- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

JetBlue (JBLU): Is the Recent Share Price Bounce Enough to Change Its Valuation Story?

Reviewed by Simply Wall St

JetBlue Airways (JBLU) has quietly bounced in the past month, even as its year to date performance remains weak. That gap between short term momentum and longer term pain is what investors are trying to make sense of.

See our latest analysis for JetBlue Airways.

That recent 1 month share price return of about 8 percent looks more like a relief rally than a full trend change, given JetBlue’s year to date share price loss of roughly 36 percent and a 1 year total shareholder return still firmly negative, so momentum is improving but from a low base.

If JetBlue’s mixed recovery has you reassessing the sector, this could be a good moment to scan other aerospace and defense stocks for more resilient travel and transport exposure.

With shares still languishing after years of steep underperformance, yet revenue and earnings trends showing tentative improvement, is JetBlue finally trading below its true potential, or is the market already braced for limited future upside?

Most Popular Narrative Narrative: 3% Overvalued

With JetBlue trading at $4.79 against a narrative fair value of $4.65, expectations hinge on a delicate balance of growth and margin repair.

The analysts have a consensus price target of $4.231 for JetBlue Airways based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $3.0.

Want to see what kind of revenue runway, margin reset, and future earnings power justify that tight fair value band? The narrative spells out the full playbook.

Result: Fair Value of $4.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor costs and exposure to volatile jet fuel prices could quickly erode margins and undermine the optimistic recovery narrative.

Find out about the key risks to this JetBlue Airways narrative.

Another Lens on Value

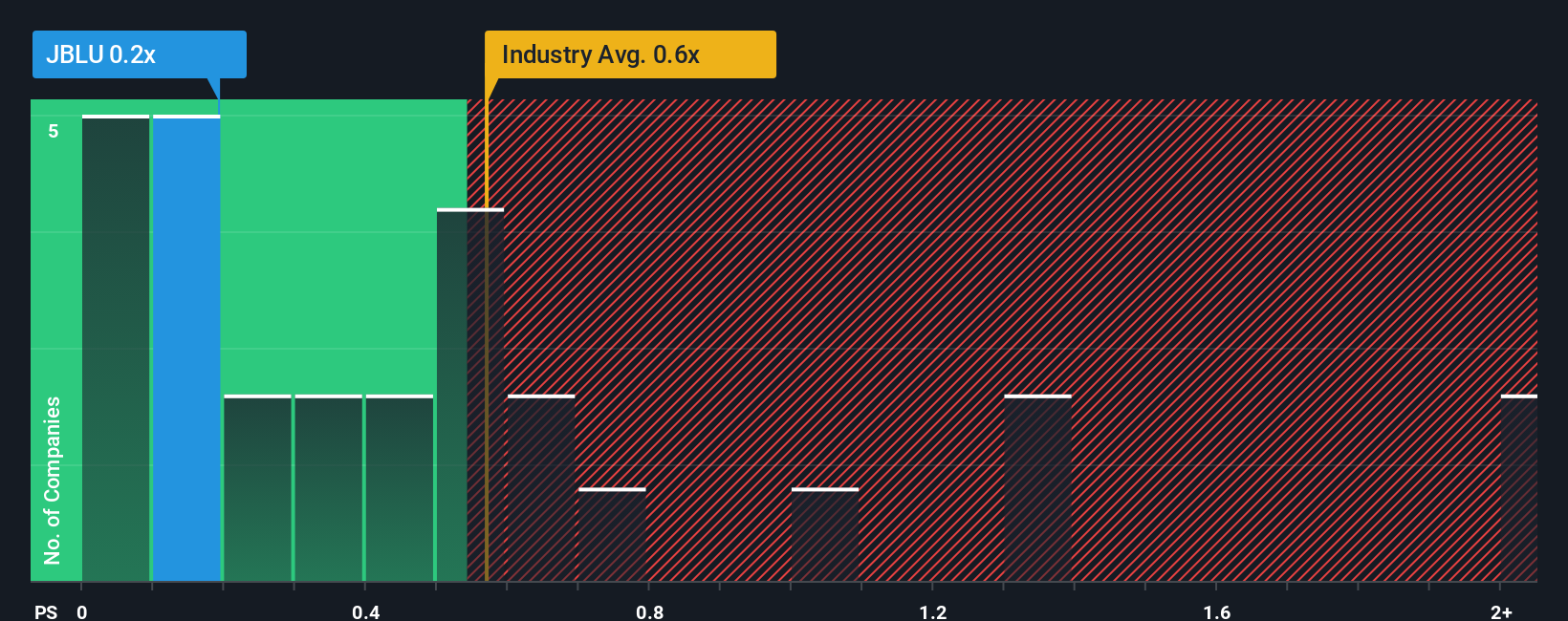

The narrative fair value says JetBlue is slightly overvalued, but its 0.2x price to sales looks deeply discounted versus peers at 0.5x and a fair ratio nearer 0.8x. If sentiment normalizes toward that fair ratio, is the real risk missing a sharp rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JetBlue Airways Narrative

If this take does not quite match your view, or you prefer to dig into the numbers yourself, you can build a bespoke JetBlue thesis in just a few minutes, Do it your way.

A great starting point for your JetBlue Airways research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to level up beyond JetBlue? Use the Simply Wall Street Screener to pinpoint fresh opportunities before the crowd and keep your portfolio ahead of the curve.

- Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Tap into transformative innovation by targeting these 26 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can help support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Fair value with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026