- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Star Bulk Carriers (SBLK): Exploring Valuation After Recent Share Price Pause

Reviewed by Simply Wall St

Star Bulk Carriers (SBLK) has seen its stock edge down about 1% over the past week, even though it has gained 17% year to date. Investors continue to weigh recent company performance against the broader shipping sector outlook.

See our latest analysis for Star Bulk Carriers.

After a strong run-up earlier in the year, Star Bulk Carriers’ recent share price slip comes as sentiment cools a bit across the shipping sector. The stock’s solid year-to-date share price return contrasts with a more muted one-year total shareholder return. This suggests momentum is pausing even as long-term holders have seen substantial gains.

If you’re eyeing wider market opportunities beyond shipping, it’s a smart time to discover fast growing stocks with high insider ownership.

With shares still well below analyst price targets but a recent pullback in performance, the key question is whether Star Bulk Carriers is underrated by the market or if its future prospects are already fully reflected in the current price.

Most Popular Narrative: 17% Undervalued

The prevailing narrative suggests Star Bulk Carriers’ fair value stands well ahead of its last close, with analysts projecting a meaningful gap to the upside. This sets the stage for a story of transformation fueled by operational modernization and a supply-demand shift.

The ongoing replacement of older, less efficient vessels with newbuilds and eco upgrades positions the fleet to benefit from tightening global emissions standards. This enables lower operating expenses and potential for higher charter rates, thereby supporting improved net margins and overall earnings.

Curious why analysts believe this company could outpace the market? The valuation hinges on a bold profit surge and aggressive margin expansion tied to strategic upgrades. Hint: there is one financial forecast in this narrative that breaks the industry mold. You will want to see how they arrive at that number.

Result: Fair Value of $21.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent flat bulk trade growth and Star Bulk’s reliance on debt could quickly turn market optimism into renewed caution among investors.

Find out about the key risks to this Star Bulk Carriers narrative.

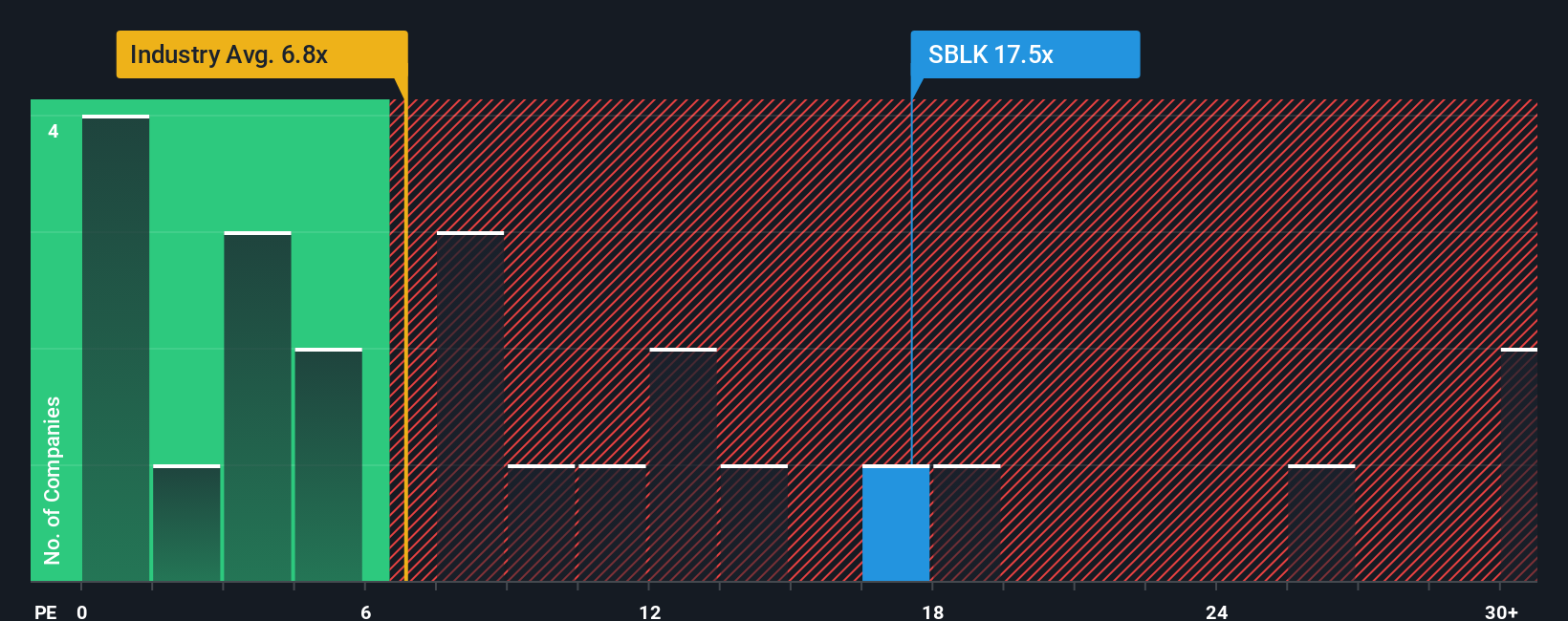

Another View: The Multiples Approach

Looking at traditional market multiples tells a different story. Star Bulk trades at a price-to-earnings ratio of 16.7x, which is far above both the industry average of 7.1x and its peer average of just 4.3x. Even so, this remains well below the fair ratio of 28x. This suggests there is both risk and potential opportunity if markets reassess what is considered “normal” for shipping valuations. Which direction do you think is more likely?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Star Bulk Carriers Narrative

Prefer a hands-on approach or have a unique outlook on Star Bulk Carriers? In just a couple of minutes, you can explore the underlying numbers for yourself and shape your own view. Do it your way.

A great starting point for your Star Bulk Carriers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your investing strategy and make sure you do not miss out on potential winners. These fresh stock selections could help you spot your next big move.

- Hunt for tomorrow’s market movers by reviewing these 861 undervalued stocks based on cash flows, which offer strong upside potential and resilient cash flows.

- Tap into reliable payouts and financial stability with these 17 dividend stocks with yields > 3%, yielding above-average returns for income-focused portfolios.

- Access trailblazing innovation in medicine by checking out these 32 healthcare AI stocks, as these are shaping the healthcare landscape with breakthrough technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives