- United States

- /

- Logistics

- /

- NYSE:UPS

UPS (UPS) Valuation Check as Shares Rebound but Longer-Term Returns Stay Negative

Reviewed by Simply Wall St

United Parcel Service (UPS) has quietly staged a rebound, with shares up about 4% over the past month and roughly 16% in the past 3 months, even as the 1 year return remains negative.

See our latest analysis for United Parcel Service.

That recent upswing in the share price, now around $98.21, suggests sentiment is stabilising after a tough stretch, with short term share price momentum improving even as the 1 year total shareholder return remains firmly negative.

If UPS has you rethinking the logistics cycle, it might also be worth exploring auto manufacturers for more ways shifting demand and trade flows are showing up in other parts of the market.

With shares still down sharply over one and three years but trading at a notable intrinsic discount, is UPS a classic value opportunity taking shape, or is the recent rebound a sign markets are already pricing in the recovery?

Most Popular Narrative Narrative: 3.2% Overvalued

According to NVF, the latest narrative fair value of $95.21 sits just below UPS's last close of $98.21, framing a cautiously optimistic long term outlook.

We believe in a cautious approach in our analysis as UPS has been clouded with sustainability issues, higher costs, and internal headwinds. Can UPS navigate financial and operational pressures with resilience? Launched in early 2025, UPS's "Efficiency Reimagined" outlined the company’s largest network overhaul in company history, and this multi-year initiative details management's goals to streamline domestic operations.

Curious how modest growth, fatter margins and a richer profit multiple can still point to a slightly stretched price? The full narrative unpacks the math.

Result: Fair Value of $95.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue softness or a bumpy execution of Efficiency Reimagined could quickly erode the modest margin gains that underpin this narrative.

Find out about the key risks to this United Parcel Service narrative.

Another Lens on Value

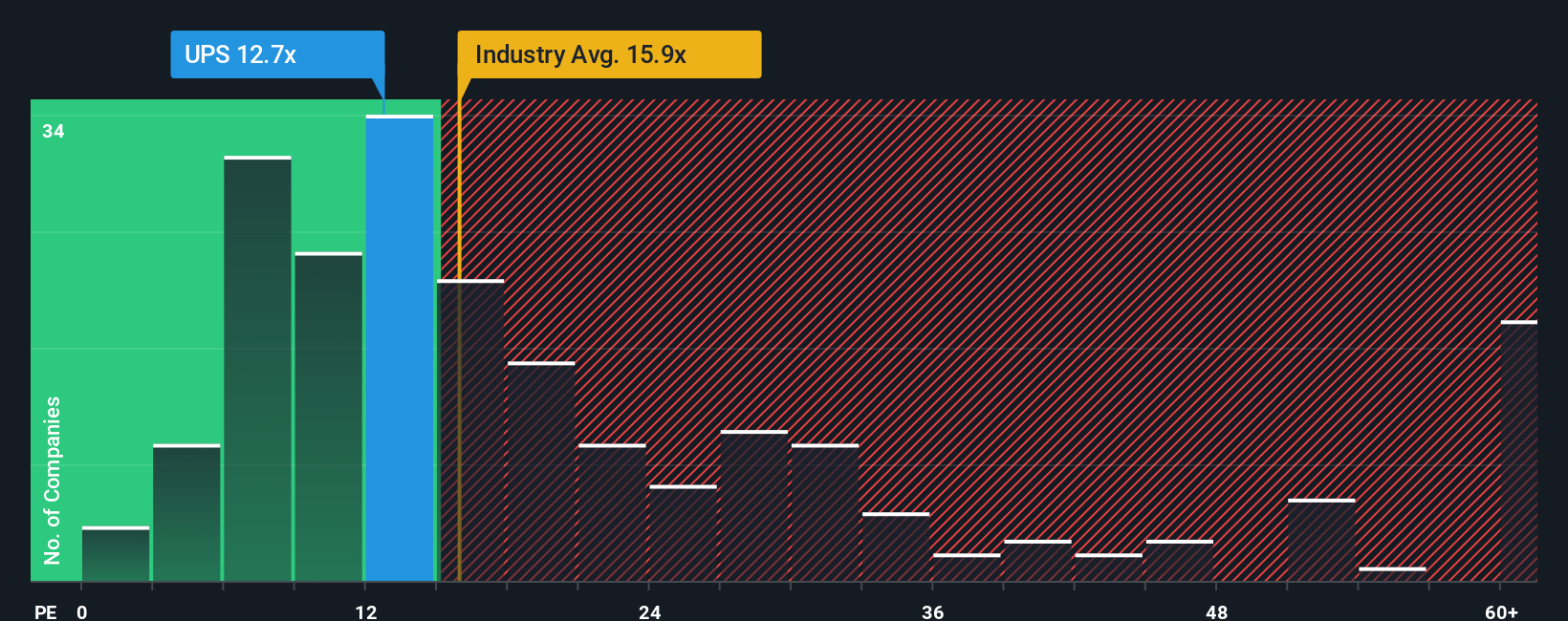

Step away from the narrative fair value, and UPS looks very different on earnings. At 14.7x earnings versus peers at 20.8x and a fair ratio of 19.3x, the stock screens as cheap, not slightly rich. This raises the question: is sentiment too gloomy?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Parcel Service Narrative

If you want to stress test these assumptions or dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to explore additional data backed ideas before the crowd moves in without you.

- Identify potential multi baggers early by scanning these 3580 penny stocks with strong financials that combine higher risk with relatively resilient fundamentals.

- Consider opportunities in productivity and automation by reviewing these 25 AI penny stocks that focus on intelligent automation and scalable business models.

- Explore value focused candidates using these 927 undervalued stocks based on cash flows to find companies trading below levels suggested by their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026