- United States

- /

- Logistics

- /

- NYSE:GXO

GXO Logistics (GXO) Is Up 5.7% After Expanding Credit Flexibility and Issuing €500 Million Bonds - What's Changed

Reviewed by Sasha Jovanovic

- On November 24, 2025, GXO Logistics announced amendments to its key credit agreements, permitting up to US$400 million in unrestricted cash to be netted from leverage calculations, and completed its first ever €500 million senior unsecured bond issue in Europe bearing 3.750% interest and maturing in 2030.

- These financing actions provide GXO Logistics with greater flexibility in managing its capital structure and liquidity, potentially bolstering its ability to fund operations and pursue growth opportunities worldwide.

- We’ll explore how GXO’s enhanced credit flexibility could support its growth strategy and influence the company’s investment narrative going forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GXO Logistics Investment Narrative Recap

To own shares of GXO Logistics, an investor has to believe in the company’s ability to deliver on integration synergies, margin improvement, and technology-driven gains, while navigating execution risks and leadership change. The recent amendments to GXO’s credit facilities and the debut of its €500 million European bond enhance financial flexibility, but are not likely to materially change the biggest short-term catalyst, Wincanton integration, or lessen top risk from ongoing leadership transitions.

Of GXO’s recent news, the appointment of Michael Jacobs as President of the Americas and Asia Pacific is particularly relevant, as it puts new executive focus on operational execution during a period of management turnover, an important context as the company tackles ambitious growth catalysts like major contract wins and the integration of Wincanton.

By contrast, investors should also be aware that frequent leadership transitions at the top may...

Read the full narrative on GXO Logistics (it's free!)

GXO Logistics' outlook projects $15.3 billion in revenue and $440.6 million in earnings by 2028. This is based on an annual revenue growth rate of 6.5% and an earnings increase of $377.6 million from current earnings of $63.0 million.

Uncover how GXO Logistics' forecasts yield a $63.94 fair value, a 26% upside to its current price.

Exploring Other Perspectives

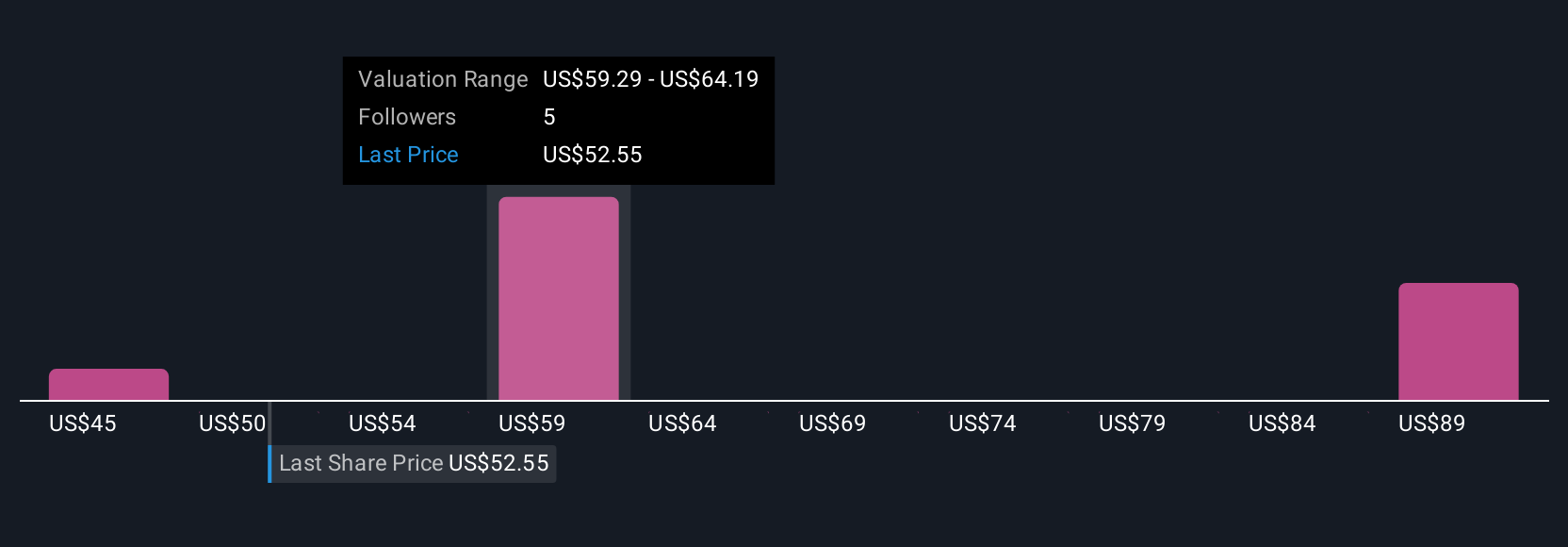

The Simply Wall St Community has three fair value estimates for GXO Logistics ranging from US$44.61 to US$63.94 per share. This diversity of opinion shows how investors weigh leadership changes and integration risks differently, making it important to review several perspectives before deciding on GXO’s outlook.

Explore 3 other fair value estimates on GXO Logistics - why the stock might be worth as much as 26% more than the current price!

Build Your Own GXO Logistics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GXO Logistics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GXO Logistics' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026