- United States

- /

- Airlines

- /

- NYSE:ALK

Alaska Air Group (ALK): Reassessing Valuation After Q4 Guidance Cut and Operational Disruptions

Reviewed by Simply Wall St

Alaska Air Group (ALK) just slashed its Q4 earnings outlook after a rough stretch that combined an internal IT outage, government driven flight cancellations, and higher fuel costs, forcing investors to reassess near term expectations.

See our latest analysis for Alaska Air Group.

Even with the guidance cut, the stock has bounced hard in the near term, with a 7 day share price return of 15.84 percent and a 3 year total shareholder return of 11.42 percent. This suggests momentum is cautiously rebuilding after a tough year.

If this rebound has you rethinking airlines and travel, it might be worth scanning other aerospace and defense stocks to see how the broader transportation and defense space is repricing risk and opportunity.

With earnings guidance reset and analysts still seeing more than 30 percent upside to their price targets, the key question now is whether Alaska Air shares remain undervalued or if the market has already priced in the recovery story.

Most Popular Narrative: 24.4% Undervalued

With Alaska Air Group closing at $49.65 against a narrative fair value of about $65.71, the story hinges on sustained growth in premium demand and loyalty economics.

The analysts have a consensus price target of $66.286 for Alaska Air Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $56.0.

Want to see what has analysts modeling a step change in earnings power, richer margins, and a future multiple below today’s industry norm, all at once? Read on.

Result: Fair Value of $65.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising unit costs and integration hiccups at Hawaiian could easily erode the expected margin gains that underpin the current upside narrative.

Find out about the key risks to this Alaska Air Group narrative.

Another Angle on Valuation

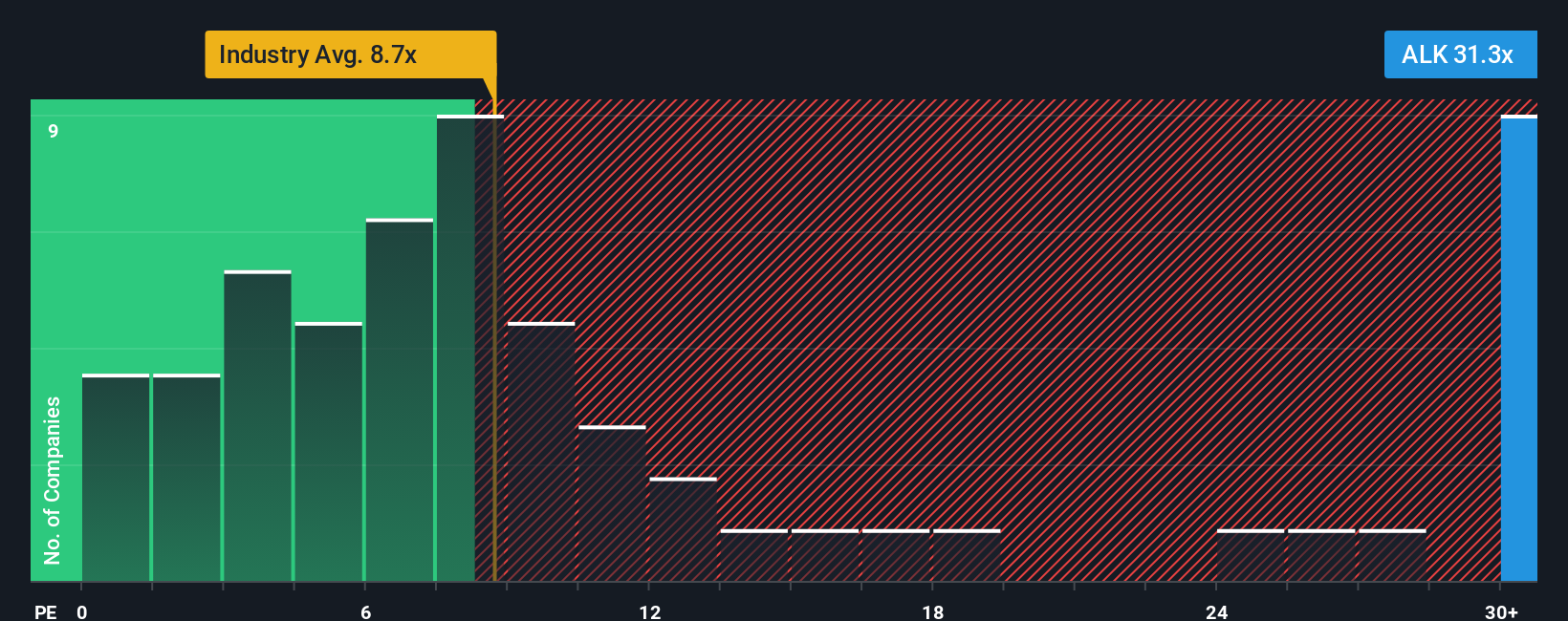

While narrative fair value points to upside, the earnings multiple tells a tougher story. Alaska Air trades on a P/E of 38.4 times, far richer than both the global airlines average of 9.1 times and its own fair ratio of 56.6 times. This raises questions about valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alaska Air Group Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Alaska Air Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more actionable investment ideas?

Before you move on, use the Simply Wall St Screener to uncover fresh opportunities that match your style, so you are not leaving potential returns on the table.

- Capture early stage growth stories by reviewing these 3575 penny stocks with strong financials that pair speculative upside with improving fundamentals and stronger balance sheets.

- Capitalize on the AI revolution through these 26 AI penny stocks riding structural demand for automation, data infrastructure, and intelligent software solutions.

- Lock in reliable income potential by targeting these 15 dividend stocks with yields > 3% that combine solid payouts with sustainable cash flows and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALK

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026