- United States

- /

- Logistics

- /

- NYSE:GXO

Can GXO (GXO) Balance Leadership Changes and Growth Goals for Long-Term Execution?

Reviewed by Sasha Jovanovic

- GXO Logistics reported higher third quarter sales of US$3.40 billion and net income of US$59 million, reaffirming its full-year 2025 guidance while announcing executive appointments and management changes.

- This combination of stronger quarterly results and leadership updates signals a focus on both operational improvement and long-term business execution across key regions.

- We'll examine how the appointment of a new regional president and robust quarterly earnings update shape GXO's investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GXO Logistics Investment Narrative Recap

For GXO Logistics, the core investment case centers on capturing growth from global trends in logistics outsourcing, automation, and new verticals like healthcare and aerospace. The latest quarterly earnings beat and management changes add clarity around business execution but do not materially shift the immediate catalysts or risks, namely, Wincanton integration and successful delivery of cost and revenue synergies remain the main focus and risk, while leadership continuity is still important given recent transitions.

Among recent announcements, the appointment of Michael Jacobs as President for the Americas and Asia Pacific stands out. His decades of supply chain experience could help GXO drive operational efficiency, aligning with management's priority to realize the anticipated synergies and margin improvements following the Wincanton integration, which is a central near-term catalyst for the business.

Yet, in contrast to the positive leadership and earnings updates, investors should still be mindful of potential challenges if integration targets for Wincanton are not fully achieved...

Read the full narrative on GXO Logistics (it's free!)

GXO Logistics' outlook anticipates $15.3 billion in revenue and $440.6 million in earnings by 2028. This is based on a 6.5% annual revenue growth rate and a $377.6 million increase in earnings from the current level of $63.0 million.

Uncover how GXO Logistics' forecasts yield a $62.12 fair value, a 19% upside to its current price.

Exploring Other Perspectives

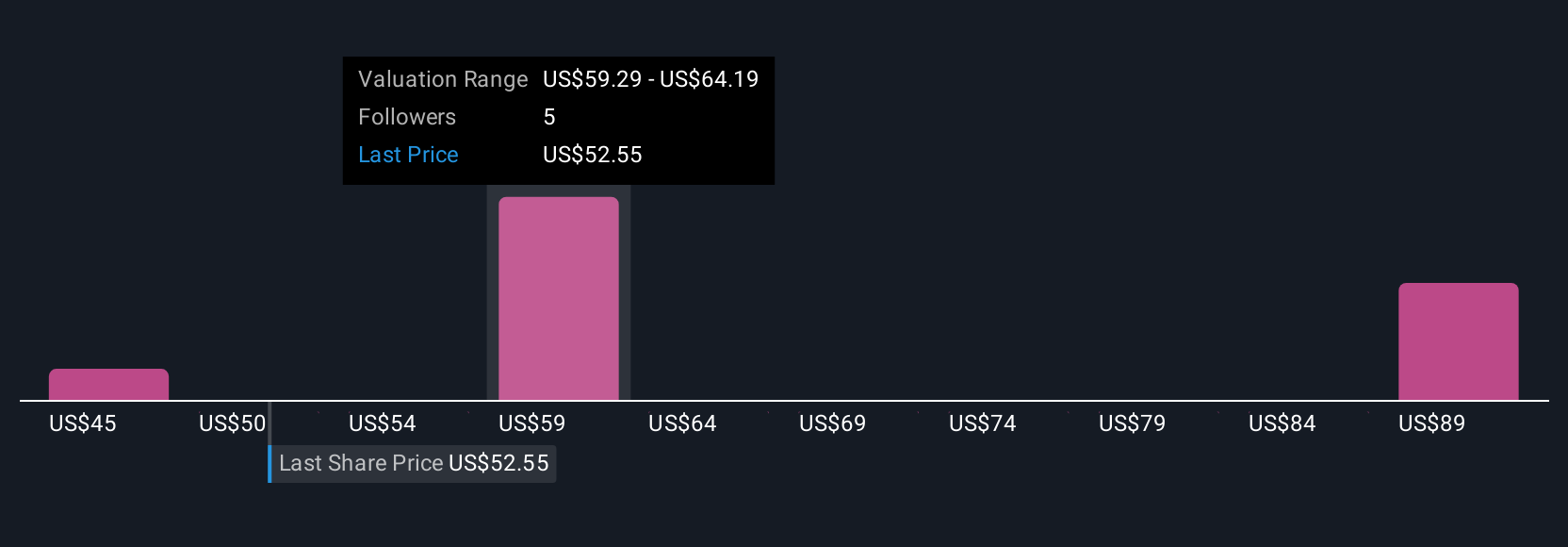

Three members of the Simply Wall St Community estimate GXO’s fair value ranges widely from US$44.61 to US$62.12 per share. Many see upside, but successful Wincanton integration remains vital to support future growth; consider multiple viewpoints when assessing potential.

Explore 3 other fair value estimates on GXO Logistics - why the stock might be worth 15% less than the current price!

Build Your Own GXO Logistics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GXO Logistics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GXO Logistics' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives