- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER) Announces Next-Generation Robotaxi Partnership With Lucid and Nuro

Reviewed by Simply Wall St

Uber Technologies (UBER) marked a significant milestone this past quarter with its Lucid Group partnership, unveiling a promising robotaxi initiative that captured investor interest. This development, along with new ventures into SNAP EBT payments on Uber Eats and the company's appointment as the official transport partner for the LA28 Olympics, aligns with its recent 20% price surge. Additionally, Uber being added to the Russell Top 50 Index and discussions around potential M&A have positively resonated with its stock's upward trajectory. These moves have consolidated investor confidence, contributing to the company's performance amidst generally bullish market conditions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments highlighted in the introduction could shape Uber Technologies' growth narrative, both in terms of revenue and potential market positioning. The Lucid Group partnership, endorsement as the official transport partner for the LA28 Olympics, and inclusion in the Russell Top 50 Index are likely to enhance Uber's brand presence and attract additional investment interest. Although these strategic engagements could bolster revenue forecasts, the potential impact on margins remains uncertain, owing to competitive pressures and operational costs in new sectors such as SNAP EBT payments and autonomous vehicles initiatives.

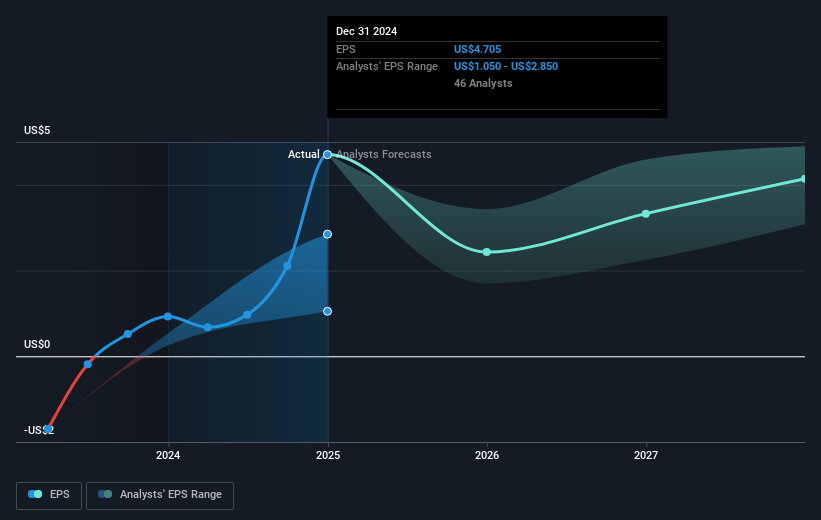

Over the past three years, Uber has seen a total shareholder return of 273.50%, reflecting the company's ability to capitalize on market opportunities, albeit with ongoing competitive challenges. In terms of annual performance, Uber outpaced the US Transportation industry, which posted a lower return of 9.6% over the last year, highlighting the company's robust market positioning. Analysts, however, forecast a decline in earnings over the next three years, averaging a 1.4% decline annually, even as revenue growth remains healthier at 11.8% per year.

While the company's recent 20% share price rally mirrors investor optimism, the stock still trades slightly below the consensus analyst price target of US$98.80, indicating there could be room for upward movement. The targeted price suggests analysts anticipate future improvements, possibly through revenue enhancements or margin expansions, to support this valuation. Investors should remain diligent in reassessing these price targets in line with evolving business results and market dynamics.

Jump into the full analysis health report here for a deeper understanding of Uber Technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives