- United States

- /

- Transportation

- /

- NYSE:XPO

Is XPO’s (XPO) Electric Fleet Rollout With AkzoNobel Reshaping Its Investment Outlook?

Reviewed by Sasha Jovanovic

- AkzoNobel recently announced a partnership with XPO Logistics to deploy the UK’s first large-scale fully electric HGV and HVO-powered trailer fleet, aiming for substantial carbon emission reductions and support for its climate targets.

- This collaboration positions XPO as a key player in sustainable supply chain solutions, highlighting its capacity to support major clients’ emissions reduction efforts in the rapidly evolving logistics sector.

- We'll now explore how XPO’s leadership in zero-emission transport could influence its investment case and long-term growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

XPO Investment Narrative Recap

To invest in XPO, you need to believe in the company's ability to harness technology and sustainability initiatives to lead the LTL freight sector, despite exposure to cyclical end-markets and margin pressures. While the recent AkzoNobel partnership highlights XPO’s leadership in zero-emission transport and strengthens its reputation with major clients, its direct impact on near-term shipment volumes or cost structures, the biggest immediate catalysts and risks, remains limited at this stage.

Among recent company announcements, XPO’s continued expansion of service centers is especially relevant, as it supports volume growth and operational efficiency in tandem with its push for greener logistics solutions. This move complements efforts such as the AkzoNobel collaboration by reinforcing XPO’s ability to support customer needs and respond to potential upticks in demand, essential for cushioning against cyclical volatility.

Yet, contrasting the company’s growth story, investors should be aware that XPO’s high dependence on the U.S. LTL segment means…

Read the full narrative on XPO (it's free!)

XPO's outlook anticipates $9.2 billion in revenue and $661 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 4.7% and a $316 million increase in earnings from the current $345 million.

Uncover how XPO's forecasts yield a $139.38 fair value, a 8% upside to its current price.

Exploring Other Perspectives

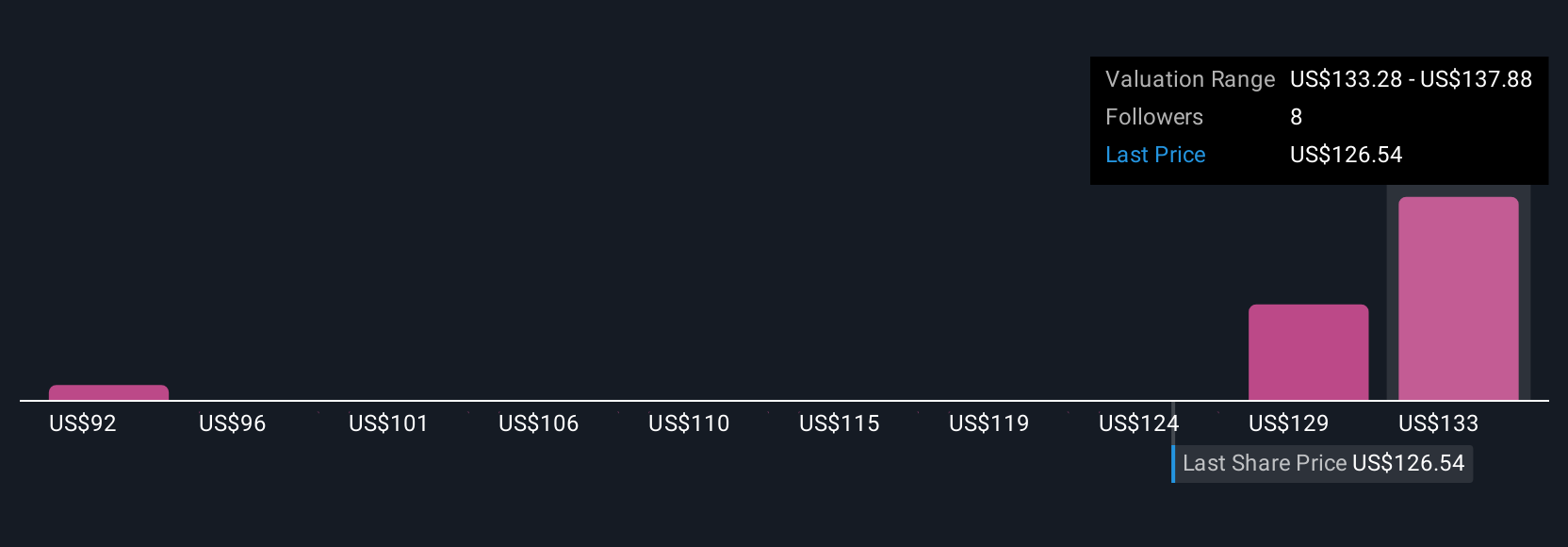

Simply Wall St Community members have issued three fair value estimates for XPO ranging from US$91.89 to US$141.97 per share. While many see upside, the company’s ongoing vulnerability to cyclical sector slowdowns shapes the wider debate on future performance.

Explore 3 other fair value estimates on XPO - why the stock might be worth 28% less than the current price!

Build Your Own XPO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free XPO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPO's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives