- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

Kirby (KEX) Is Up 19.1% After Record Power Orders Boost Q3 Earnings and Buybacks—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 29, 2025, Kirby Corporation reported third-quarter results showing revenue of US$871.16 million and net income of US$92.5 million, as well as continued share repurchases under its long-standing buyback program.

- A surge in power generation demand from data centers and industrial customers helped offset softer conditions in marine transportation, underlining Kirby's diversified growth drivers.

- We’ll now explore how Kirby’s record power generation orders and capital allocation shape its forward-looking investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Kirby Investment Narrative Recap

To own a piece of Kirby today, investors need to believe that the company’s mix of marine transportation and distribution, especially power generation for data centers and industrial markets, can offset headwinds in chemicals and petrochemicals. The recent third-quarter results reinforce the biggest short-term catalyst, strong demand for power generation, but do little to ease the largest risk around sluggish petrochemical shipping and ongoing inflationary pressures, as the core marine business remains exposed to broader market uncertainty.

One of the most relevant recent announcements is Kirby’s continued share repurchases, with 1,742,964 shares bought back for US$156 million during the third quarter. The ongoing buyback reflects confidence in the company’s ability to generate strong free cash flow even as near-term earnings are shaped by shifts in demand between its two main segments.

Yet for investors, it’s equally important to understand that in contrast to rising demand for data center-backed power generation, the company remains heavily exposed to...

Read the full narrative on Kirby (it's free!)

Kirby's outlook forecasts $3.9 billion in revenue and $445.6 million in earnings by 2028. This projection assumes 6.1% annual revenue growth and a $142.6 million increase in earnings from the current level of $303.0 million.

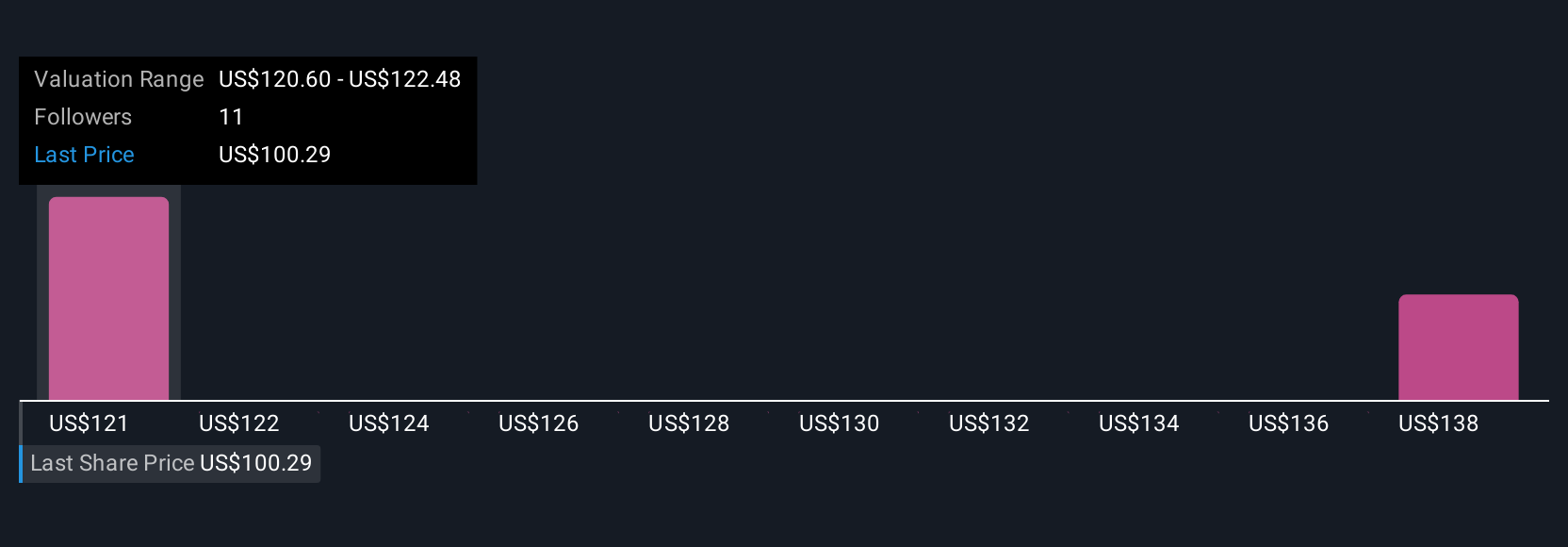

Uncover how Kirby's forecasts yield a $116.17 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Two individual fair value estimates from the Simply Wall St Community range from US$85.33 to US$116.17 per share. While several market participants expect data center growth to support revenue, others cite exposure to petrochemical shipping headwinds as a limiting factor in Kirby’s overall performance.

Explore 2 other fair value estimates on Kirby - why the stock might be worth 18% less than the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives