- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (DAL): Assessing Valuation as Share Price Rebounds on Profit Surprise

Reviewed by Simply Wall St

Delta Air Lines (DAL) stock has seen a bit of movement lately, with investors keeping a close eye on its recent performance. Over the past month, shares are up about 3%, while the past 3 months have added just over 2%.

See our latest analysis for Delta Air Lines.

After lagging for much of the year, Delta’s 1-year total shareholder return is still down around 5%, but renewed optimism and a strong 1-day share price jump suggest momentum could finally be shifting for the airline as travel demand stabilizes.

If recent movement in Delta has you reconsidering where opportunity may surface next, broaden your search and discover See the full list for free.

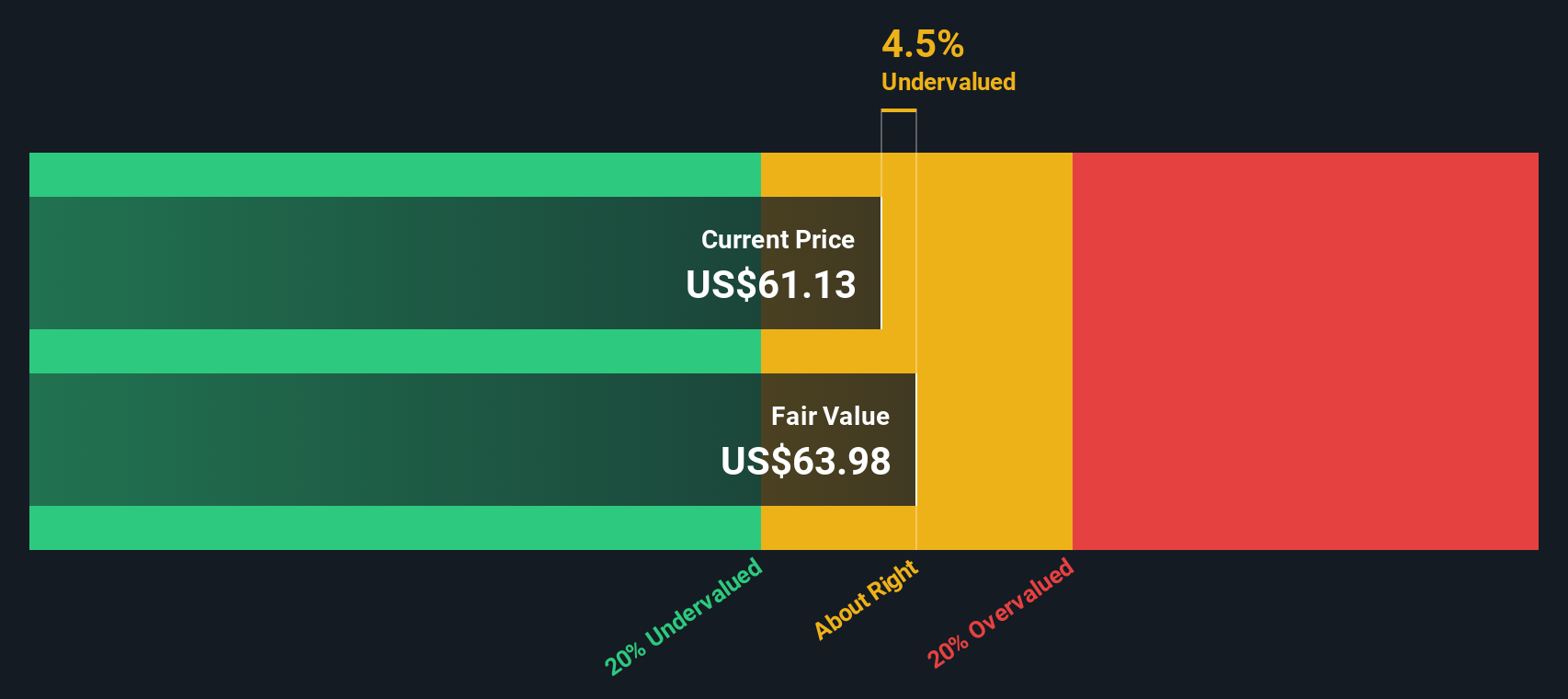

With shares trading at a notable discount to both analyst targets and some measures of intrinsic value, the question stands: are investors overlooking Delta’s potential, or is the market already factoring in all possible future growth?

Most Popular Narrative: Fairly Valued

According to PittTheYounger, Delta’s fair value estimate is nearly in line with its last close price. Narrative assumptions paint a nuanced picture of value for investors willing to look past broad airline sector headwinds.

With today’s trading update on Q2, Delta has smashed all expectations. In a time of year when many others are struggling to turn a profit, reaping the bulk of their earnings over the summer and the Holidays towards the end of the year, the guys from Atlanta achieved a whopping 2.7 cents of gross profit per available seat mile (with total revenue per ASM at 21.4 cents and total cost per ASM at 18.7 cents). Small wonder the shares pop by over 10 per cent pre market.

Curious how an airline’s profit engine can defy seasonal trends and market worries? The narrative behind this surprising valuation leans on unique profit ratios and select growth triggers. See which future trends and financial calculations catalyzed the fair value number, something most investors won’t spot in the headline metrics.

Result: Fair Value of $59.84 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks linger as economic shocks or a sudden drop in travel demand could quickly erode Delta’s current momentum.

Find out about the key risks to this Delta Air Lines narrative.

Another View: Discounted Cash Flow Model Suggests More Upside

While multiples suggest Delta is fairly valued, our DCF model tells a different story. The SWS DCF model estimates Delta’s fair value at $104.65 per share, which is significantly above the current price. If this calculation is accurate, the market may be underestimating Delta’s long-term cash flows.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delta Air Lines Narrative

If our assessment leaves you unconvinced or you’d rather dive into the numbers yourself, you can craft your own Delta narrative in just a few minutes: Do it your way

A great starting point for your Delta Air Lines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities go far beyond a single sector. Open up your portfolio to proven strategies and emerging trends. These three ideas can help you stay a step ahead:

- Capture market potential by targeting undervalued companies. See which names are standing out using these 865 undervalued stocks based on cash flows.

- Boost your passive income stream by going straight to these 14 dividend stocks with yields > 3% with yields greater than 3%.

- Tap into the healthcare revolution by checking out these 32 healthcare AI stocks, spotlighting companies advancing medical innovation with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives