- United States

- /

- Transportation

- /

- NasdaqGS:CSX

[CSX] (CSX) Announces US$0.13 Dividend; Share Price Remains Flat

Reviewed by Simply Wall St

CSX (CSX) recently affirmed a $0.13 per share quarterly dividend, which will be paid in mid-September. This stable dividend policy coincides with the company completing significant labor agreements, aligning wage increases and health benefits with other unions. Over the last quarter, the company's stock saw a 20% increase, a move that contrasts with major indices remaining near record highs but relatively unchanged in the same period. While the market has been buoyed by strong earnings in various sectors, CSX's actions—centered around dividends and labor stability—may have added weight to its notable stock performance.

The recent affirmation by CSX of a $0.13 per share quarterly dividend might enhance investor confidence by highlighting the company's commitment to returning value to shareholders. With the dividend aligning with significant labor agreements, CSX is emphasizing stability, possibly impacting revenue and earnings positively as operational efficiencies are realized through the completion of infrastructure projects like the Howard Street Tunnel.

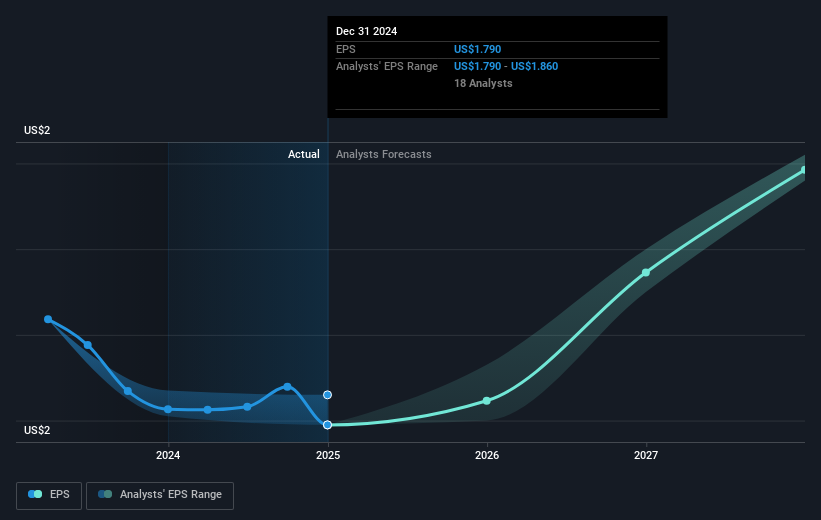

Over a five-year period, CSX has delivered a total return of 45.47%, illustrating strong performance despite recent challenges. However, it underperformed the broader US market and the US Transportation industry over the past year. These metrics provide context for the company's growth trajectory and its ability to adapt to market fluctuations. With a current share price of $33.26, CSX remains slightly below the analyst price target of $34.77, suggesting room for potential upward movement as efficiency projects may drive future revenue and margin growth.

This focus on infrastructure and labor stability is likely to influence future revenue, with analysts forecasting annual revenue growth of 3%. Meanwhile, earnings are predicted to reach $3.8 billion by 2028, reflecting an incremental profit margin improvement. However, risks from infrastructure project challenges or macroeconomic uncertainties could impact these forecasts. As CSX navigates these landscapes, maintaining operational efficiency will be key to meeting or exceeding analyst expectations.

Dive into the specifics of CSX here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives