- United States

- /

- Transportation

- /

- NYSE:RXO

Can RXO's (RXO) Credit Outlook Shift Reveal Deeper Challenges in Freight Market Resilience?

Reviewed by Sasha Jovanovic

- On December 2, 2025, S&P Global Ratings revised its outlook on RXO Inc. to negative from stable, affirming the company’s ‘BB’ issuer credit rating due to weaker credit metrics amid persistent softness in the freight market and significant volume declines in the truckload brokerage segment.

- This outlook revision highlights the risk that RXO could face further credit rating pressure if current freight market conditions and cost challenges persist.

- We'll explore how S&P Global's negative outlook revision and concerns over RXO's credit health may reshape the investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RXO Investment Narrative Recap

To be a shareholder in RXO today, you must believe in the company's digital transformation, diversification across end-markets, and long-term potential of its asset-light, tech-focused model. The negative outlook from S&P Global Ratings primarily highlights credit risk, but doesn't materially change the near-term catalyst, ongoing growth in less-than-truckload brokerage, which remains critical for stabilization; the biggest short-term risk continues to be prolonged freight market weakness impacting volume and margins.

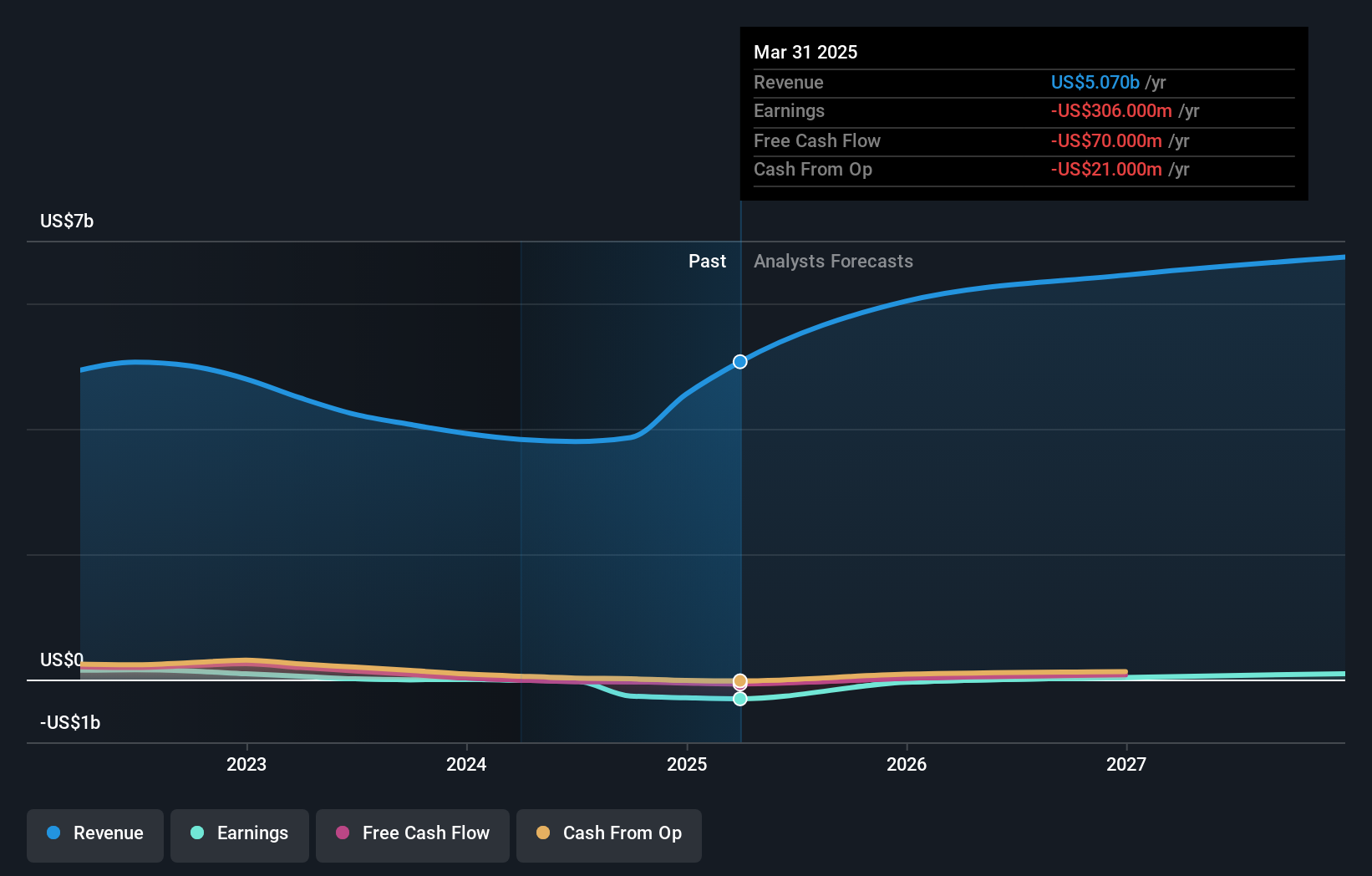

RXO’s Q3 2025 earnings, reported on November 6, showed improved year-over-year sales and narrower losses, even as core truckload volumes declined sharply. This most recent update underscores both the resilience and vulnerability of RXO’s business model, where efforts to preserve pricing and shift toward LTL brokerage represent important catalysts amidst persistent credit and industry headwinds.

In contrast, the company’s credit health and its impact on future financing flexibility is a risk investors should be aware of, especially if...

Read the full narrative on RXO (it's free!)

RXO's outlook anticipates $6.9 billion in revenue and $132.5 million in earnings by 2028. This reflects a 7.3% annual revenue growth rate and a $440.5 million increase in earnings from the current earnings of -$308.0 million.

Uncover how RXO's forecasts yield a $15.59 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$14.75 to US$15.59, with two unique perspectives included. While the market’s view on RXO’s credit risks has shifted, it is important to consider why outlooks can vary significantly and what this might mean for future business strength and valuation.

Explore 2 other fair value estimates on RXO - why the stock might be worth just $14.75!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026