- United States

- /

- Transportation

- /

- NYSE:NSC

Norfolk Southern (NSC): Assessing Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Norfolk Southern.

Norfolk Southern’s impressive 7.6% 1-month share price return has built on solid momentum this year, with a year-to-date share price gain of 26.4%. Investors appear increasingly optimistic, and the company’s 1-year total shareholder return of 23.7% shows that longer-term holders have also benefited as sentiment has improved around both growth prospects and efficiency gains.

If you want to discover other companies attracting investor interest right now, broaden your search and see what stands out in our fast growing stocks with high insider ownership.

With Norfolk Southern’s stock posting double-digit gains and confidence building, investors are considering whether there is still room for upside or if markets have already factored in all of the company’s expected future growth.

Most Popular Narrative: 3.5% Undervalued

Norfolk Southern’s latest fair value estimate stands at $307, about $10 above its most recent closing price. This has caught investors’ attention and set expectations for what could be next.

The commitment to $150 million in productivity and cost reduction initiatives over three years is being propelled by better labor productivity and fuel efficiency. These factors are anticipated to sustain EPS growth even if revenue growth slows.

Curious how a legacy rail operator justifies a premium price in today’s market? The core narrative rests on some bold transformation assumptions and a unique profit formula that challenges traditional sector trends. Unpack these controversial building blocks for yourself by reading the entire narrative.

Result: Fair Value of $307 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing storm restoration costs and uncertain coal demand may challenge Norfolk Southern’s recent momentum. These factors could prompt a reassessment of its future outlook.

Find out about the key risks to this Norfolk Southern narrative.

Another View: DCF Model Puts a Different Spin on Value

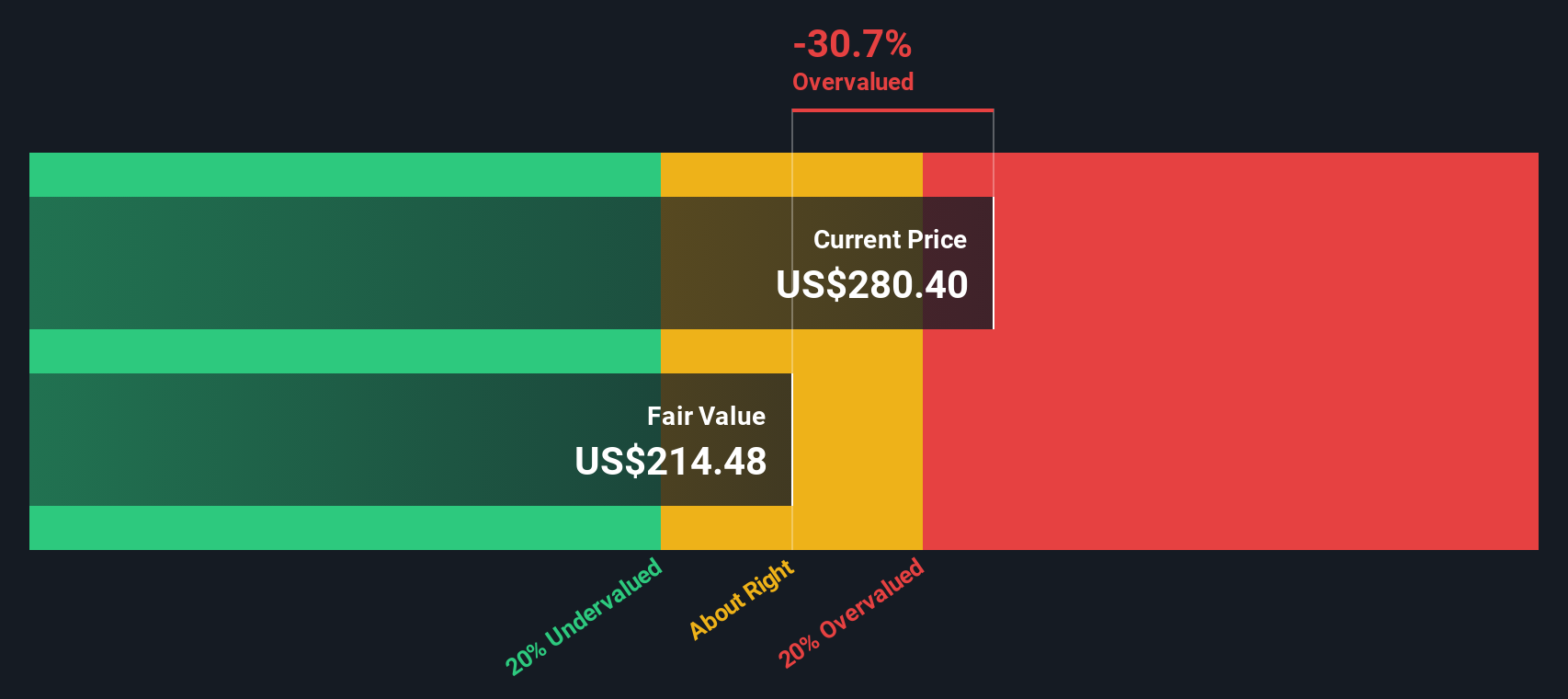

While analysts see slight undervaluation on a multiple basis, our SWS DCF model currently suggests Norfolk Southern may actually be trading above fair value. This method takes into account all expected future cash flows, rather than focusing solely on near-term results. Could a more cautious DCF outlook signal limited upside from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Norfolk Southern for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Norfolk Southern Narrative

If you see things differently or want to dig deeper yourself, you can shape your own Norfolk Southern story in just a few minutes with Do it your way.

A great starting point for your Norfolk Southern research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your investing strategy unstoppable by checking out handpicked stock selections tailored to different opportunities. Smart moves today can mean more gains tomorrow, so take action:

- Tap into the future of artificial intelligence innovations by browsing these 25 AI penny stocks. These companies are positioned to disrupt major industries and capture significant growth.

- Boost your portfolio's income potential with these 19 dividend stocks with yields > 3%, which includes stocks offering attractive yields and steady return profiles for cash flow-focused investors.

- Unlock bargain opportunities on the market right now with these 891 undervalued stocks based on cash flows, giving you the chance to find companies trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives