- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Why Hertz (HTZ) Is Down 5.3% After Wave of Negative Analyst Ratings and What’s Next

Reviewed by Sasha Jovanovic

- In recent days, multiple analysts issued 'Sell' or 'Strong Sell' ratings for Hertz Global Holdings, reflecting heightened bearish sentiment toward the company's outlook.

- This wave of negative analyst sentiment is particularly significant, as it emerged even while the broader market was experiencing strength, highlighting company-specific concerns.

- We'll explore how this shift in analyst opinion may alter Hertz's longer-term investment narrative and perceived risks.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hertz Global Holdings Investment Narrative Recap

To be a shareholder in Hertz Global Holdings, you need to believe that ongoing operational improvements, digital partnerships, and a younger fleet can boost margins and restore profitability, even in a rapidly evolving rental market. The sharp shift in negative analyst sentiment does not appear to materially alter the company's most important near-term catalyst, which remains its ability to control costs and stabilize operating performance, but it does highlight continued concern over execution risks and financial flexibility.

A recent development of note is Hertz’s Q3 2025 earnings, where the company achieved a net income of US$184 million after a large year-over-year loss. This improvement aligns with ongoing cost control efforts, which are crucial in the context of recent bearish analyst calls, as investors weigh whether operational gains can offset persistent sector pressures and financial constraints.

In contrast, investors should be especially mindful of Hertz’s heavy and ongoing debt loads, because if credit conditions change suddenly...

Read the full narrative on Hertz Global Holdings (it's free!)

Hertz Global Holdings' narrative projects $8.8 billion revenue and $424.8 million earnings by 2028. This requires a 0.8% annual revenue decline and a $2.9 billion increase in earnings from the current $-2.5 billion.

Uncover how Hertz Global Holdings' forecasts yield a $4.39 fair value, a 12% downside to its current price.

Exploring Other Perspectives

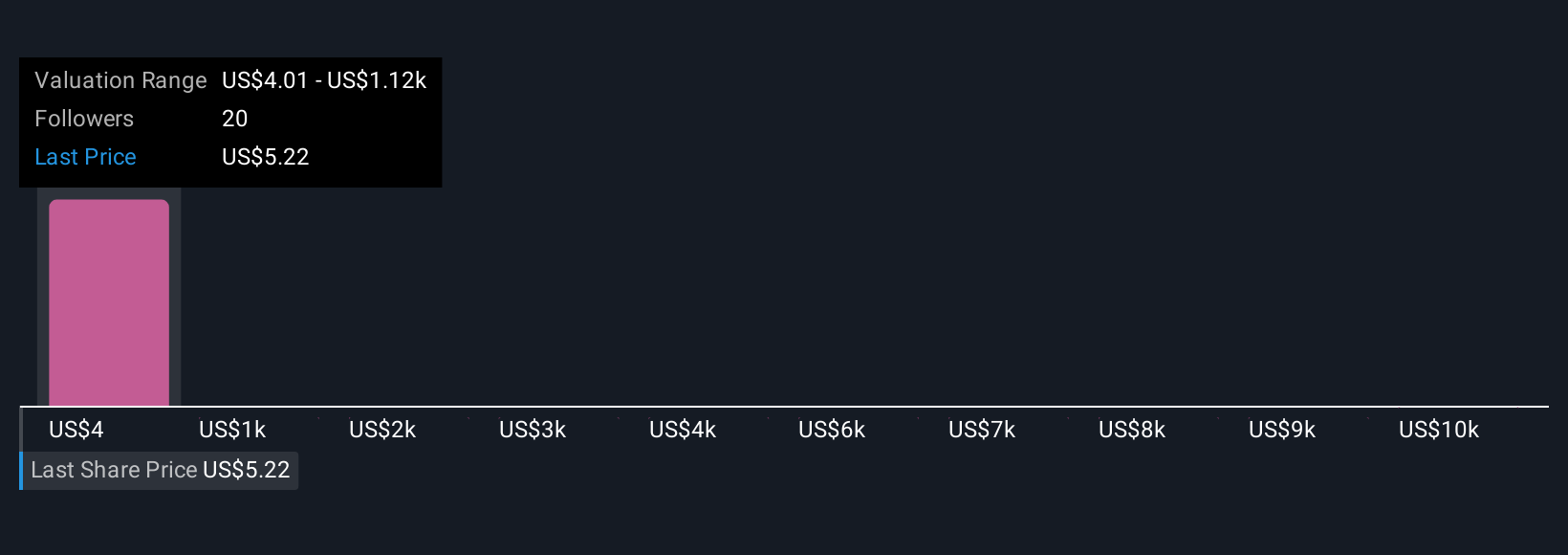

Six fair value estimates from the Simply Wall St Community stretch from US$0.001 to US$11,155, reflecting vastly different outlooks. Against this wide range, persistent pricing pressures still raise questions about Hertz’s margin expansion potential going forward.

Explore 6 other fair value estimates on Hertz Global Holdings - why the stock might be a potential multi-bagger!

Build Your Own Hertz Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hertz Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hertz Global Holdings' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026