- United States

- /

- Airlines

- /

- NasdaqGS:SNCY

Sun Country Airlines (SNCY) Profit Margins Improve, Reinforcing Bullish Narratives on Earnings Quality and Valuation

Reviewed by Simply Wall St

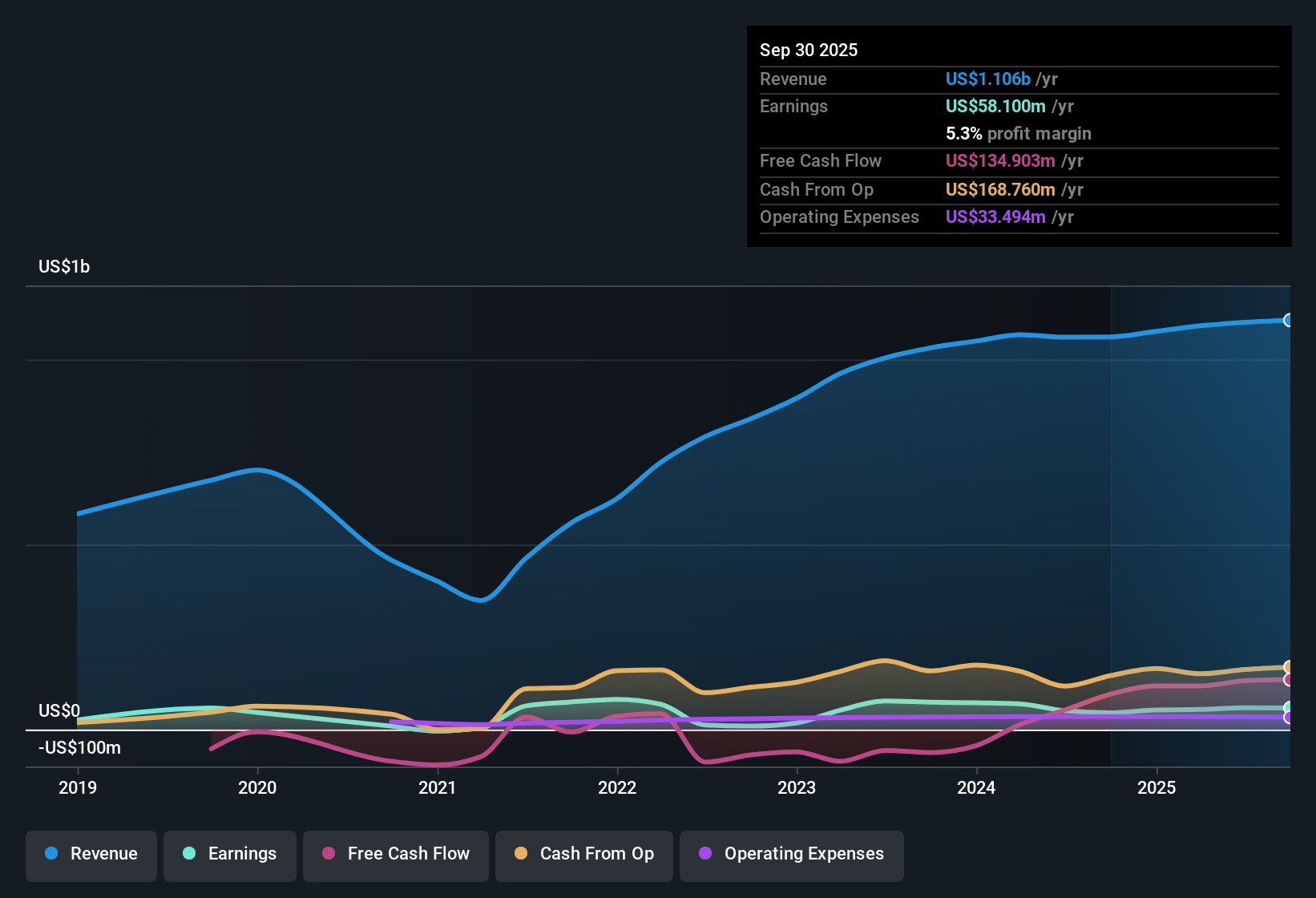

Sun Country Airlines Holdings (SNCY) delivered annual earnings growth of 15.2% over the past five years, ramping up to 28.8% in the most recent year. Profit margins improved to 5.3% from 4.3% year-over-year, and revenue is forecast to rise 8.9% annually, a bit slower than the broader US market's 10.3% projection. With annual earnings projected to surge 36.8%, valuation metrics are turning heads: SNCY trades at a price-to-earnings ratio of 10.3x, below its peer group, and the current share price of $11.27 is well under its discounted cash flow fair value estimate of $85.01. This positions the company as a compelling prospect for growth-minded investors.

See our full analysis for Sun Country Airlines Holdings.Let’s see how these results stack up against the market’s prevailing narratives, which assumptions hold up, and which might need a rethink as the numbers come in.

See what the community is saying about Sun Country Airlines Holdings

Profit Margins Poised for Expansion

- Analysts expect Sun Country's profit margins to grow from 5.4% today to 13.2% in three years. This represents nearly triple the current efficiency and may contribute to stronger net income.

- According to analysts' consensus, margin strength could persist as cargo operations increase and digital initiatives reduce costs.

- Rising cargo revenues are expected to add stability by reducing dependence on volatile seasonal passenger travel.

- Digital booking and crew tools may boost operating efficiency, supporting the long-term outlook for margin expansion.

- To see how analysts are weighing these changing profit drivers, check out the full consensus narrative for Sun Country Airlines Holdings here. 📊 Read the full Sun Country Airlines Holdings Consensus Narrative.

Fleet Upgrades Drive Cost Tension

- Significant capital spending is expected as Sun Country incorporates new aircraft, manages higher labor costs from union contracts, and navigates expenses related to fleet transitions and asset upgrades.

- Some analysts caution that these pressures could impact cash generation and net income.

- Rising labor expenses and pilot wage increases could create unpredictable effects on free cash flow.

- Transitional costs and uneven asset utilization may limit near-term margin gains even as revenue grows.

Valuation Gap Widens vs. DCF Fair Value

- Shares trade at $11.27, significantly below the DCF fair value of $85.01 and at a 10.3x price-to-earnings multiple. This remains discounted compared to both the analyst target of $17.00 and the peer group average of 15.7x PE.

- Analysts' consensus view is that the valuation discount may be attributed to persistent risks.

- Geographic concentration and a heavy focus on leisure travel suggest that, despite strong growth potential, the market factors in volatility.

- Peers may trade at higher multiples but could have different industry or regional risks, which may help explain Sun Country's relative discount.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sun Country Airlines Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or risk the consensus missed? Dive in and share your perspective. Your narrative could be ready in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sun Country Airlines Holdings.

See What Else Is Out There

Sun Country faces uncertainty from labor costs, fleet upgrade expenses, and volatility tied to leisure travel. These factors could constrain consistent cash flow and earnings growth.

If choppy cash flow worries you, use stable growth stocks screener (2112 results) to focus on companies showing steady revenue and earnings through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNCY

Sun Country Airlines Holdings

An air carrier company, operates scheduled passenger, air cargo, charter air transportation, and related services in the United States, Latin America, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives