- United States

- /

- Transportation

- /

- NasdaqGS:LSTR

Landstar System (LSTR): Exploring Valuation After Weaker Third Quarter Earnings

Reviewed by Simply Wall St

Landstar System (LSTR) just released its third quarter results, showing both sales and net income moving lower compared to last year. Investors are now weighing what this means for the company’s outlook.

See our latest analysis for Landstar System.

Landstar’s latest financials seem to be weighing on sentiment, with the share price sliding to $130.13 and the year-to-date share price return now sitting at -23.6%. While management has affirmed the dividend and continued buybacks, neither has offset the steeper 1-year total shareholder return of -30.4%. Overall, long-term momentum appears to be fading as investors wait for signs of a turnaround.

If the recent volatility has you rethinking your portfolio mix, now is the perfect time to discover fast growing stocks with high insider ownership.

With shares trading near a multi-year low after a sharp drop in earnings, the question is whether Landstar System is undervalued at current levels, or if the market is accurately reflecting the company’s growth challenges ahead.

Most Popular Narrative: 0.7% Undervalued

Compared to Landstar System's latest closing price of $130.13, the most widely followed narrative places fair value slightly higher at $131.07. This suggests the market is largely in sync with consensus expectations. This narrow gap shows how investor sentiment is closely connected to assumptions about stability and growth in a turbulent market.

Robust growth in infrastructure-related and data center freight, fueled by domestic investment and the AI/data center buildout, is expected to drive continued strength in Landstar's specialized heavy haul segment. This supports higher revenue per load and overall earnings growth.

Curious what projections power this valuation call? The narrative hints at a freight surge and profit boosts driven by significant shifts in US infrastructure but leaves key numbers and market assumptions under wraps. Dive in to discover which forecast changes could tip the balance.

Result: Fair Value of $131.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weak demand for trucking and rising insurance costs could quickly shift sentiment if these challenges persist or become more severe.

Find out about the key risks to this Landstar System narrative.

Another View: What Do Multiples Say?

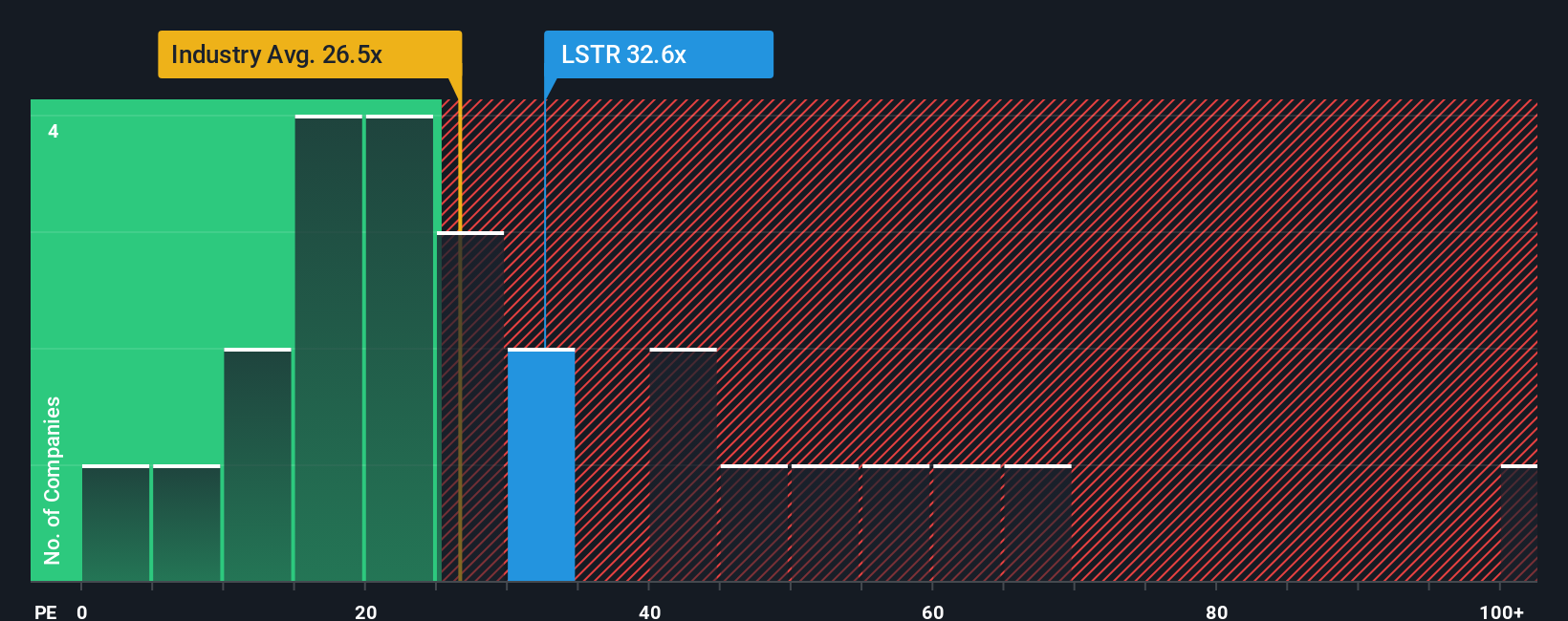

Looking through the lens of valuation multiples, Landstar System appears pricey. Its price-to-earnings ratio sits at 32.6x, well above both the Transportation industry average of 26.5x and the peer average of 32x. The gap to its fair ratio of 16.1x highlights potential overvaluation, raising questions about whether investors are overestimating the recovery.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Landstar System Narrative

You are always free to question the consensus and dig into the numbers yourself. Building a unique perspective is quick and straightforward. Do it your way

A great starting point for your Landstar System research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look for the next opportunity before the crowd catches on. Uncover fresh possibilities and take control of your investment future today.

- Unlock steady cash flow and join thousands of investors thriving with higher yields by checking out these 16 dividend stocks with yields > 3%.

- Get ahead of tomorrow’s tech trends by targeting these 24 AI penny stocks, which are transforming industries from healthcare to automation with artificial intelligence breakthroughs.

- Secure your edge by spotting value with these 870 undervalued stocks based on cash flows, often overlooked despite strong fundamentals and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSTR

Landstar System

Provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives