- United States

- /

- Marine and Shipping

- /

- NYSE:GSL

How Investors Are Reacting To Global Ship Lease (GSL) Expanding Its Fleet With Eco-Chartered Vessels

Reviewed by Sasha Jovanovic

- Global Ship Lease announced the acquisition of three 8,600 TEU, Korean-built containerships with ECO upgrades for US$90 million, each featuring attached charters to a leading liner and expected delivery around year-end 2025.

- This move brings the total fleet to 71 vessels with an expanded capacity, supporting the company’s ongoing focus on opportunistic fleet renewal and efficiency upgrades.

- Next, we'll explore how adding long-term chartered eco-upgraded vessels could influence Global Ship Lease's investment narrative and future outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Global Ship Lease Investment Narrative Recap

To be a shareholder in Global Ship Lease, one needs to believe that demand for midsize and smaller containerships will remain robust, supporting high vessel utilization and favorable charter rates even amidst global uncertainties. The recent acquisition of three eco-upgraded vessels, while bolstering long-term efficiency, does not materially shift the immediate catalysts or the main short-term risk, persistent volatility in charter rates stemming from changing global trade flows and market normalization.

Among recent developments, the company’s third-quarter earnings stand out, with Global Ship Lease surpassing expectations and reporting rising revenue and net income year-over-year. This operational momentum, coupled with the new vessel purchases, may lend support to ongoing catalysts such as high utilization rates in targeted ship classes, even as market conditions remain unpredictable.

However, in contrast, investors should be aware of persistent risks linked to overcapacity and potential shifts in customer chartering behavior that could suddenly reduce visibility on earnings and cash flows...

Read the full narrative on Global Ship Lease (it's free!)

Global Ship Lease's narrative projects $621.0 million in revenue and $270.6 million in earnings by 2028. This assumes a 5.3% annual revenue decline and a $112.4 million decrease in earnings from $383.0 million currently.

Uncover how Global Ship Lease's forecasts yield a $37.67 fair value, a 6% upside to its current price.

Exploring Other Perspectives

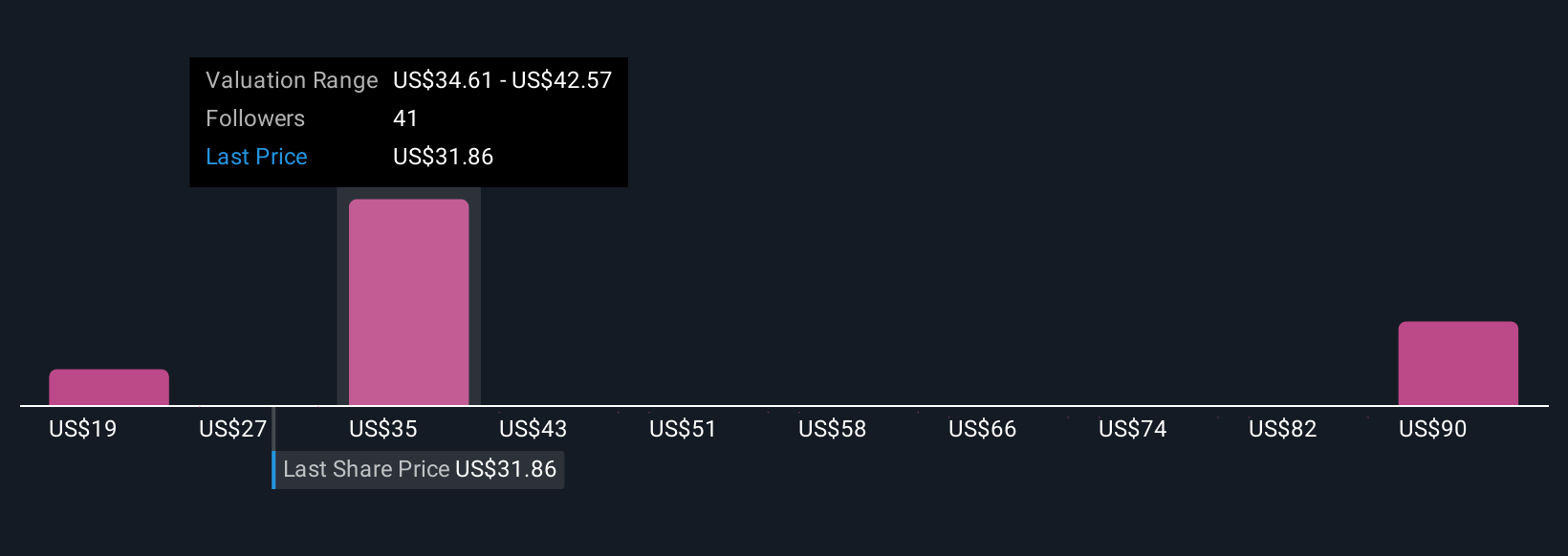

Nine private investor fair value estimates from the Simply Wall St Community range widely from US$23.59 up to US$101.08. While many see opportunity, some flag the risk of supply outpacing demand for midsize vessels, shaping sharply differing outlooks.

Explore 9 other fair value estimates on Global Ship Lease - why the stock might be worth 34% less than the current price!

Build Your Own Global Ship Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Ship Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Ship Lease's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GSL

Global Ship Lease

Engages in owning and chartering of containerships under fixed-rate charters to container shipping companies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026