- United States

- /

- Airlines

- /

- NasdaqGS:UAL

How Investors Are Reacting To United Airlines (UAL) Cancellations Amid FAA Staffing Shortages and Ground Stops

Reviewed by Sasha Jovanovic

- United Airlines Holdings recently cancelled around 510 flights over a weekend following Federal Aviation Administration directives during the U.S. government shutdown, as the FAA imposed a ground stop at Harry Reid International Airport due to staffing shortages.

- This large-scale disruption highlights how external government actions and regulatory interventions can swiftly affect airline operations and scheduling across major markets.

- We’ll examine how the FAA-mandated flight cancellations amid staffing shortages may influence United Airlines' investment case.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

United Airlines Holdings Investment Narrative Recap

To be a United Airlines Holdings shareholder, you need confidence in travel demand resilience and the company’s ability to offset operational disruptions with earnings growth. The recent FAA-mandated cancellations due to government staffing shortages present an operational challenge but appear unlikely to alter the key short-term catalyst, robust booking trends, nor the main risk, which remains long-term shifts in business travel demand and high debt levels. So far, these cancellations do not appear to be material to United’s overall investment case.

Among United’s recent announcements, record Q4 2025 revenue guidance stands out, as it directly speaks to earnings momentum despite industry headwinds. This forward-looking outlook could help insulate investor confidence from temporary regulatory interruptions, as strong top-line performance remains a central catalyst supporting the current narrative for United’s stock.

However, investors should be aware that unlike episodic flight disruptions, the structural risk of a prolonged decline in high-yield business travel could...

Read the full narrative on United Airlines Holdings (it's free!)

United Airlines Holdings' narrative projects $67.6 billion revenue and $4.2 billion earnings by 2028. This requires 5.2% yearly revenue growth and an $0.9 billion earnings increase from $3.3 billion currently.

Uncover how United Airlines Holdings' forecasts yield a $123.20 fair value, a 30% upside to its current price.

Exploring Other Perspectives

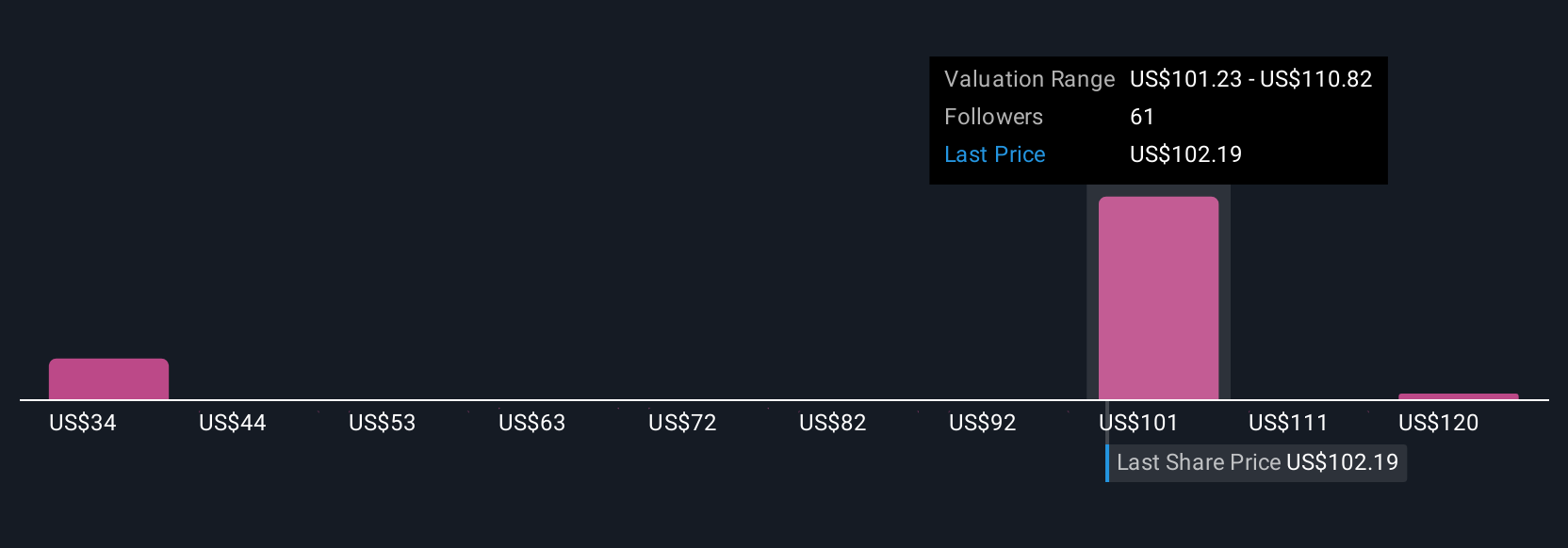

Five Simply Wall St Community members estimate fair values between US$105.10 and US$203.76 per share, showing a wide span of opinion. While most focus on UA’s potential to accelerate revenue in international markets, structural challenges in premium travel demand may temper performance over time, explore how your outlook aligns with others.

Explore 5 other fair value estimates on United Airlines Holdings - why the stock might be worth just $105.10!

Build Your Own United Airlines Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Airlines Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Airlines Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Airlines Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives