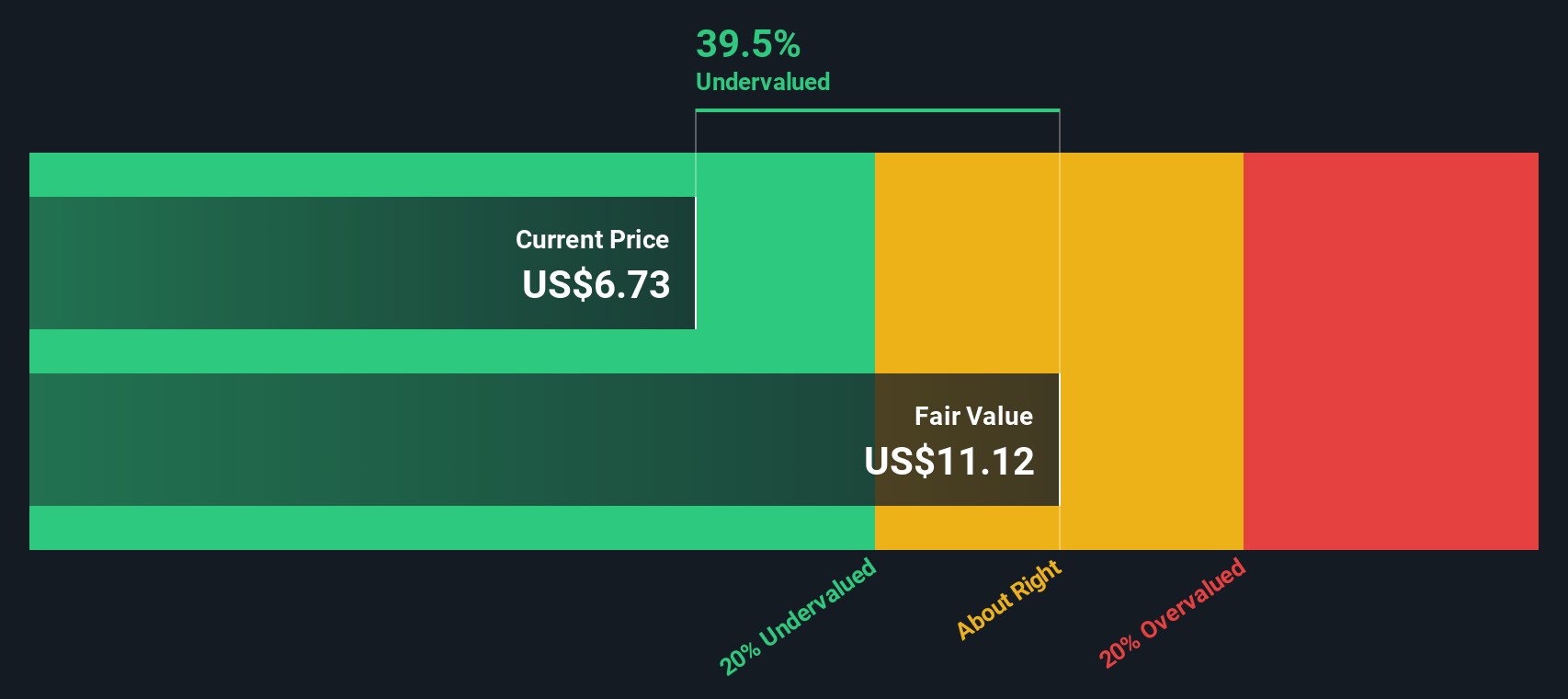

With Robotaxis rolling out, earnings rebounding, and a hefty discount to analyst targets, investors now face a key question: Is DiDi still undervalued, or is the market already pricing in its next leg of growth?

Price to Sales of 0.8x: Is it justified?

On a price to sales basis, DiDi Global looks inexpensive, with its 0.8x multiple sitting well below many peers despite the recent share price rebound.

The price to sales ratio compares a company’s market value to its revenue, which is particularly useful for fast growing or still unprofitable platform businesses like DiDi.

Here, the market is assigning DiDi a 0.8x price to sales multiple even though earnings are forecast to grow more than 50 percent annually and the stock is trading around 72.7 percent below the SWS DCF fair value estimate. This suggests investors may still be underpricing its long term monetisation potential.

Versus the US Transportation industry average of 1.2x and a fair price to sales ratio estimate of 1.2x, DiDi’s 0.8x stands out as a steep, arguably pessimistic discount that could narrow if execution and profitability targets are met.

Explore the SWS fair ratio for DiDi Global

Result: Price to Sales of 0.8x (UNDERVALUED)

However, regulatory shifts or slower than expected adoption of autonomous services could delay profitability improvements and keep DiDi’s valuation discount in place for longer.

Find out about the key risks to this DiDi Global narrative.

Another View on Value

Our DCF model paints an even more aggressive picture than the price to sales ratio, suggesting DiDi could be worth around $19.36 per share versus the current $5.28. That is roughly a 73 percent gap. Can the Robotaxi rollout and profit turnaround really close it?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DiDi Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DiDi Global Narrative

If you would rather challenge these assumptions or dig into the numbers yourself, you can build a personalized view of DiDi in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DiDi Global.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning stock shortlists built from real fundamentals, not hype, so you can stay one step ahead.

- Explore early stage opportunities by reviewing these 3574 penny stocks with strong financials that pair small market caps with comparatively stronger financial profiles.

- Consider the next productivity wave by targeting these 26 AI penny stocks involved in machine learning and automation developments.

- Look for value oriented ideas by filtering for these 908 undervalued stocks based on cash flows where market pessimism may have pushed prices below some measures of estimated worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026