- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft (LYFT) Healthcare Push: Assessing Valuation After Smart on FHIR Integration with Epic

Reviewed by Simply Wall St

Lyft (LYFT) just made a serious move into healthcare delivery, rolling out its Smart on FHIR App with VectorCare so hospitals can book and track patient rides directly inside Epic’s electronic health record system.

See our latest analysis for Lyft.

The market seems to like this healthcare push, with Lyft’s 90 day share price return of 29.7 percent and year to date share price return of 68.28 percent signaling building momentum despite a still mixed five year total shareholder return of negative 50.99 percent.

If this kind of strategic pivot has your attention, it might be worth exploring healthcare stocks as another way to find transportation adjacent names benefiting from healthcare and mobility trends.

With shares still trading at a hefty intrinsic discount but already bumping near analyst targets, is Lyft a classic underappreciated turnaround story, or has the market largely priced in its next leg of growth?

Most Popular Narrative Narrative: 4.6% Undervalued

With Lyft closing at $22.97 against a narrative fair value of $24.07, the story suggests modest upside built on very specific operating assumptions.

The analysts have a consensus price target of $17.123 for Lyft based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $10.0.

Curious how relatively mild revenue growth, rising margins and a lower future earnings multiple still point to upside from here? The detailed narrative reveals the math.

Result: Fair Value of $24.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging competition from Uber and potential regulatory setbacks related to insurance or autonomous vehicles could easily derail the upbeat earnings and margin narrative.

Find out about the key risks to this Lyft narrative.

Another Angle on Valuation

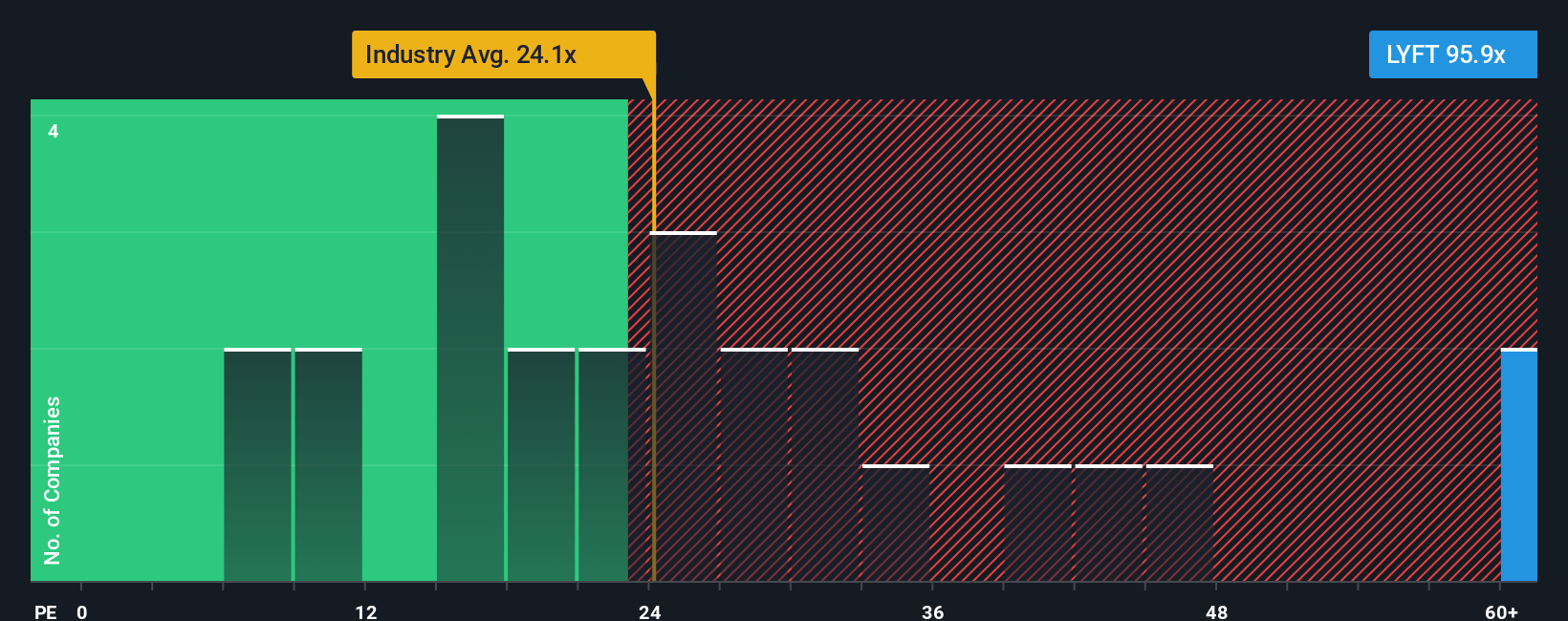

Those upbeat fair value estimates sit awkwardly beside Lyft’s current pricing on earnings. At about 60.9 times earnings versus 31 times for the US transportation group and a fair ratio nearer 21.2 times, the stock carries clear multiple risk if sentiment cools or growth slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lyft Narrative

If this perspective does not quite fit yours, or you prefer to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lyft.

Ready for more investment ideas?

Do not stop with a single stock. Broaden your opportunity set now with targeted screeners that surface strong businesses before the crowd catches on.

- Capture early stage potential by reviewing these 3574 penny stocks with strong financials that aim to turn financial resilience into outsized long term gains.

- Ride structural growth trends through these 907 undervalued stocks based on cash flows that pair compelling cash flow discounts with solid business quality.

- Position yourself for the next wave of innovation by scanning these 28 quantum computing stocks reshaping computing and data security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026