- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX): Revisiting Valuation After Recent Share Price Gains and Infrastructure Updates

Reviewed by Kshitija Bhandaru

This week, CSX (CSX) has caught investor interest following modest gains over the past month. This has brought its year-to-date return to 11%. With transportation stocks drawing attention, many are watching how CSX navigates this environment.

See our latest analysis for CSX.

CSX’s share price momentum has been picking up, with a 9.6% gain over the past month helping to lift its year-to-date return above 10%. While some peers have faced recent turbulence, CSX’s strong three- and five-year total shareholder returns suggest that steady, long-term value creation is still the bigger story here.

If you’re curious to broaden your search beyond railroads and transportation stocks, you can discover fast growing stocks with high insider ownership.

But with shares edging closer to analyst targets and showing steady recent gains, investors now face a familiar question: Is CSX trading at a discount, or has the market already factored in the company’s growth prospects?

Most Popular Narrative: 7.5% Undervalued

CSX's most widely followed narrative places its fair value at $38.44 per share, which is above the recent closing price of $35.57. This sets the stage for a deeper look at the factors driving this valuation, including ongoing network upgrades and projected growth in key financial metrics.

CSX's completion of major infrastructure projects, such as the Howard Street Tunnel and Blue Ridge subdivision rebuild, is expected to improve network fluidity. This is anticipated to lead to increased operational efficiency and service reliability, which should enhance revenue and margin growth.

Think the fair value estimate is just about strong train lines? There’s more beneath the surface. Key forecasts behind this price hinge on bold assumptions for top-line growth and expanding profit margins. Which specific industry trends and ambitious financial targets turn these upgrades into that headline number? Dig into the full narrative for all the details.

Result: Fair Value of $38.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if infrastructure projects stall or if volatility in the commodity market pressures margins. Either scenario could quickly undermine this upbeat outlook.

Find out about the key risks to this CSX narrative.

Another View: But What About DCF?

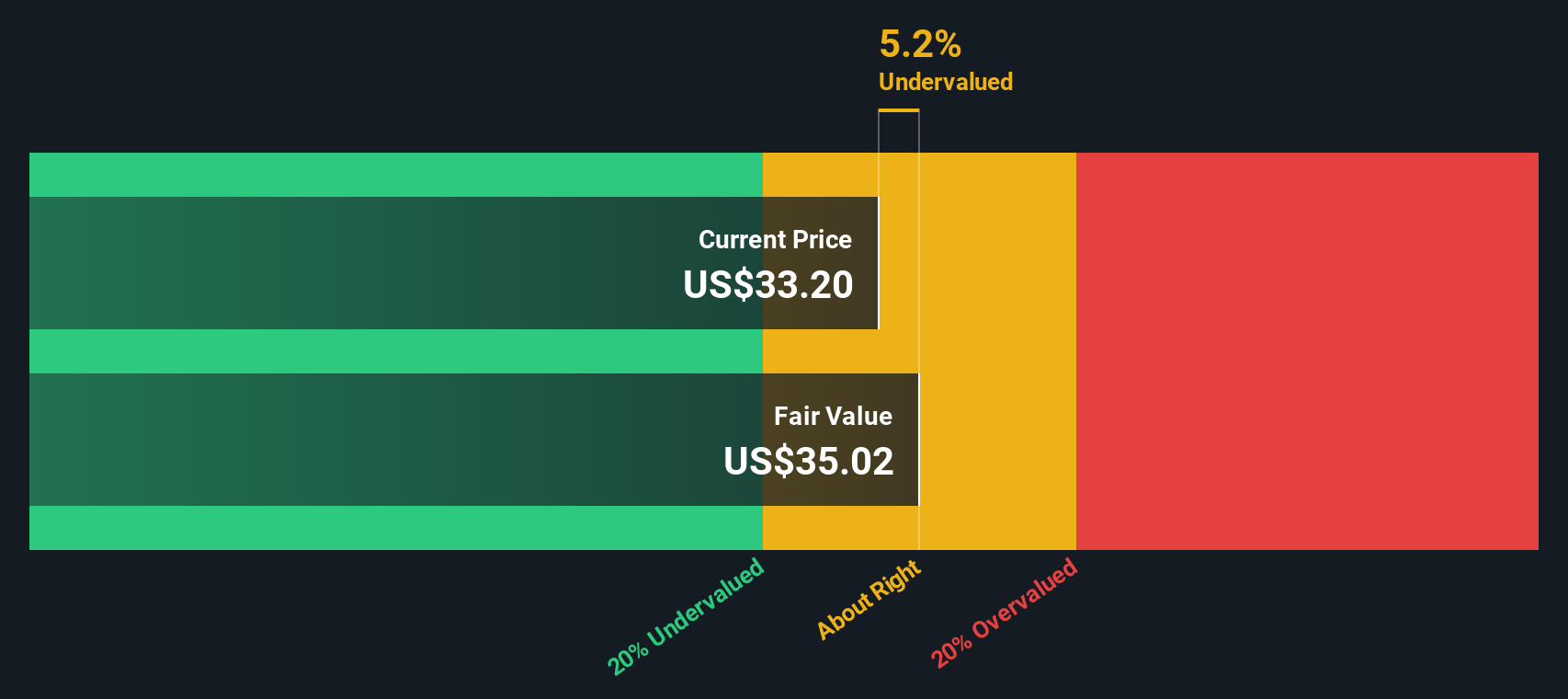

While the analyst consensus finds CSX undervalued based on its future growth and profit margins, our SWS DCF model suggests a different perspective. Using projected cash flows and a discount rate, the DCF approach values CSX much closer to its current price. Is the potential upside already priced in, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSX Narrative

If you’d like to dig into the numbers yourself or craft a different take on CSX, you can quickly build your own narrative in just a few minutes. Do it your way.

A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunity can strike beyond the obvious picks. Don’t let tomorrow’s winners pass you by when new prospects are just a click away.

- Unlock market-beating income by tapping into these 18 dividend stocks with yields > 3%, which deliver reliable yields above 3%.

- Pinpoint companies positioned for the AI wave with these 25 AI penny stocks and catch growth before it hits the mainstream.

- Snap up value opportunities now by scanning these 893 undervalued stocks based on cash flows and track stocks overlooked by others but primed for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026