- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

How Investors May Respond To Capital Clean Energy Carriers (CCEC) Vessel Sale and Debt Repayment Plan

Reviewed by Sasha Jovanovic

- On November 20, 2025, Capital Clean Energy Carriers Corp. announced the sale of its M/V Buenaventura Express container vessel (142,411 DWT/13,312 TEU, hybrid scrubber-fitted, built 2023 by Hyundai Samho Industries) to a third party, with expected delivery in early 2026.

- The company anticipates a US$4.4 million book gain from the sale and plans to use the cash proceeds to pay down an estimated US$84.4 million in debt and for general corporate purposes.

- We'll look at how this vessel sale and debt reduction shapes Capital Clean Energy Carriers' investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Capital Clean Energy Carriers Investment Narrative Recap

To be a shareholder in Capital Clean Energy Carriers, an investor should be confident in long-term demand for clean energy shipping and the company's ability to sign profitable, long-term contracts for highly specialized vessels. The sale of the M/V Buenaventura Express and corresponding debt reduction is unlikely to materially affect the most important short-term catalyst, securing stable charter coverage for newbuild vessels, but does marginally ease financing pressures. The biggest risk remains exposure to floating-rate debt, which could impact margins if interest rates remain elevated.

Of the recent announcements, the company's addition to the S&P Global BMI Index on September 21, 2025, stands out as most relevant in this context. Index inclusion may improve liquidity and raise visibility among institutional investors, supporting the company's ongoing capital access and aligning with the catalyst of attracting funding for fleet renewal and newbuild programs.

However, investors should be mindful that a large portion of the company’s debt remains exposed to floating interest rate risk, and...

Read the full narrative on Capital Clean Energy Carriers (it's free!)

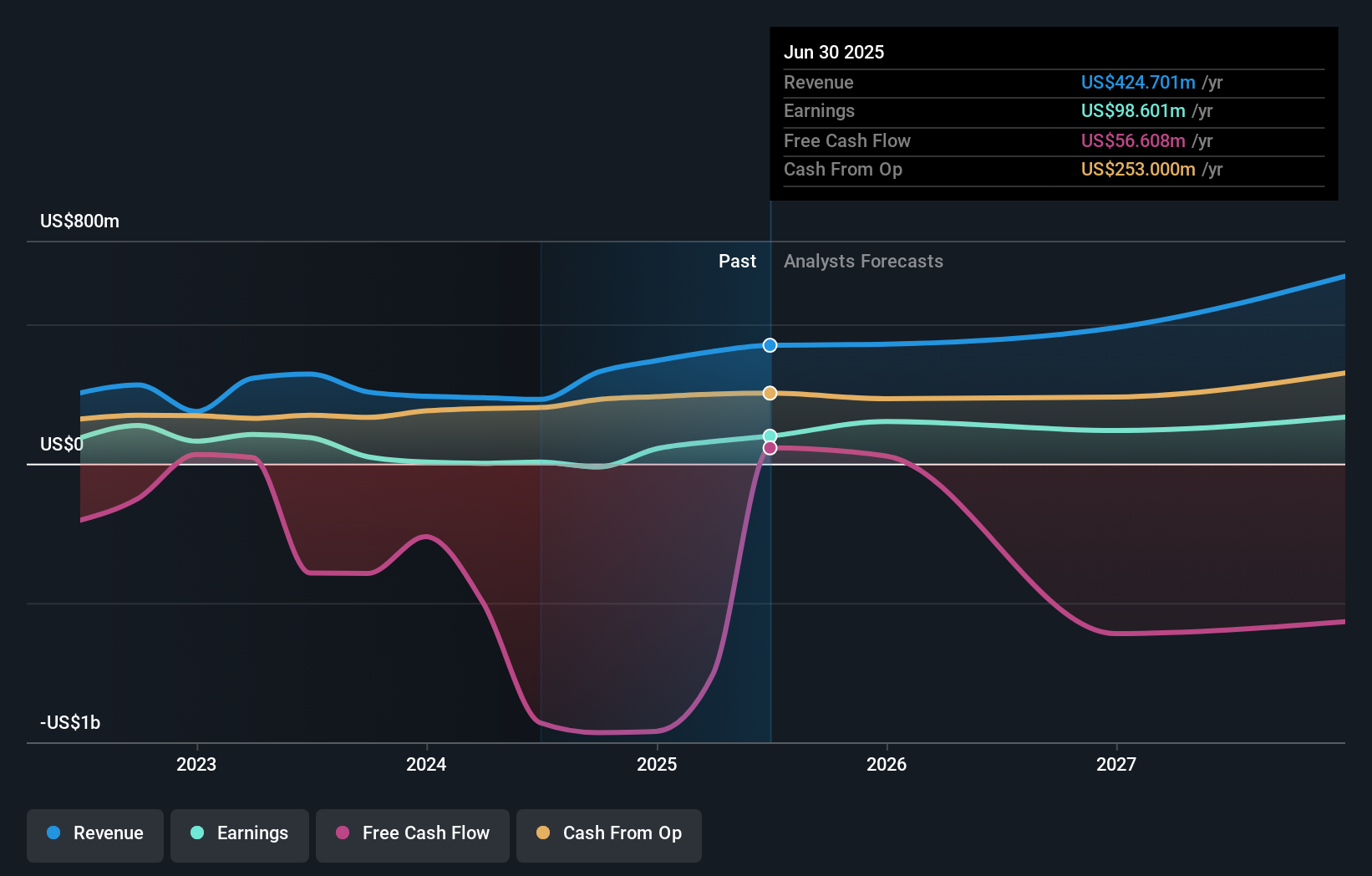

Capital Clean Energy Carriers is projected to reach $683.8 million in revenue and $161.0 million in earnings by 2028. This outlook relies on an annual revenue growth rate of 17.2% and a $62.4 million increase in earnings from the current level of $98.6 million.

Uncover how Capital Clean Energy Carriers' forecasts yield a $25.80 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided one fair value estimate for Capital Clean Energy Carriers at US$25.80 per share. While this single view may not capture the full range of market sentiment, many participants remain focused on the company's exposure to floating-rate debt, which could play a significant role in future performance.

Explore another fair value estimate on Capital Clean Energy Carriers - why the stock might be worth just $25.80!

Build Your Own Capital Clean Energy Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Capital Clean Energy Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Clean Energy Carriers' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026