- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Star Bulk Carriers (SBLK): Valuation Insights Following Steep Q3 Earnings Decline and New Dividend Announcement

Reviewed by Simply Wall St

Star Bulk Carriers (SBLK) just released its third quarter results, revealing a steep drop in revenue and net income compared to last year. The company also declared a quarterly dividend, both events providing fresh context for investors.

See our latest analysis for Star Bulk Carriers.

Despite the dip in quarterly results, Star Bulk Carriers’ story is not all gloom. The company completed an $8.6 million share buyback and continues to reward shareholders with dividends, and these moves may have helped steady the stock’s momentum. With a year-to-date share price return of 28.39% and a 320.85% total shareholder return over five years, Star Bulk’s longer-term performance shows resilience amid market ups and downs.

If you’re interested in expanding your watchlist beyond shipping, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With fundamentals under pressure but a solid share price rally this year, the key question now is whether Star Bulk Carriers is undervalued or if recent gains suggest the market has already priced in any future growth.

Most Popular Narrative: 12.6% Undervalued

According to the most closely watched narrative, the fair value target for Star Bulk Carriers is set meaningfully above its last close price. This creates an opportunity to discuss emerging industry trends and the assumptions supporting a positive outlook on the company’s potential direction.

The ongoing replacement of older, less efficient vessels with newbuilds and eco upgrades positions the fleet to benefit from tightening global emissions standards, enabling lower operating expenses and the potential for higher charter rates, which in turn may support improved net margins and overall earnings.

Curious about what fuels this optimistic view? The explanation centers on a focus on margin expansion, efficiency upgrades, and a financial model that forecasts profit growth ahead of industry averages. Want to see which numbers support this valuation? Discover the underlying factors shaping this price target.

Result: Fair Value of $22.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as an aging fleet requiring costly upgrades or exposure to volatile commodity cycles could still undermine Star Bulk Carriers’ long-term profitability.

Find out about the key risks to this Star Bulk Carriers narrative.

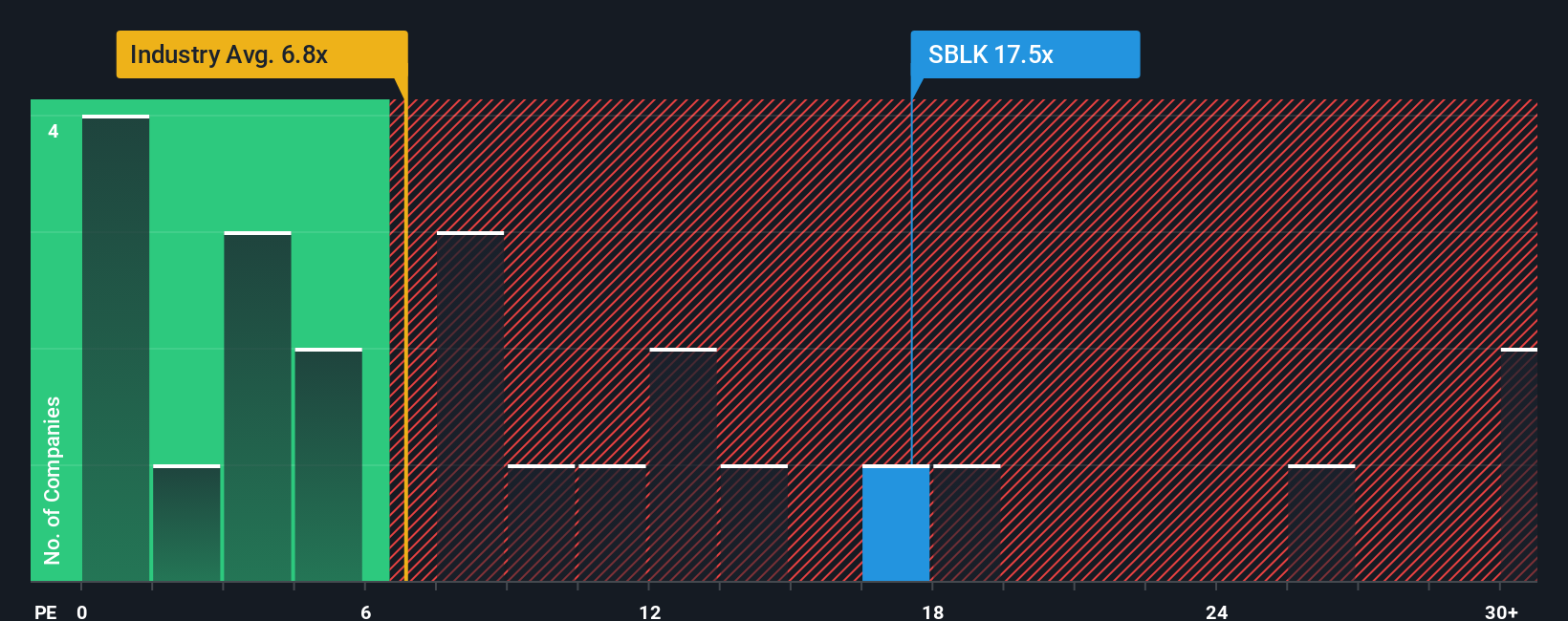

Another View: What Do Earnings Ratios Say?

Looking through the lens of earnings multiples, Star Bulk Carriers trades at 36.9 times earnings, which is much higher than both the peer average of 5.1 and the North American shipping industry’s 7.1. However, its fair ratio stands at 41.4, leaving the stock not far off a level the market could ultimately price towards. This gap highlights the uncertainty in where the valuation will settle over time. Which story do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Star Bulk Carriers Narrative

If you want to dig into the numbers yourself or have a different take, it only takes a few minutes to build your own view of Star Bulk Carriers. Do it your way

A great starting point for your Star Bulk Carriers research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your portfolio’s future. Uncover the next potential market leaders and promising opportunities you might be missing out on by tapping into these investor-focused themes:

- Capture high returns from market mispricing by analyzing these 914 undervalued stocks based on cash flows which is packed with compelling cash flow bargains.

- Boost your income stream by reviewing these 15 dividend stocks with yields > 3% that offer robust yields above 3% and stand out for sustainability.

- Ride the momentum of rapid innovation with these 25 AI penny stocks featuring companies pioneering advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026